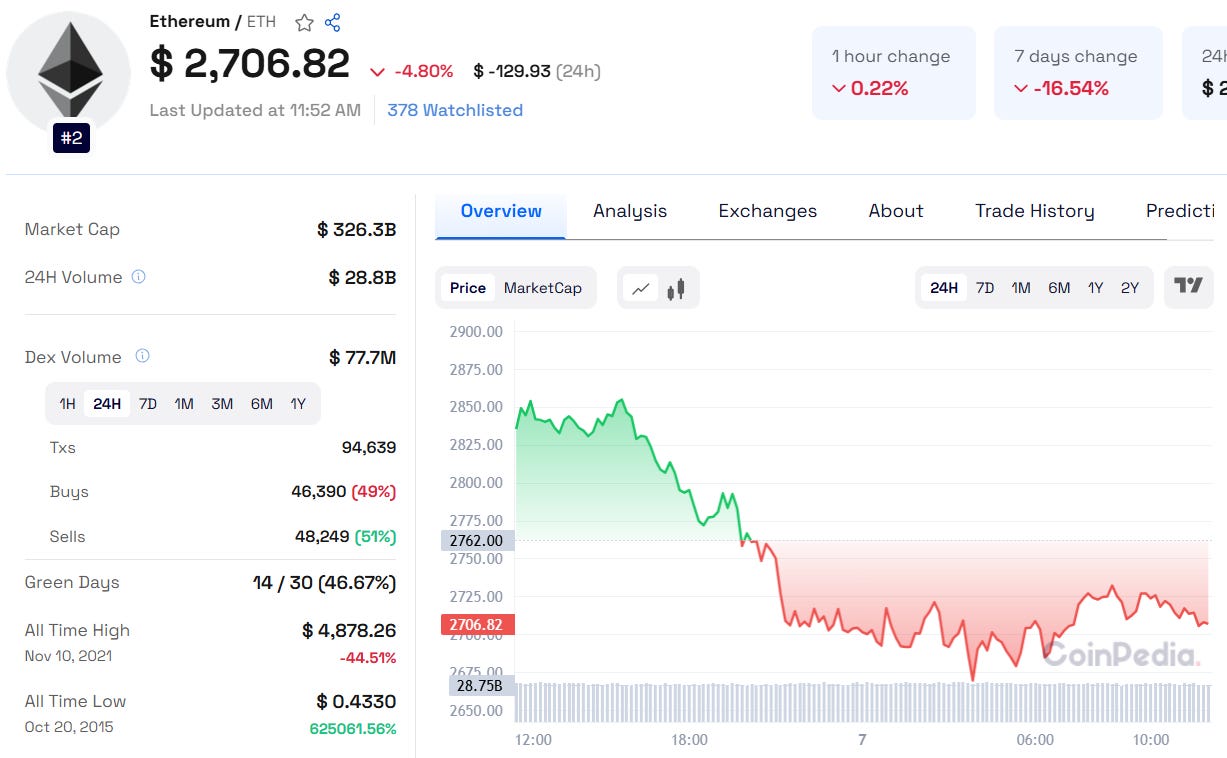

Ethereum (ETH) is facing strong resistance near $3,000, failing to regain bullish momentum. After a sharp 13.87% drop in early February, Ethereum price today remains under pressure, hovering around $2,715. Traders are now eyeing key support and resistance levels to determine the next move.

Ethereum Price Analysis: Key Support and Resistance Levels

Current Price: $2,715 (as of February 9)

Resistance Level: $3,000

Support Levels: $2,359 and $1,905

If ETH continues its decline and closes below $2,359, it could extend losses toward its next major weekly support at $1,905.

Read Ethereum Price Prediction 2031, 2032, 2033, 2040, 2050

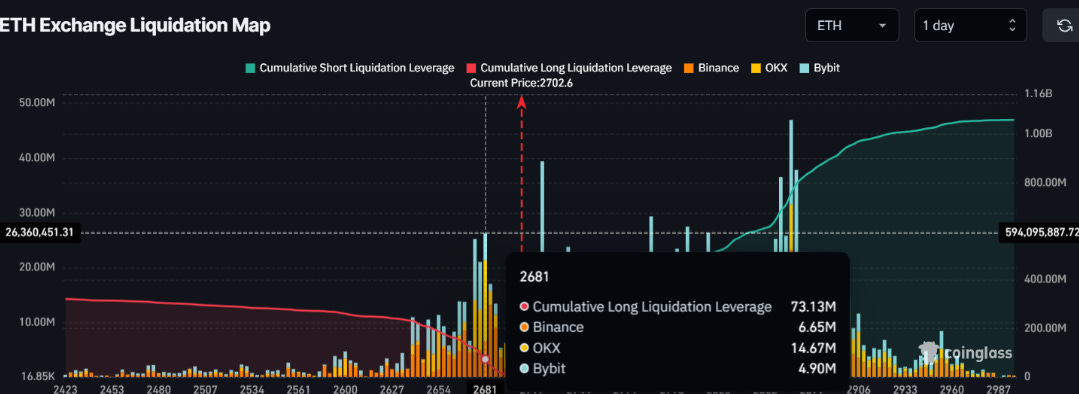

Traders Are Betting on Short Positions

Market sentiment remains bearish, with traders increasing their short positions. According to Coinglass, two major liquidation levels are:

📌 $2,680: Long traders hold $73.50 million in positions.

📌 $2,780: Short traders hold $325 million in positions.

This data suggests that traders expect more downside before Ethereum price prediction turns bullish.

Also Read: Algorand Price Prediction 2025, 2026 – 2030: Will ALGO Price Hit $1?

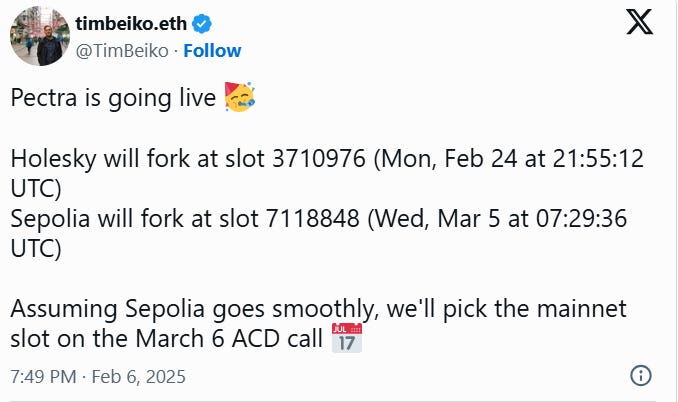

Ethereum’s Pectra Upgrade Could Be a Game-Changer

Ethereum developers have scheduled the Pectra upgrade for testnet launches on:

✅ Holesky Testnet: February 26

✅ Sepolia Testnet: March 5

The mainnet launch could happen in early April, depending on testnet performance. Pectra will introduce:

Account Abstraction: Improved transaction efficiency.

Increased Staking Balance: From 32 ETH to 2,048 ETH, helping validators consolidate nodes.

Zero-Knowledge Enhancements: Boosting privacy and scalability.

Ethereum Price Prediction: What’s Next?

Despite Ethereum’s underperformance compared to Bitcoin and Solana, analysts believe ETH could recover long-term.

🔹 Ethereum Price Prediction 2025: $5,000 - $7,000

🔹 Ethereum Price Prediction 2030: Above $10,000

In the short term, ETH must reclaim $3,000 to shift momentum. If the downtrend continues, $2,359 and $1,905 will be critical support levels to watch. Traders should keep an eye on ETF flows, on-chain data, and the Pectra upgrade for potential bullish catalysts.