Ethereum MVRV Drops! Is a 40% Crash Coming?

Ethereum price faces rejection around its descending trendline

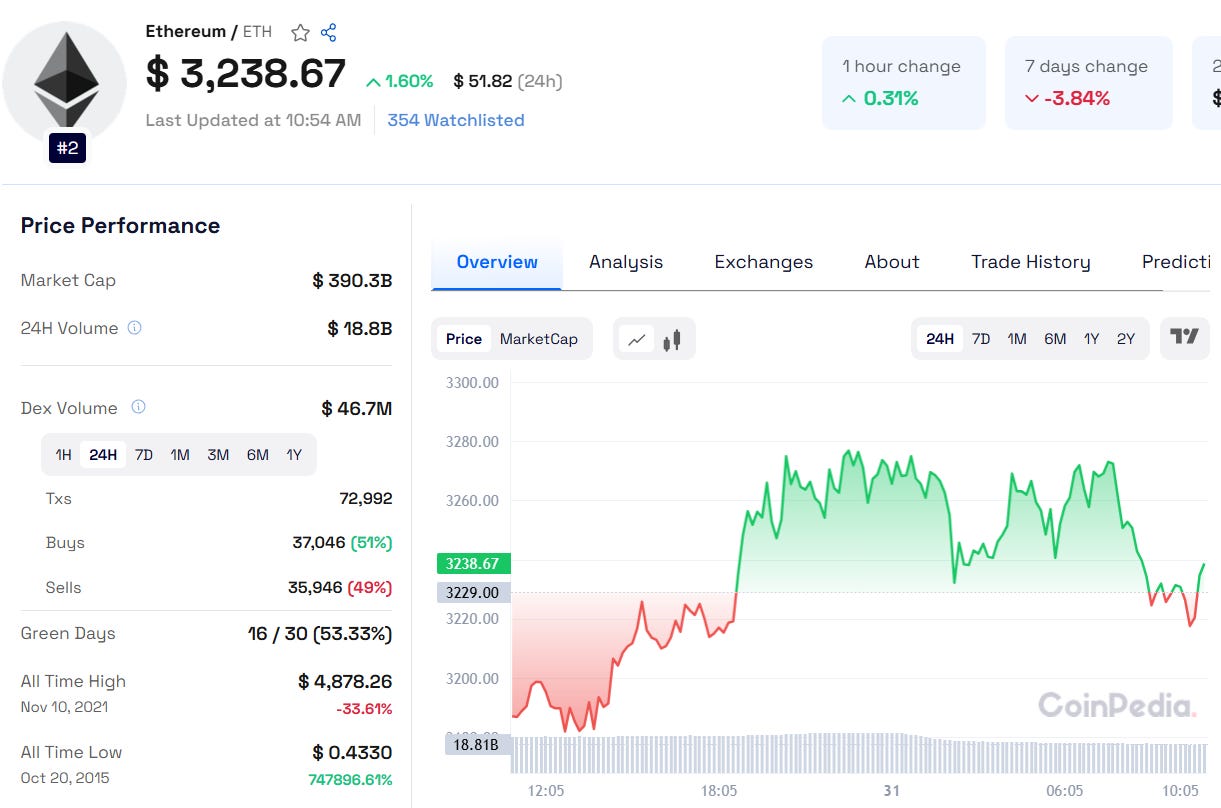

Ethereum price rebounded from the crucial $3,000 support level on Monday, gaining 6.33% by Thursday. However, as of Friday, ETH faces rejection near a descending trendline and trades around $3,231. The next move will depend on whether Ethereum breaks above this resistance or falls back to retest key support.

Key Support and Resistance Levels

Support: $3,000 (psychological level), $2,810 (next major support)

Resistance: $3,730 (critical breakout zone)

If Ethereum price fails to hold above the $3,000 mark, a daily close below this level could trigger further declines toward $2,810. Conversely, a breakout above the descending trendline could push ETH toward $3,730 and beyond.

Read Ethereum Price Prediction 2025

Technical Indicators Signal Bearish Pressure

RSI: Currently at 46, after rejecting from 50, signaling bearish momentum.

MACD: Indicates indecisiveness, similar to Bitcoin’s price movement.

Liquidity Gap: Exists between $2,900 and $3,100, which could cause rapid price moves.

Rising Open Interest but Bearish Sentiment

Market data reveals increasing open interest, suggesting new positions are being built.

However, funding rates indicate that many traders are shorting ETH, anticipating a price drop.

If Ethereum dips into the liquidity gap, short sellers may face forced liquidations, potentially triggering a sharp price reversal.

Also Read: Near Protocol Price Prediction 2030

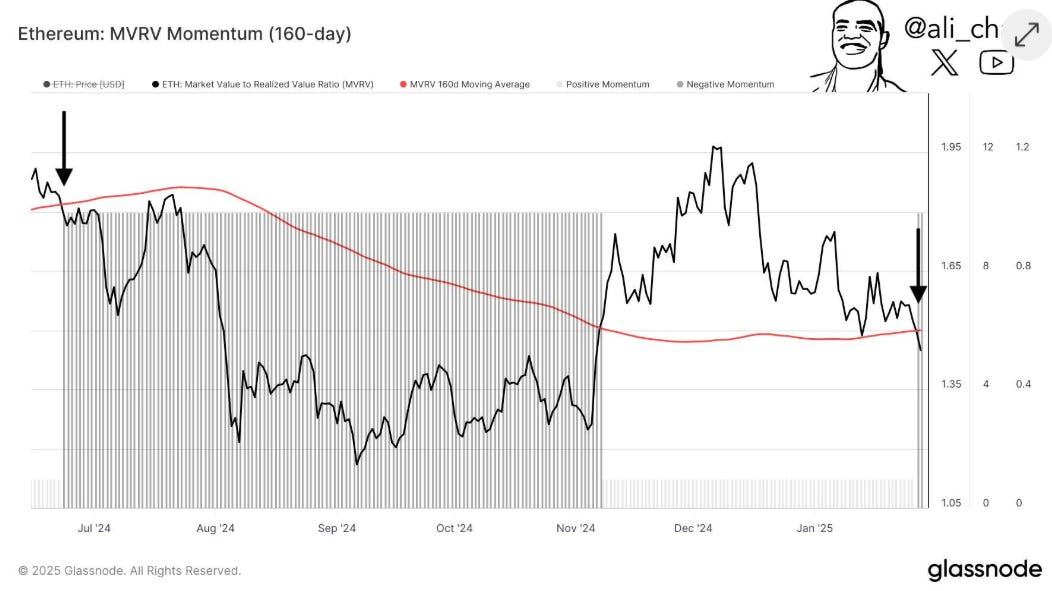

MVRV Ratio Signals Caution

Ethereum’s Market Value to Realized Value (MVRV) ratio has dropped below the 160-day moving average. The last time this happened, ETH plunged 40%, from $3,500 to $2,100.

Will Ethereum Go Up?

Despite short-term volatility, long-term investors remain optimistic about Ethereum price prediction 2025 and Ethereum price prediction 2030. If ETH breaks above key resistance, it could challenge its all-time high in the near future.