Ethereum's market is at a crossroads, with institutional sell-offs clashing against strong whale accumulation. As ETH follows Bitcoin’s past trends, investors anticipate a breakout while security threats and regulatory scrutiny shape market sentiment.

Institutional Selling vs. Whale Accumulation

Recent Ethereum (ETH) transactions show contrasting activity between institutional entities and crypto whales.

Golem Network transferred 4,850 ETH (worth $13.26 million) to an exchange, likely for liquidation.

This follows a larger movement from Golem’s multi-signature wallets, suggesting an intent to offload assets.

Conversely, Ethereum whales purchased ETH worth $12.98 million, indicating strong bullish sentiment.

These opposing trends highlight market volatility and the balance between accumulation and distribution.

Read Ethereum Price Prediction 2050 for more detailed insights

Ethereum’s Market Trends and Potential Breakout

Ethereum’s current price action mirrors Bitcoin’s third market cycle.

Historically, Bitcoin saw consolidation before major breakouts, which Ethereum now appears to be replicating.

ETH is forming a converging triangle pattern, signaling a potential breakout.

If this pattern holds, Ethereum could surpass $6,000 in the near future.

However, failure to maintain support could lead to price stagnation or decline.

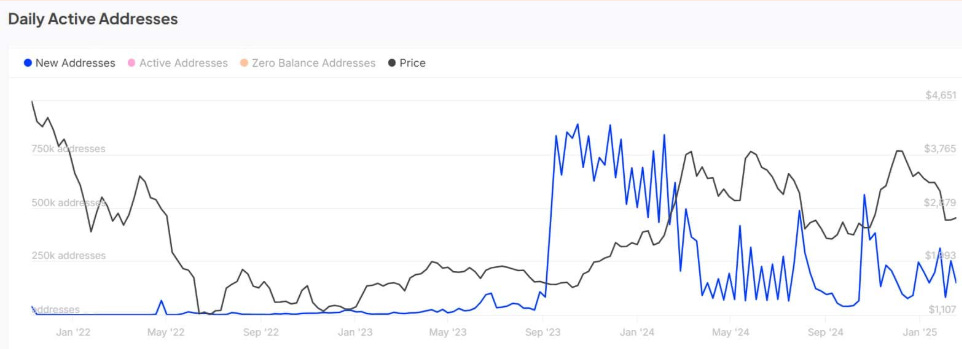

Ethereum’s on-chain activity is rising, with a 12.1% increase in new addresses over the past week.

More active users typically signal growing demand, which often precedes strong price movements.

Also Read: VET Price Prediction 2025, 2026 – 2030: Will VET Price Hit $0.1?

