Hello, There Crypto Champs!

Bitcoin Surge Alert! 🚀 With CPI data dropping, Bitcoin is eyeing a breakout past $60K. Will the FOMC meeting ignite the next bull run? Dive in for crucial updates and predictions!

Crypto Market Overview

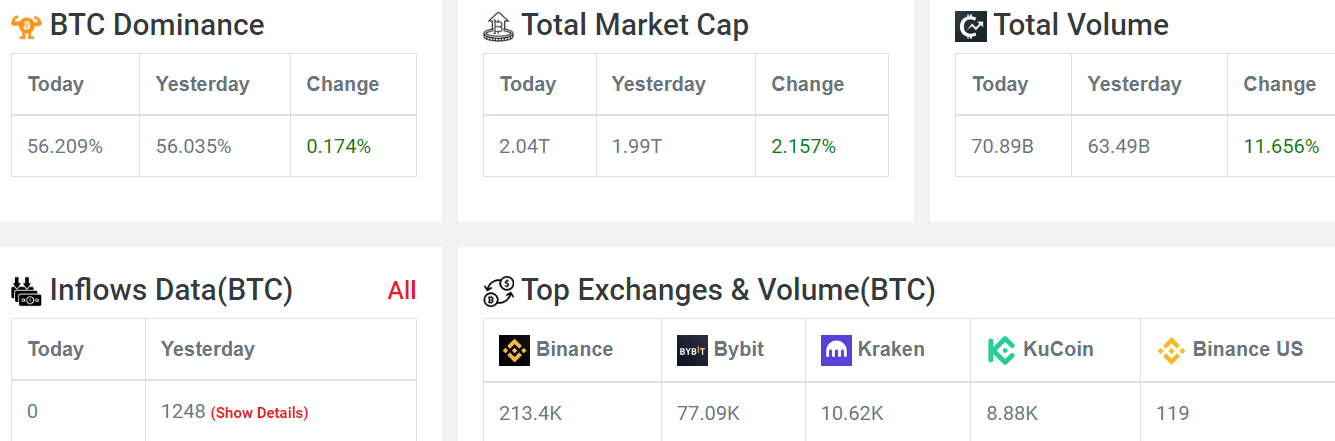

Here’s a quick look at the current crypto market stats:

Market Cap: Up by 2.9%

Volume: Increased by 12.2%

Inflows: No new data since midnight, but yesterday saw an inflow of 1,248 BTC.

Fear & Greed Index: Still in the fear zone at 31, though recent sentiment shows more buying.

BTC Heat Map: Positive, with BTC up 2.88% and ETH up 1.26%.

Bitcoin Price Action

Here’s the current situation with Bitcoin:

Current Price: $57,956, while ETH price is trading at $2,364.48 (+1.11%). SOL price shows a gain of 2.11%.

Recent Movement: After the CPI data release, Bitcoin briefly hit $58,400. However, no sustained bullish movement followed.

Rate Cut Expectations: The FOMC meeting might lead to a 25 basis point rate cut rather than a 50 basis point cut, which would have been more bullish for the market.

Willy Woo's Prediction: Willy Woo predicts Bitcoin's short-term bullish trend could last 1-3 weeks but remains uncertain about medium-term trends, highlighting a possible longer re-accumulation phase before another rally.

Potential upside targets include $60,470 and $62,626.

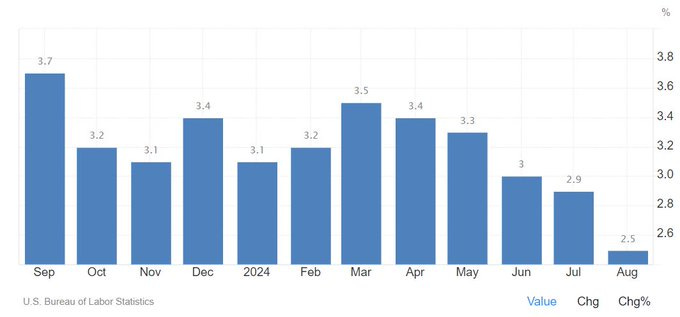

CPI Data Impact on Crypto

The Consumer Price Index (CPI) data was released yesterday. Here’s what you need to know about its impact on the crypto market:

CPI Release: The CPI came in at 2.5%, as forecasted.

Market Reaction: No major bullish sentiment followed since the CPI was in line with expectations. A lower CPI would have been a positive signal for the market.

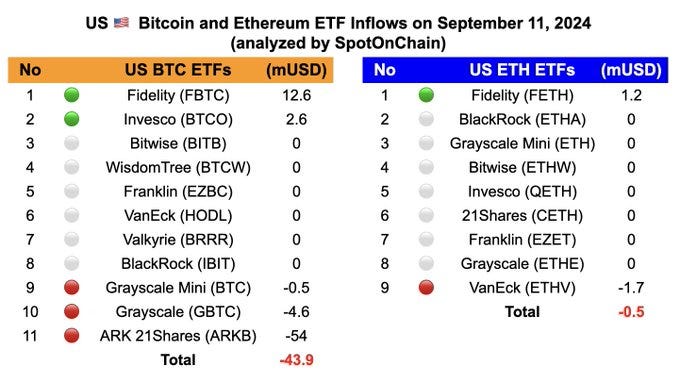

ETF Updates

Let’s talk ETFs:

Bitcoin ETFs: No significant changes recently. Notably, BlackRock hasn’t made any purchases in the last 11 days and has sold twice.

Key Player: Ark Invest, led by Cathie Wood, is the one to watch closely. Remember, when we mention BlackRock or Ark Invest not buying, it’s about investor decisions, not individual executives.

Global Crypto Adoption

Here’s a surprising update on global crypto adoption:

Top Country: India currently leads in crypto adoption, despite the 30% tax and the ban on international crypto exchanges.

Other Leaders: Nigeria, Indonesia, the U.S., and Vietnam follow. India's massive population contributes to its top position.

The Trump Effect on Crypto

Trump's Changing Crypto Stance: Trump, once critical of Bitcoin, now supports crypto, hinting that his presidency could boost the U.S. as a global crypto leader. Many predict Bitcoin could hit $100,000 if Trump wins.

Market Reaction to Harris' Rise: Kamala Harris’ strong debate performance has made her the frontrunner, causing fear of stricter regulations. This led to a drop in cryptocurrency prices and related stocks.

Crypto's Limited Debate Presence: Despite crypto-supported super PACs raising $202 million, crypto wasn’t mentioned in the debate, leaving its future tied to the election outcome and potential regulation.

UK Introduces Crypto Bill

New UK Crypto Bill: The UK has introduced a new bill that classifies Bitcoin and other cryptocurrencies as personal property, aiming to clarify their legal status.

Impact on Adoption: This move is expected to speed up the acceptance of digital assets in the UK, potentially attracting more institutional investors.

Market Reaction: Ash Crypto tweeted a bullish outlook, noting that the legal recognition will likely boost market participation and investor confidence.

Final Thoughts

Election Debates: During the first debate between Trump and Kamala Harris, crypto was not discussed. This lack of mention could be something to watch as the elections approach.

Despite recent bullishness and testing the $58,000 level, Bitcoin may face delays before hitting a new all-time high due to macro uncertainties.

Stay Updated: Keep an eye on these developments and how they might influence the market.