ETH Whales Face Bear Market Losses: Is an Ethereum Price Surge Ahead?

Ethereum Price on the Edge: Will $2,125 Hold?

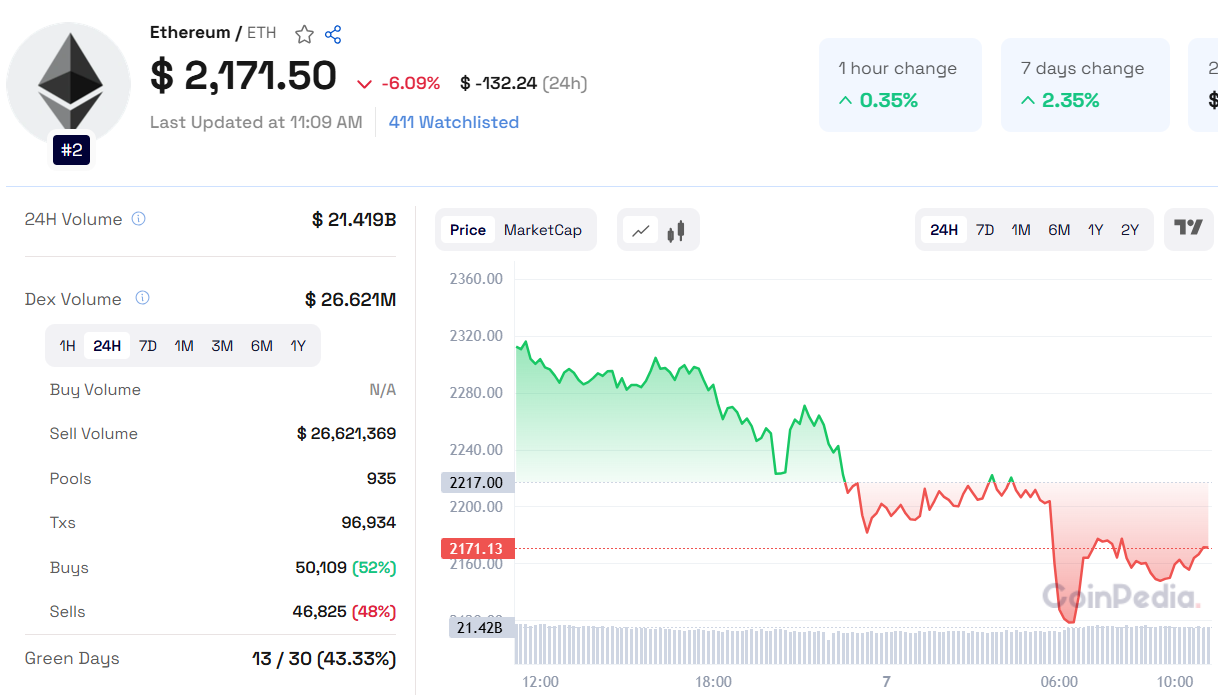

Ethereum (ETH) witnessed significant price swings, finding support at $2,125 before rallying 13.56%. As bearish indicators emerge, here’s a detailed analysis of Ethereum’s price action and market outlook.

Price Performance and Key Levels

Initial Rally: ETH found support at $2,125 on Saturday, rising 13.56% to close above $2,359 on Sunday.

Price Reversal: Recent gains were erased on Monday. ETH found support again at $2,125 and recovered 3.65% by Wednesday.

Current Status: As of Friday, ETH declines, approaching its $2,125 support level.

Read ETH Price Prediction for 2025, 2026 - 2030

Bearish Indicators

Support Threat: A close below $2,125 could extend the decline to retest the weekly support level of $1,905.

RSI Signal: The Relative Strength Index (RSI) reads 35, showing bearish momentum after rejection at its neutral level of 50.

MACD Crossover: The Moving Average Convergence Divergence (MACD) signaled a bearish crossover last week, suggesting a potential downward trend.

