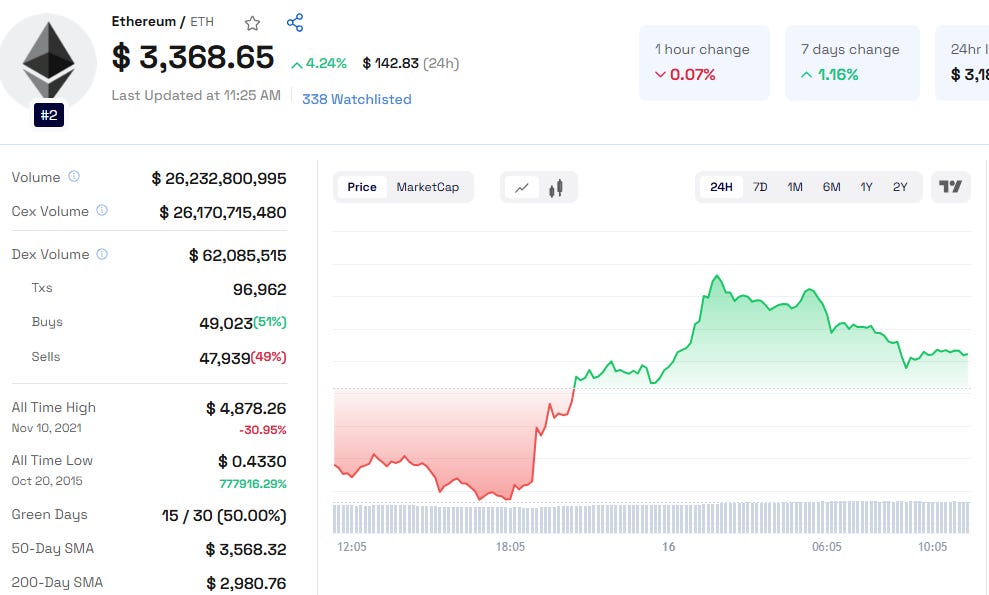

Ethereum (ETH) is showing promising momentum, recently reaching $3,425.50, a critical resistance level. While it encountered resistance and dipped slightly, traders are hopeful for a positive breakout. Let’s explore the latest Ethereum price trends, insights, and predictions for 2025 and beyond.

Current Ethereum Price Analysis

Resistance Level: $3,425.50

Support Levels: $3,250.00 and $3,222.00

Key Target Levels: $3,570.00 and $3,680.00

Ethereum’s price movement suggests a bullish outlook if it surpasses the $3,425.50 resistance. However, failure to break through could result in a dip toward $3,222.00, or even $2,791.22, before attempting another upward trend.

Trading Range Today: Between $3,250.00 and $3,520.00.

