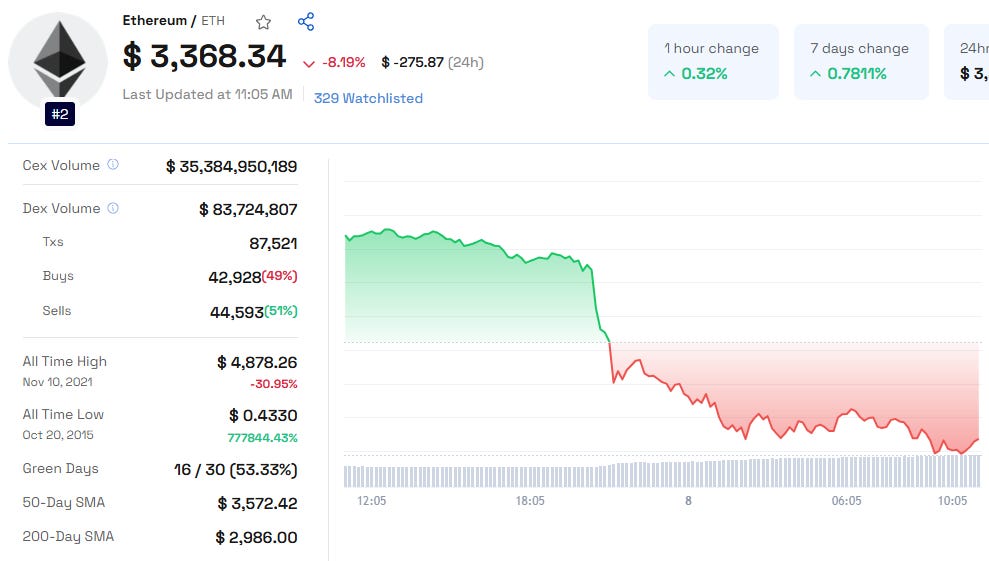

Ethereum consolidates near $3,650 after surpassing the 4-hour 200 MA at $3,629, signaling bullish momentum. Holding this support could drive further gains and shape its trajectory.

Ethereum’s Current Performance

Key Support Level: The 4-hour 200 moving average at $3,629 is a crucial indicator of strength. A sustained hold above this level could signal strong buyer interest.

Immediate Risk: If Ethereum fails to hold this support, a retest of the $3,500 demand zone is likely. Historically, this level has acted as a springboard for rebounds.

Read Detailed Ethereum Price Prediction For More Insights

Ascending Channel: A Bullish Sign?

ETH is currently trading within an ascending channel, a pattern typically associated with bullish continuation. According to renowned analyst Carl Runefelt, if ETH can maintain its position, it could set the stage for a rally toward a new ETH all-time high. However, a short-term breakdown could result in Ethereum testing $3,500 before regaining momentum.

Macro Factors Impacting Ethereum

Federal Reserve Policies: The Fed’s hawkish stance and strong U.S. economic data have created headwinds for high-risk assets like Ethereum. Liquidity conditions are unlikely to improve significantly in 2025.

Market Liquidations: Over $300 million in liquidations across the crypto market recently contributed to sharp price fluctuations.

Broader Sentiment: The ISM data suggests inflation may not be cooling as expected, keeping investors cautious.

Also Read: Stellar Price Prediction 2025, 2026 – 2030

Ethereum Price Prediction for 2025

Despite short-term challenges, Ethereum’s long-term outlook is optimistic. Analysts expect the upcoming pro-crypto regulatory environment in the U.S. to be a game-changer:

Spot ETF Advantage: Ethereum remains the only major altcoin with a spot ETF in the U.S., solidifying its position as the king of DeFi.

Regulatory Shifts: The incoming U.S. administration is packed with pro-crypto advocates, which could foster innovation and growth in the sector.

Potential Bitcoin Reserve: Speculation around the U.S. establishing an official Bitcoin reserve could further boost the entire crypto market.

Key Milestones Ahead

Reclaiming Last Year’s Highs: Ethereum’s ability to reclaim its previous highs will be pivotal for restoring trader and investor confidence.

Adoption Growth: By 2030, Ethereum’s adoption could skyrocket, driven by its dominance in decentralized finance and its position as a leading blockchain for innovation.

Will Ethereum Go Up? Key Takeaways

Short-Term Risks: Losing the $3,629 support could trigger a pullback to $3,500.

Long-Term Potential: Ethereum price prediction for 2030 suggests strong growth fueled by broader adoption, pro-crypto regulations, and its role in DeFi.

Strategic Opportunities: If Ethereum drops below $3,000, it may present a valuable buying opportunity for long-term investors.

Ethereum’s 2025 outlook balances challenges and opportunities. Despite macroeconomic pressures, its strong fundamentals and growing adoption hint at a promising future. Stay informed to navigate Ethereum’s path to new milestones.