Bullish Scenarios

Recovery Potential: Holding the $2,125 support level could trigger a rally toward the $3,000 resistance.

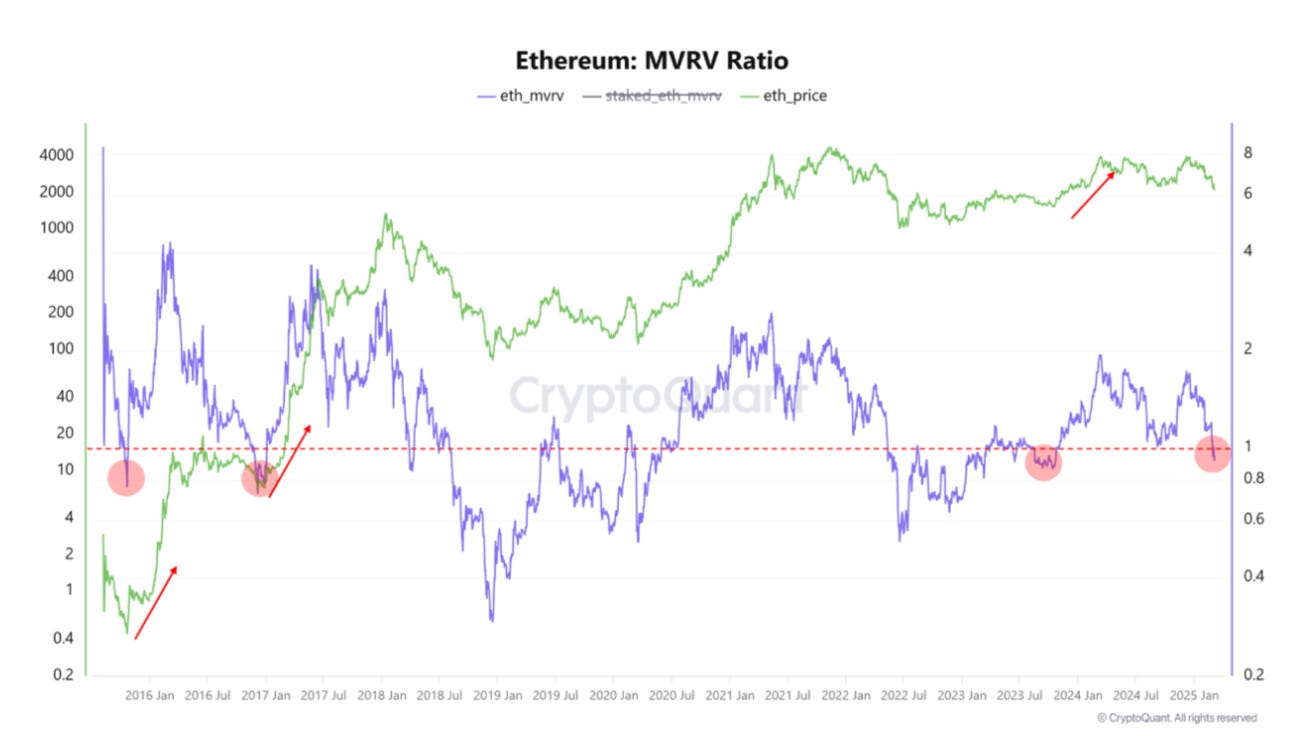

MVRV Ratio: Ethereum’s Market Value to Realized Value (MVRV) ratio is below 1, indicating proximity to the average purchase price of all holders.