Bybit Hack and Lazarus Group Connection

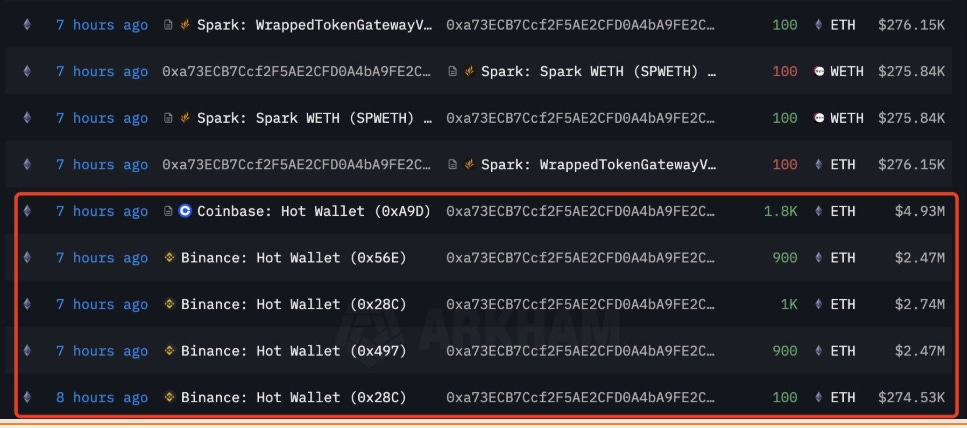

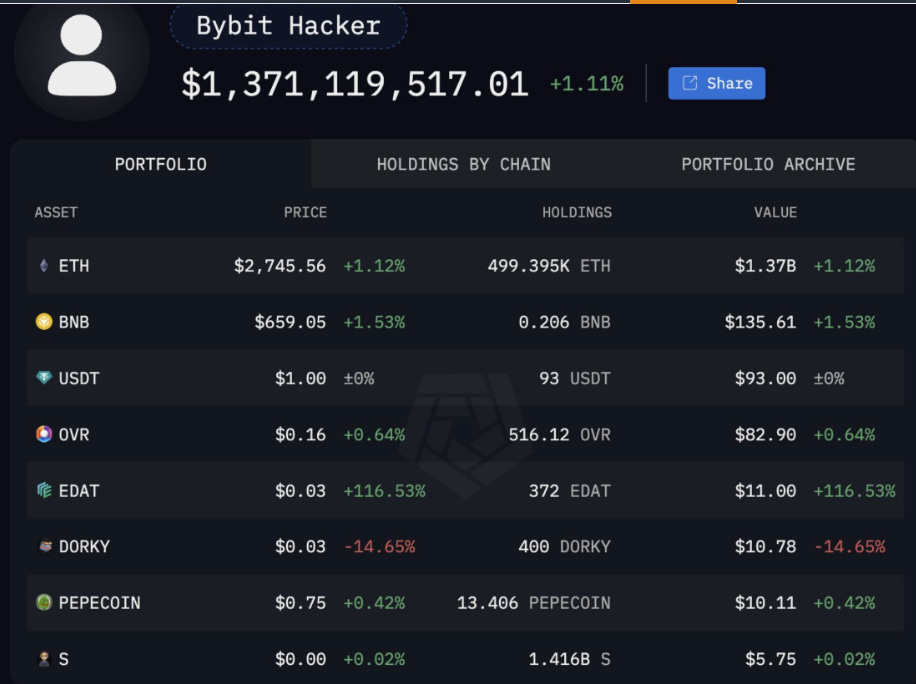

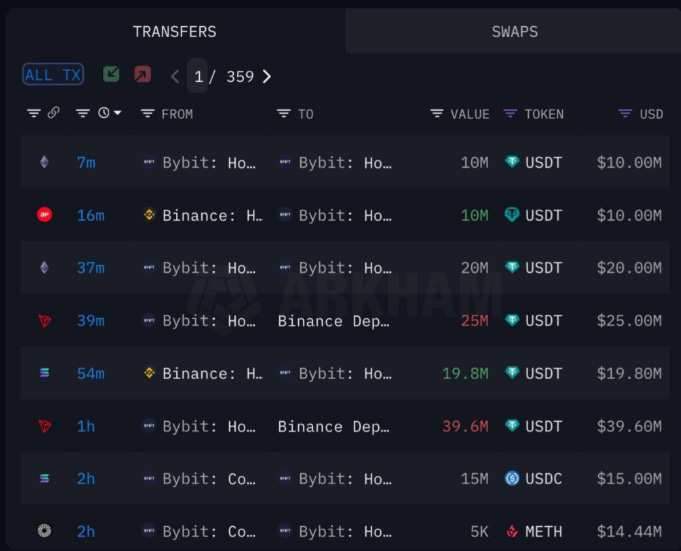

Arkham Intelligence linked the Bybit hack to the North Korean Lazarus Group.

The group allegedly stole 400,000 ETH (worth $1.37 billion) and distributed funds across 53 wallets.

On-chain data suggests laundering attempts via decentralized exchanges (DEXs) and cross-chain bridges.

Binance intervened by transferring 50,000 ETH to Bybit to stabilize liquidity.

Despite reassurances from Bybit’s CEO, investor confidence remains weak.

Ethereum is currently struggling at $2,616, while Bitcoin is facing resistance below $97,000.

Regulatory and Security Considerations

Authorities are expected to increase scrutiny on crypto exchange security.

Traders are reassessing the risks of holding assets on centralized exchanges due to rising cyber threats.

Future market stability may depend on security improvements and regulatory actions.