Read detailed Ethereum Price Forecast 2040 for more insights

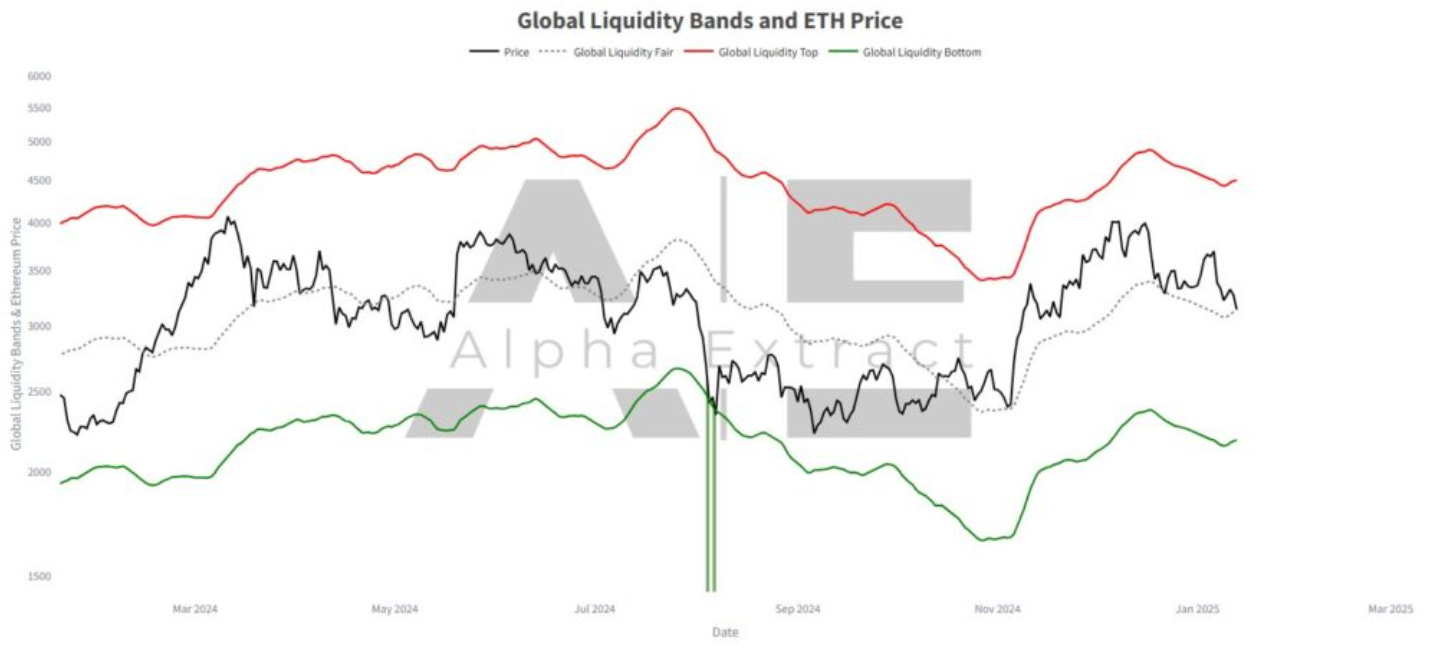

Global Liquidity Bands: A Key Indicator

Ethereum’s price recently aligned with its Global Liquidity Fair Value—a critical point in market analysis. Historically, this level has acted as a catalyst for price movements. Ethereum’s trajectory through 2024 has consistently interacted with the liquidity top and bottom bands, reflecting significant volatility.

Bitcoin’s Stability: Currently around $90,000, Bitcoin’s performance could stabilize Ethereum or trigger a rally.

Key Insight: If Ethereum rebounds from this level, a bullish trend could follow. However, downward pressure may push prices toward the liquidity bottom around $2,000.

Also Read: Jasmy Price Prediction 2030

Decreasing Exchange Balances and Supply Shock

Ethereum’s balance on centralized exchanges (CEX) has dropped sharply, from 30 million ETH in 2022 to just 19.5 million by January 2025. This decline aligns with previous bullish trends, as lower exchange reserves often lead to supply shocks and price increases.

Historical Trend: During 2024, as exchange balances fell, Ethereum’s price frequently exceeded $3,000.

Investor Takeaway: Reduced supply signals strong potential for higher prices, making now a favorable time to accumulate ETH.

Grayscale’s Impact on Ethereum Price

Grayscale’s recent moves have raised concerns about selling pressure. The transfer of over $50 million worth of ETH to Coinbase Prime hints at a possible sell-off, which could introduce short-term volatility.

Key Transfers:

12.25K ETH ($39.24M)

3.518K ETH ($11.27M)

Potential Impact: Price dips if Grayscale continues to transfer large amounts.

Actionable Tip: Monitor Grayscale’s wallet activity to anticipate short-term price fluctuations.

Long-Term Ethereum Predictions

Ethereum’s all-time high (ATH) remains a benchmark for future expectations. Investors frequently ask, “Will Ethereum go up?” and “What is the Ethereum price prediction for 2030?”

Bullish Drivers: Decreasing supply, robust demand, and adoption trends.

Future Targets: With a dwindling supply, Ethereum could revisit or exceed its ATH in the coming years.