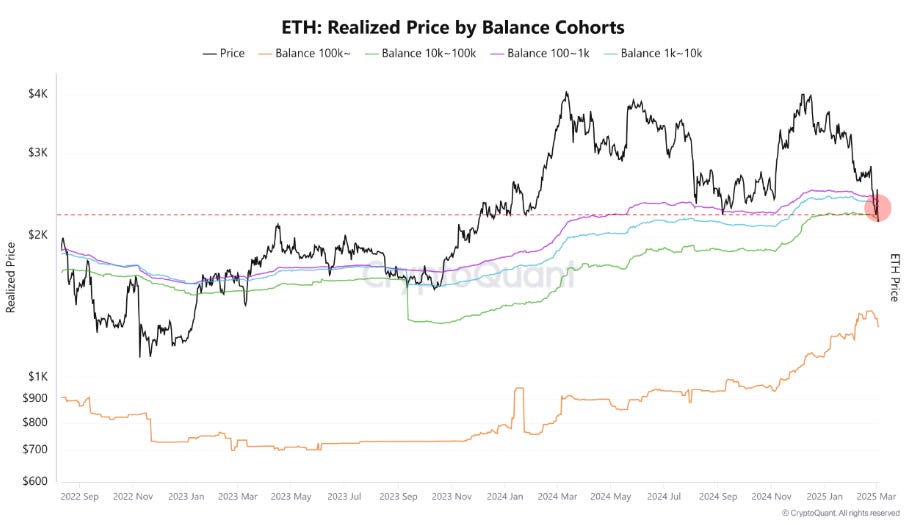

Whale Activity: Whale investors' realized prices are concentrated around $2,200-$2,300, potentially forming strong support.

Also Read: EGLD Price Prediction 2025

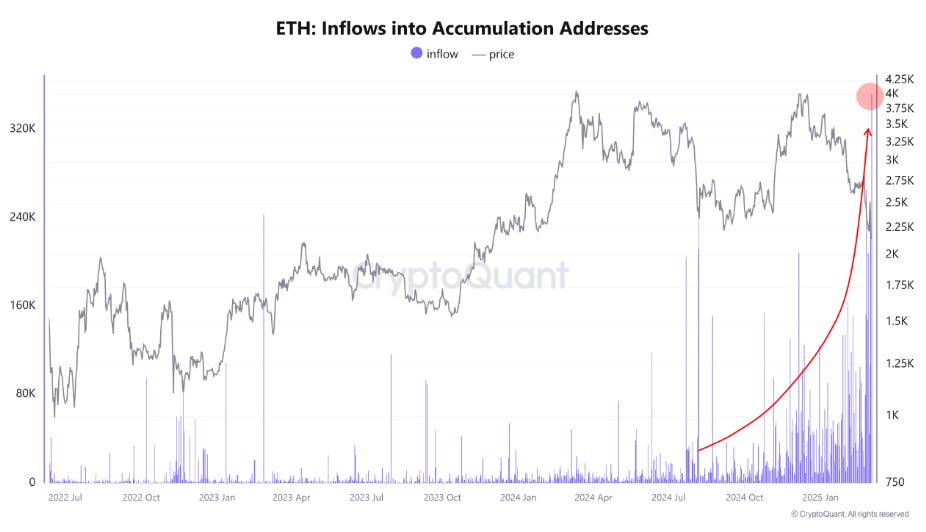

On-Chain Data: Accumulation Trend

Accumulation Addresses: Data from CryptoQuant shows a rise in accumulation addresses—wallets receiving but not withdrawing ETH.

Market Sentiment: Increased accumulation suggests investors view current prices as attractive, possibly signaling a shift toward a bullish market sentiment.

Macroeconomic and Development Factors

External Pressures: U.S. liquidity policies, global economic factors, and market uncertainty could impact Ethereum’s price.

Pectra Upgrade: Ethereum’s recent Pectra upgrade aims to enhance scalability and efficiency, potentially driving a new bullish phase.

Market Positioning

Price and Market Cap: Ethereum trades at $2,217.58, up 5.51% in 24 hours but down 10% over the week.

Institutional Interest: Strong fundamentals and network upgrades could attract institutional investors, reinforcing Ethereum’s status as the DeFi leader.