Ethereum Price Drops as Whale Buys 4,993 ETH—Breakout Incoming?

Can Ethereum Price Hold $2,200 After Pectra Setbacks?

Ethereum's Pectra upgrade faced setbacks on testnets, but developers quickly resolved the issues. With bearish market signals and whale accumulation, can ETH maintain its critical $2,200 support level?

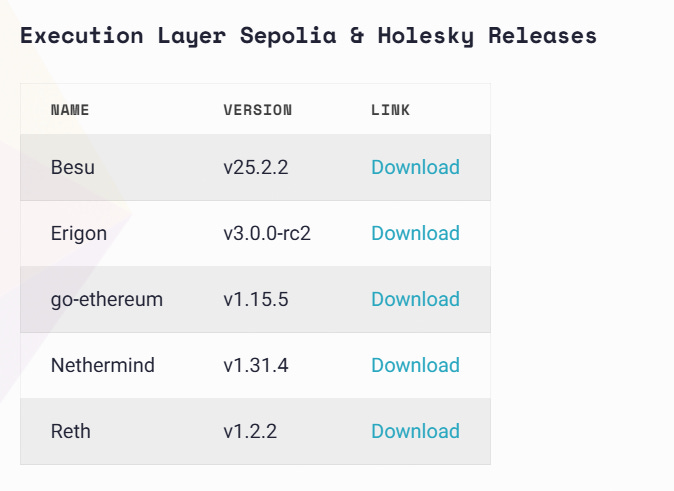

Pectra Deployment Issues on Sepolia Testnet

Bug in Deposit Contract: Pectra upgrade on Sepolia testnet hit by a bug preventing execution layer (EL) clients from processing transactions.

Quick Resolution: Ethereum core developer Tim Beiko confirmed the issue was fixed promptly.

Previous Challenges: This is the second issue for Pectra in two weeks, following a Holesky testnet failure due to EL client configuration problems.

Mainnet Safety Assured: Developers emphasized that these issues are unique to testnets and won’t affect the Ethereum mainnet.

Read Ethereum Price Prediction 2025, 2026 - 2030 for more detailed insights

Key Features of Pectra Upgrade

Account Abstraction: Introduces features like sponsored transactions and ERC-20 gas fee payments.

Staking Enhancement: Increases maximum staking balance per node from 32 ETH to 2,048 ETH.

Wallet Recovery: Adds improved recovery options for wallets.

Uncertain Timeline: Recent testnet issues may delay the planned April mainnet deployment.

