ETH Price Rallies 10% Amid Decline in CME Short Positions

Ethereum Price Prediction: ETH Breaks $1,700 as Short Positions Drop

Ethereum saw a strong rally on Tuesday, jumping 11.19% and breaking through the key $1,700 resistance level for the first time since April 6. As of Wednesday, ETH is holding steady around $1,780, continuing its upward momentum.

This bullish move is driven by a combination of improving macroeconomic sentiment and a sharp drop in short positions on the Chicago Mercantile Exchange (CME), which has also revived interest in a bullish Ethereum price prediction.

ETH Technical Outlook

The Relative Strength Index (RSI) on the daily chart currently sits at 54, above the neutral 50 level. This suggests growing bullish momentum in the market.

If the rally continues, Ethereum could next aim for the daily resistance level at $1,861.

On the downside, a correction could see ETH retesting support near $1,449.

What’s Driving the Rally?

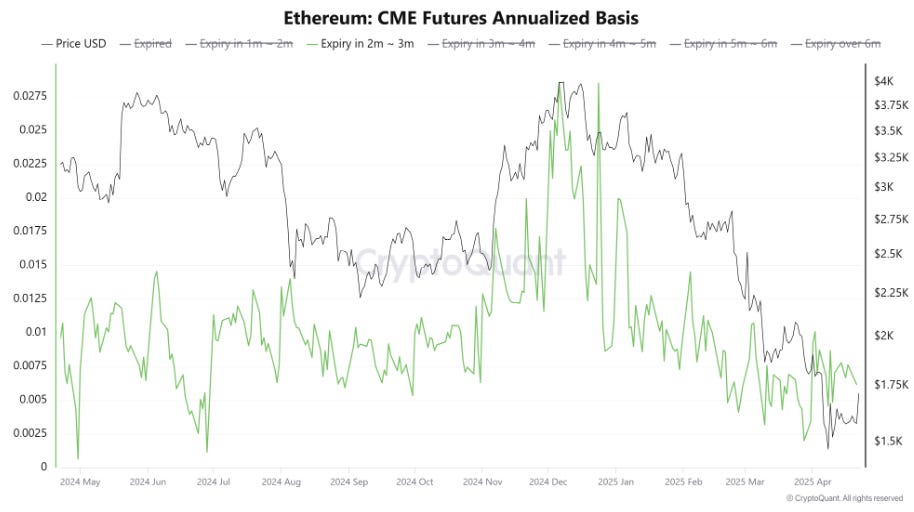

A key factor behind Ethereum’s recent surge is the steady decline in CME short positions. For the first time in 2025, the total open interest in ETH shorts across all trader categories has dropped below $500 million. This reflects a cooling in bearish sentiment.

Another major influence is the drop in the Ethereum CME basis—from 20% in November to around 4–5% in April. The basis is the difference between ETH futures and spot prices. When the basis was high, hedge funds took advantage of arbitrage opportunities by:

Buying spot ETH ETFs

Shorting ETH futures on the CME

These trades are now being unwound as the basis narrows, largely due to recent market corrections following U.S. tariffs and the Federal Reserve’s hawkish tone.

Also Read: Bitcoin SV Price Prediction 2025-2030

ETF Outflows Show Cooling Interest

Since mid-February, U.S. spot ETH ETFs have seen nearly $1 billion in net outflows. Total net assets in these ETFs dropped to an all-time low of $5.21 billion as of Monday, according to SoSoValue data.

With arbitrage pressure easing and CME shorts declining, Ethereum now has more room to climb. However, analysts say that continued gains will require supportive macroeconomic news. A recent statement from U.S. Treasury Secretary Scott Bessent suggesting a possible easing of U.S.-China tariffs has added to the positive outlook.