ETH Bounces Back After Week-Long Bearish Pressure, What's Next?

What’s next for Ethereum price after $3,395?

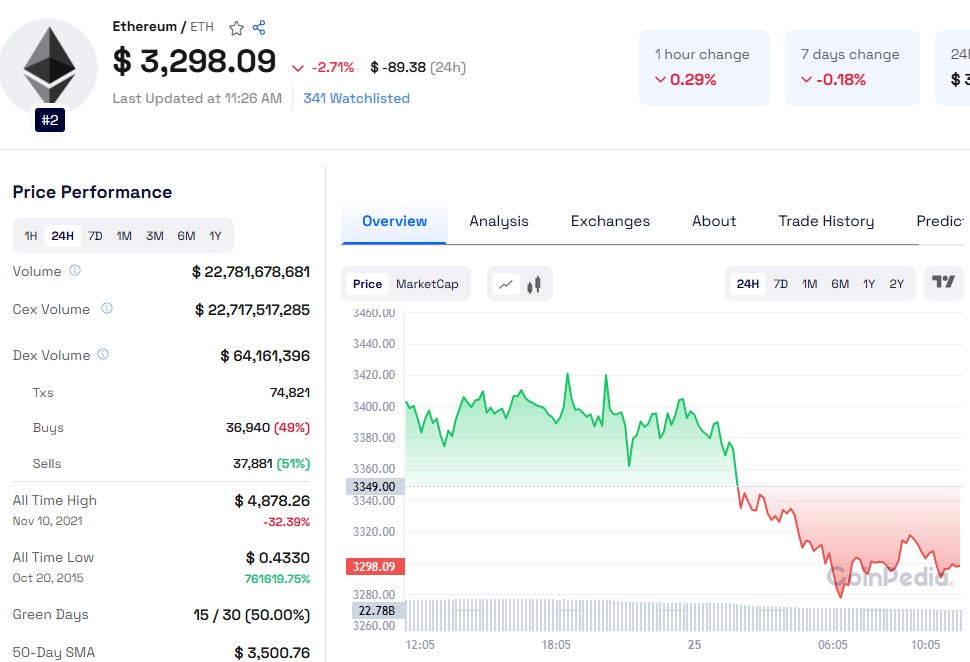

Ethereum surges 2.57% in 24 hours, hitting $3,395.47! A promising rally fueled by fresh optimism and groundbreaking advancements—could this be the start of Ethereum’s next big leap?

Ethereum Price Analysis: A Bullish Trend Emerging

Ethereum's price action over the past few days indicates a strong bullish trend. Let’s break down the key factors that support this optimistic outlook.

Relative Strength Index (RSI): The RSI is approaching overbought territory, a sign of strong buying momentum.

Moving Average Convergence Divergence (MACD): The MACD line recently crossed above the signal line, suggesting the continuation of upward momentum in the short term.

Golden Cross Formation: The 50-period Exponential Moving Average (EMA) crossed above the 200-period EMA, forming a “golden cross,” a highly regarded bullish signal in technical analysis.

Resistance Levels: Immediate resistance is identified at $3,421, and breaking above this could push ETH toward the next major resistance at $3,500.

Support Levels: Key support is seen at $3,300 and $3,200. Staying above these levels is crucial for maintaining the bullish outlook.

Read detailed ETH Price Prediction 2040 for more insights

Ethereum's Mixed Sentiment: Rising Criticism and Market Shifts

Despite the positive price action, Ethereum faces some challenges driven by negative sentiment within the community. The Ethereum Foundation’s leadership has faced criticism, especially after Solana’s recent rally with the TRUMP meme coin. As a result, some investors have shifted their funds to other assets, causing fluctuations in ETH on-chain metrics.