Also Read: PEPE Price Prediction 2025, 2026 – 2030

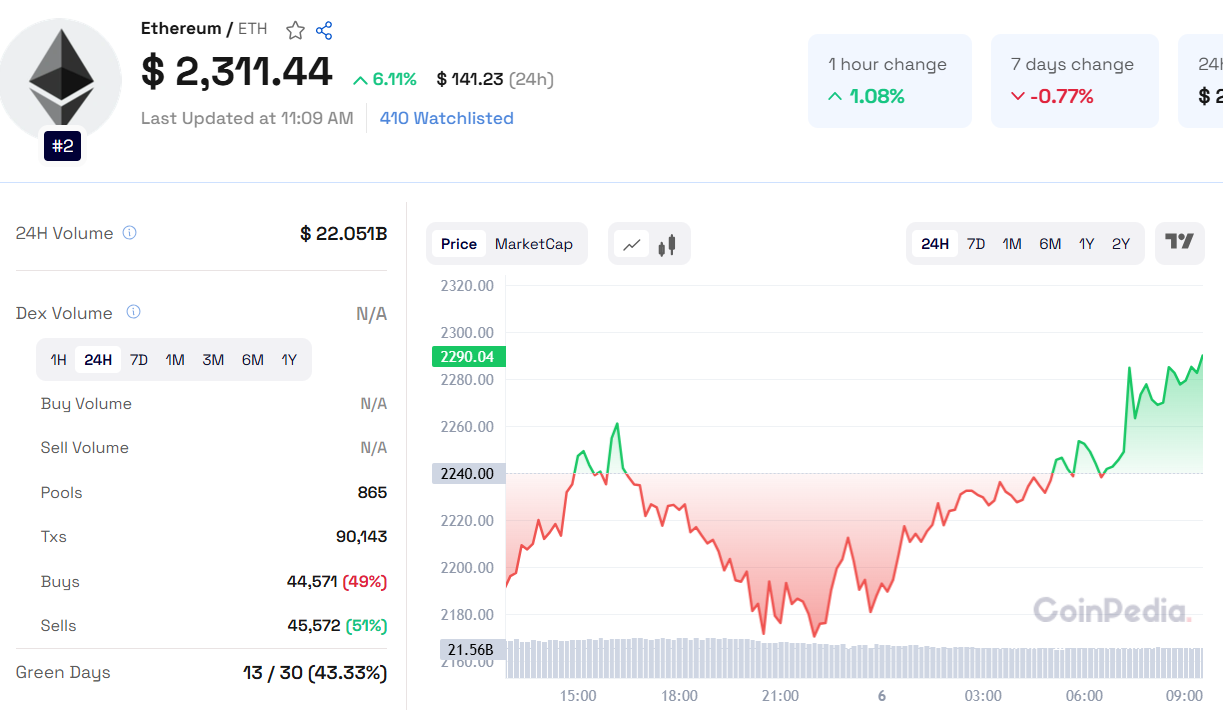

Ethereum Price Analysis: Critical Levels to Watch

Support Struggle: ETH is battling to hold the $2,200 support level amid bearish momentum.

Futures Liquidations: $44.63 million liquidated in the past 24 hours, with $20.02 million in longs and $24.61 million in shorts.

Key Price Zones: A weekly close below $2,200 could push ETH to $1,500. Reclaiming the ascending channel could target $2,850.

Market Indicators: RSI below neutral and the Stochastic Oscillator in the oversold region signal potential seller exhaustion.

Whale Activity and Institutional Confidence

"7 Siblings" Whale Moves: Bought 4,993 ETH for $10.36 million at an average price of $2,075. Now holds 1,157,000 ETH worth $2.4 billion.

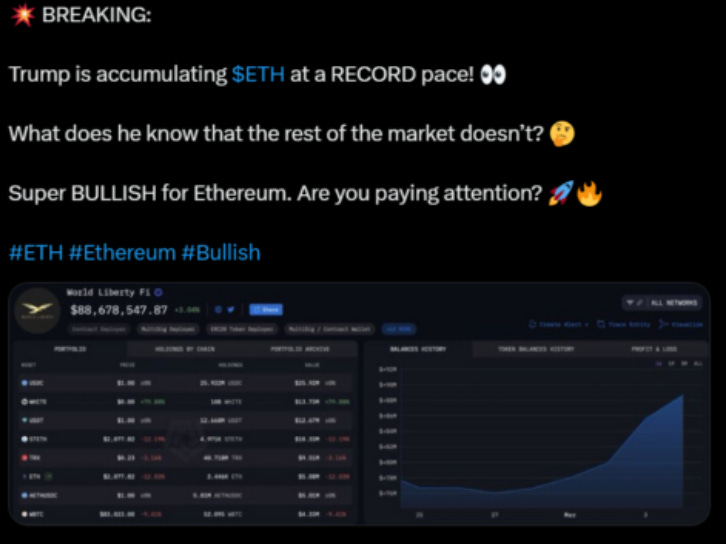

Trump’s Ethereum Accumulation: Former U.S. President Donald Trump's ETH purchases fuel bullish sentiment.

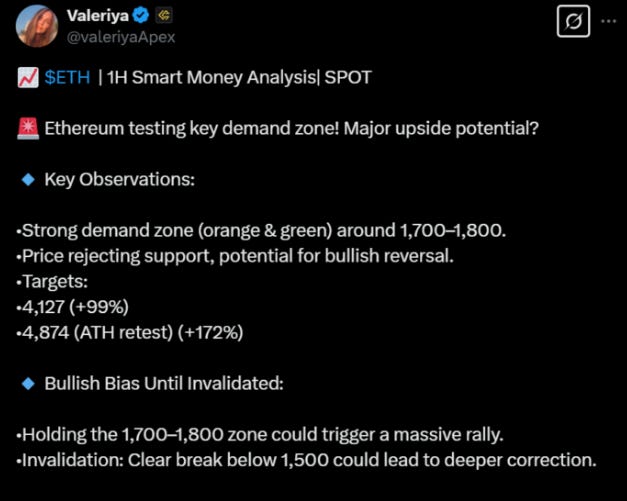

Analyst Outlook: Bullish Potential vs. Downside Risks

ValeriyaApex Analysis: Key demand zone is $1,700-$1,800.

Upside Potential: Possible rallies to $4,127 (+99%) or all-time high of $4,874 (+172%).

Risk Warning: A drop below $1,500 could invalidate bullish predictions, while holding above $1,700 might support a rally.

Ethereum's market outlook is mixed, but strong whale activity and institutional interest indicate a potential bullish reversal. Key support levels will determine ETH's next big move.