Ethereum: Can bulls help ETH break THIS price for a 23% rally.

Can ETH price sustain gains or face another dip?

Ethereum (ETH) has experienced significant price movements recently, with both declines and signs of recovery. Here’s a breakdown of the latest trends, key levels, and technical indicators driving the market.

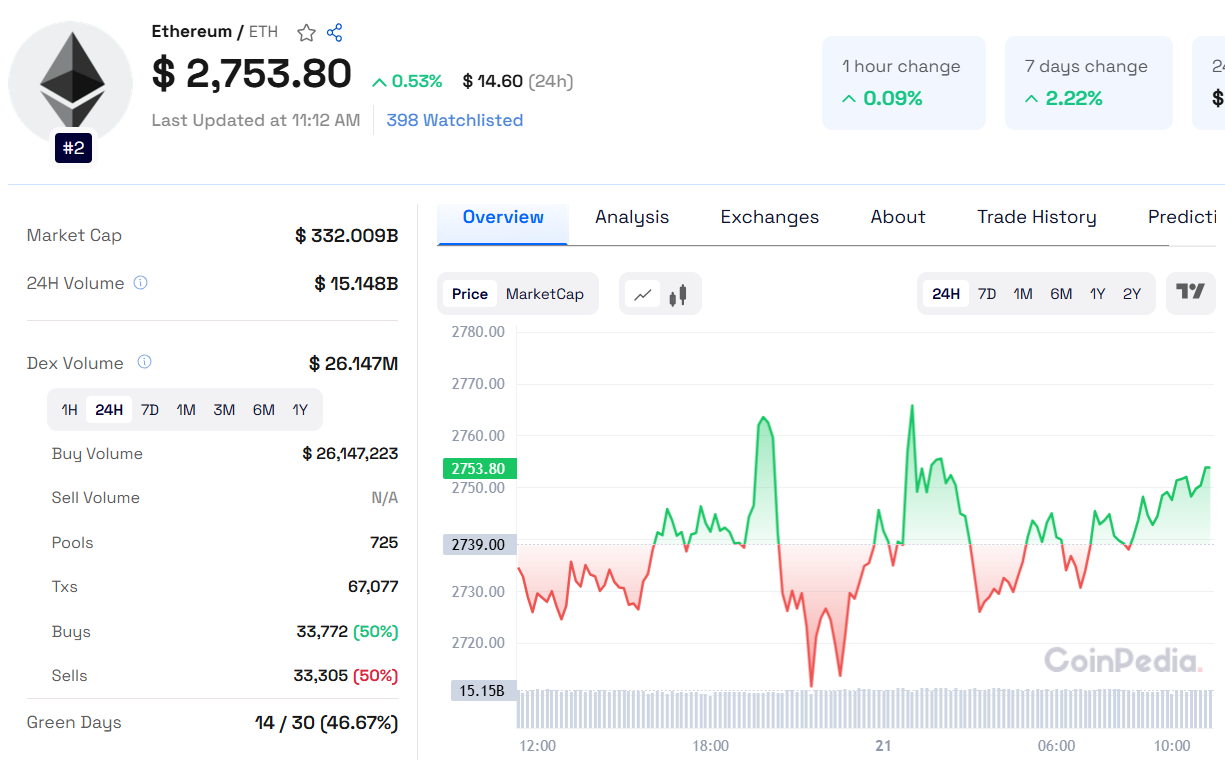

Recent Price Movement

On February 1, ETH faced rejection at a descending trendline, leading to a 13.87% drop.

This decline pushed ETH below the crucial $3,000 level.

The downward trend continued with another 9% drop the following week.

Last week, ETH saw a 1.3% recovery, followed by an additional 3% gain this week.

As of Friday, ETH is trading around $2,740.

Read ETH Price Prediction for more detailed insights

Key Resistance and Support Levels

Resistance: ETH must break above $3,000 to confirm an upward trend.

Support: If ETH fails to sustain its momentum, it could decline to $2,359.

A further drop could push ETH to the next major support at $1,905.

Technical Indicators: Bullish Signals Emerging?

RSI (Relative Strength Index): Currently at 44, up from the oversold level of 30. A move above 50 is needed for susta

ined bullish momentum.

MACD (Moving Average Convergence Divergence): Recently showed a bullish crossover, signaling a potential price increase.

Also Read: Stellar Price Prediction 2025, 2026 – 2030: Will The XLM Coin Reach $1?

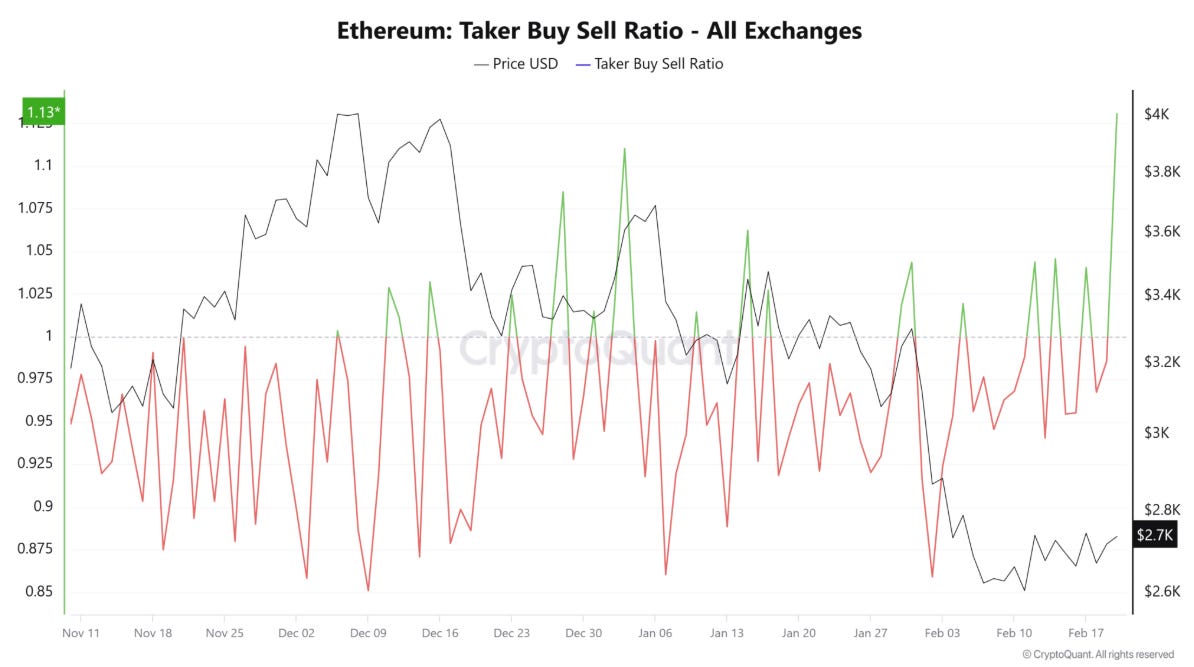

Market Sentiment: Buyers Gaining Control

Taker Buy-Sell Ratio: Reached 1.13, its highest level this year, indicating increased buying pressure.

Funding Rate: 0.0050% (positive), showing traders are confident in Ethereum’s future gains.

Liquidity Inflows: Strong Market Confidence

Ethereum Netflow: Data from Artemis reveals $100.7 million in net inflows over the past seven days.

This signals strong investor confidence and could fuel a price rally.

If ETH maintains its upward momentum, it could break $3,000 and rally toward $3,440.

Failure to hold support may result in further declines, with key levels to watch at $2,359 and $1,905.

Monitoring technical indicators and liquidity trends will be crucial for predicting the next major move.