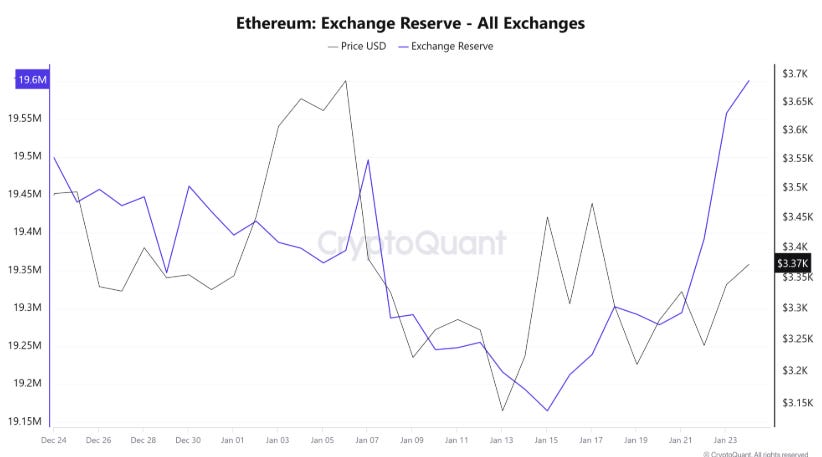

Increased Exchange Reserve: Ethereum's exchange reserve grew by over 434,000 ETH in the last nine days, a sign of rising selling pressure. An increase in ETH held on exchanges often indicates that investors are preparing to sell.

Decline in Staked ETH: The total value staked in Ethereum dropped to a six-month low of 34.15 million ETH, suggesting that many investors are opting not to hold their ETH long-term.

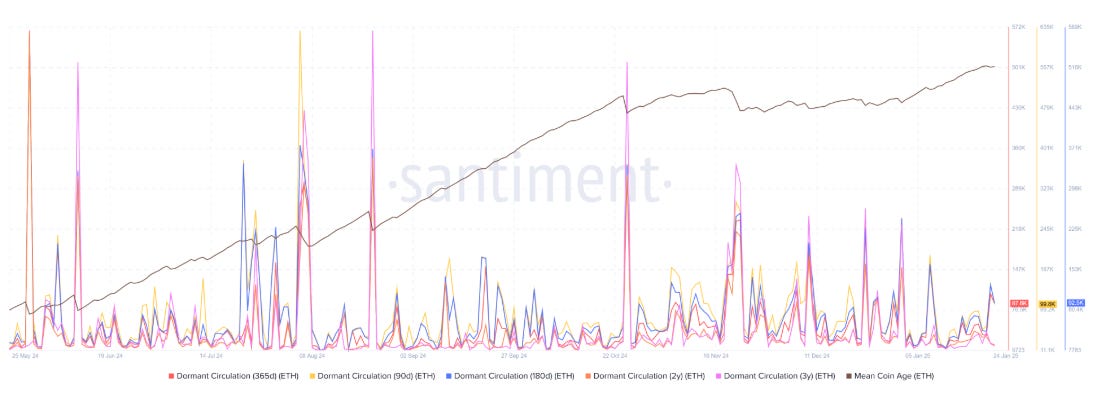

Dormant Circulation: A slight uptick in dormant circulation shows that both short-term and long-term holders are moving their ETH, further indicating some unease in the market.

Also Read: Stacks Price Prediction 2025 – 2030

Ethereum Price Prediction 2025 and Beyond: What’s Next for ETH?

As we look to the future, Ethereum price predictions for 2025 and beyond vary, with some analysts projecting significant price gains and others cautioning about volatility.

Ethereum Price Prediction 2025: Some experts forecast that Ethereum could reach $5,500 or higher in 2025, driven by its technological developments and the growth of its ecosystem.

Potential Range for 2025: Other predictions estimate that ETH could reach a range of $3,500 to $5,000 by the end of 2025, with much of this hinging on the broader market sentiment and Ethereum’s ability to maintain its technological edge.

Ethereum Price Prediction 2030: Looking further ahead, Ethereum price predictions for 2030 are even more optimistic, with some analysts predicting ETH could surpass its all-time high of $4,878, potentially setting new records.

Will Ethereum Continue to Rise?

As the market adjusts, questions like "Will Ethereum go up?" remain a key concern for investors. With the open interest in Ethereum futures reaching an all-time high of 9.50 million ETH, it’s clear that derivatives traders are maintaining their positions, despite the mixed sentiment.

Moreover, Ethereum’s ability to bounce back quickly after periods of negative sentiment is a promising sign. Despite recent volatility, ETH remains a strong player in the market, supported by ongoing developments and increasing Ethereum adoption.