Ethereum Price at $2,600: Can Whales Push ETH to $3,000?

ETH ETF Inflows Surging! What’s the Impact?

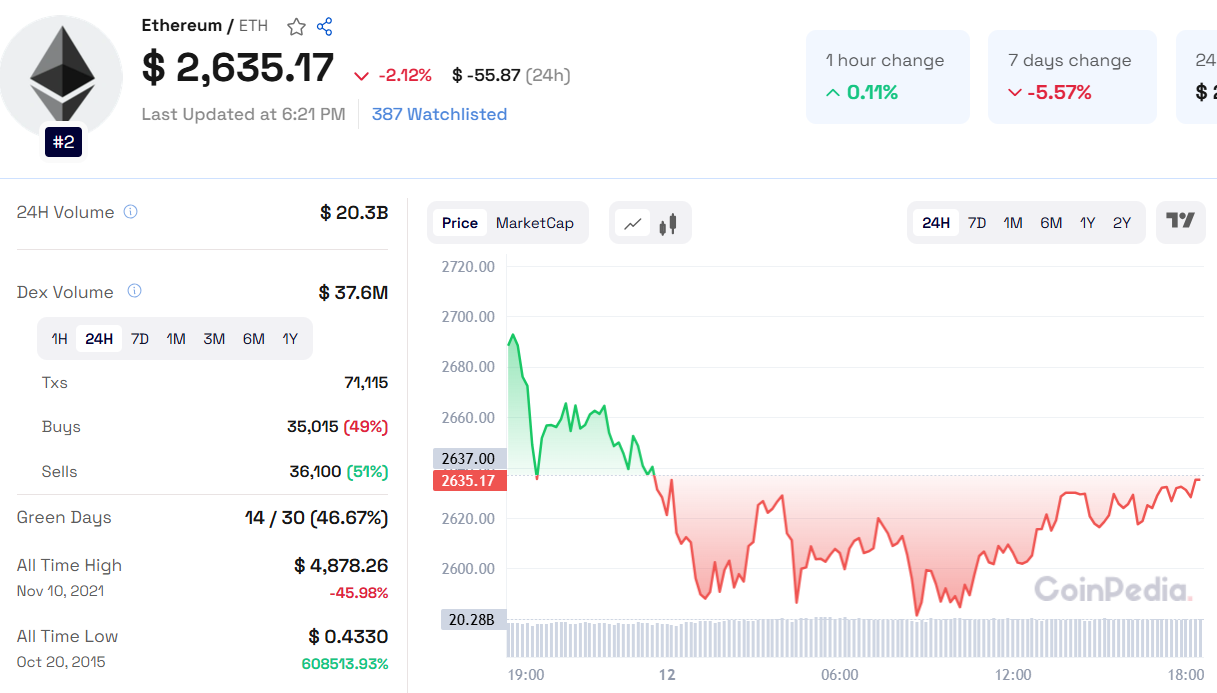

Ethereum is facing a crucial moment as its price struggles to sustain dominance above the $2,600 level. With recent market pullbacks, ETH has returned to a critical support trendline, leaving traders wondering about its next move.

Ethereum Price Today: Is a Bullish Comeback Near?

Ethereum recently formed a $2.1K candle with a significant price rejection, indicating a potential capitulation phase. Since then, price volatility has reduced, but ETH still holds above its weekly trendline. A bullish comeback remains possible as long as Ethereum maintains this key support level.

Technical analysis from crypto enthusiast Ted Pillows suggests that Ethereum is forming an ascending triangle pattern, with the overhead resistance near $4,000. If ETH continues its current trend, a breakout could push prices into the overhead supply zone, strengthening the bullish case.

Read Ethereum Price Prediction 2025 for more insights

Ethereum Whales and Institutional Demand

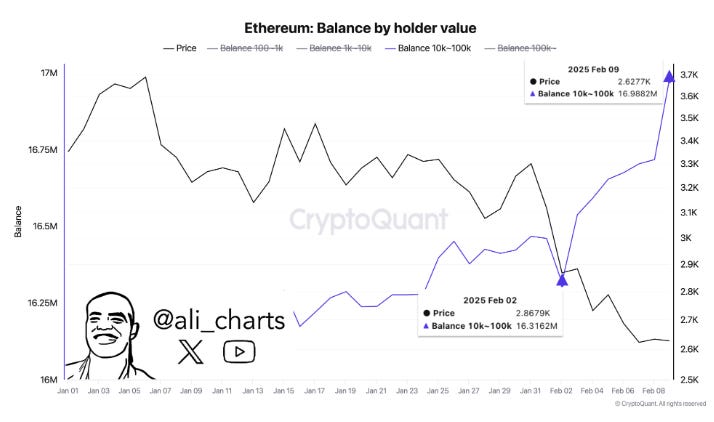

Despite short-term price fluctuations, Ethereum whales and institutional investors remain optimistic. Crypto analyst Ali Martinez reports that whales have accumulated 600,000 ETH in the past week. This increased buying activity has pushed the total balance of large holders (10K–100K ETH) to 16.99 million ETH.

Additionally, more than 1 million ETH has been withdrawn from exchanges, reducing the available supply. Lower exchange supply combined with rising demand increases the likelihood of an ETH price surge.

Institutional interest in Ethereum is also growing. On February 11, U.S. spot Ethereum ETFs recorded a $12.5 million net inflow. BlackRock led the charge, increasing its cumulative Ethereum holdings to $4.44 billion.

Donald Trump’s World Liberty Financial also joined the buying spree, acquiring 1,917 ETH for $5 million USDC. The fund now holds $48.43 million worth of Ethereum.

Also Read: Filecoin Price Prediction 2025, 2026 – 2030: Is FIL Price Worth Investing?

Ethereum Price Prediction: What’s Next?

Ethereum Price Prediction February: If ETH holds above $2,600, a breakout toward $3,000–$3,200 is possible. However, failure to maintain support may lead to a retest of $2,400.

Ethereum Price Prediction 2025: With increasing institutional adoption and potential ETF approvals, ETH could challenge its all-time high and aim for $6,000–$8,000.

Ethereum Price Prediction 2030: Long-term, Ethereum’s role in DeFi, NFTs, and enterprise adoption could push prices beyond $15,000, assuming continued growth and market stability.

Ethereum remains at a pivotal point, but strong whale activity and institutional demand support a bullish outlook. If ETH breaks key resistance levels, it could trend toward new highs. Traders should monitor the price action closely as Ethereum moves toward a decisive phase.