Can Ethereum Price hit $4,000 before January ends?

What’s next for Ethereum price prediction 2025?

Ethereum’s price has been showing significant movement, sparking debates about its potential recovery or further decline. Let’s dive into the key developments shaping the Ethereum price today and what the future might hold.

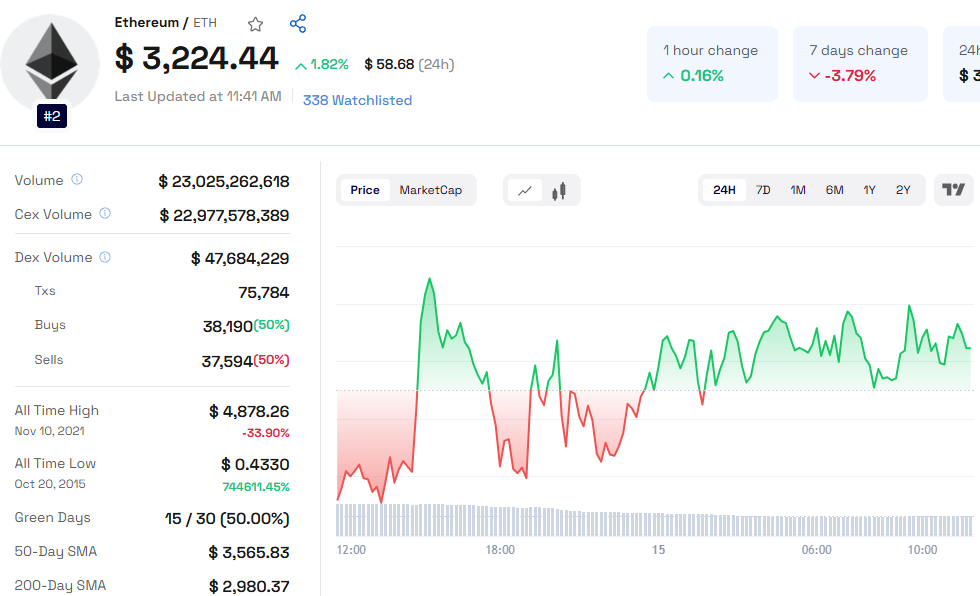

Recent Ethereum Price Movement

Resistance Rejection: On January 6, Ethereum faced rejection at the $3,730 daily resistance level.

Decline and Recovery: ETH declined 15.47% to reach a low of $2,920 but rebounded above its 200-day EMA at $3,114 on Monday.

Current Status: As of Wednesday, Ethereum hovers around $3,223, recovering 2.81% from recent lows.

Curious to know Ethereum’s price in 2026? Don’t Miss: ETH Price Prediction 2026

Key Levels to Watch

Upside Potential: If ETH closes above $3,235, it could retest the resistance at $3,730. Breaking this level may pave the way for further recovery toward the $4,000 mark and beyond.

Downside Risks: A close below $3,114 might push ETH toward the $3,000 psychological support. Failing to hold this level could trigger further declines.

Indicators Signal Mixed Momentum

RSI: The daily Relative Strength Index (RSI) is at 41, below the neutral level of 50, suggesting bearish momentum.

MACD: A bearish crossover on the MACD indicates a potential downtrend and sell signal.

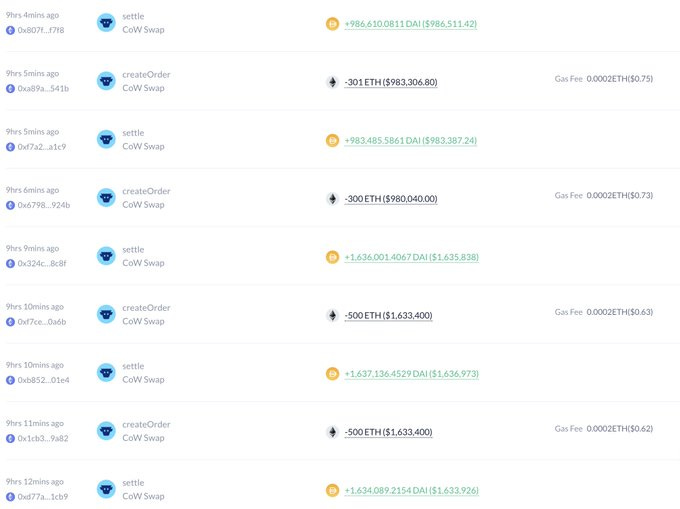

Whale Activity Adds Market Drama

Whale Movements: A large ETH holder recently sold 10,070 ETH (worth $33 million) at $3,280, incurring a $1 million loss. Despite this, the whale still holds 13,959 ETH, valued at $45 million.

💡 Did You Know?

Whales often influence market sentiment. Large sell-offs can create short-term price dips, offering potential buying opportunities.

Also Read: ALGO Price Prediction 2030

Positive Signals for Ethereum Price

Funding Rates: After turning negative near $3,000, funding rates have rebounded, signaling renewed buying interest.

Accumulation Zone: Ethereum has traded between $2,800 and $4,000 for nearly 10 months in 2024, indicating strong accumulation.

Analysts predict a breakout could push ETH to the $4,000 level, representing a potential 30% gain from current prices.

Economic Factors Supporting Ethereum

Global economic developments have provided support for cryptocurrencies like Ethereum:

Weaker Dollar: A dip in the dollar index boosted demand for riskier assets.

Trade Optimism: Reduced trade worries improved market sentiment.

Federal Reserve Impact: If inflation data supports lower interest rates, Ethereum could see further gains.

Ethereum Price Prediction 2025 and Beyond

Short-Term Targets: Analysts forecast ETH reaching $4,103, $4,788, or even $5,568 if bullish momentum continues.

Long-Term Outlook: Breaking the $4,000 barrier could set the stage for Ethereum to challenge its all-time high of $4,879 and possibly hit $5,000 or more in 2025.

Final Thoughts: Will Ethereum Go Up?

While technical indicators hint at bearish momentum, improved funding rates and strong accumulation suggest recovery potential. If Ethereum can sustain its current momentum and break key resistance levels, a bullish rally could be on the horizon.

Stay tuned to ETH news and monitor economic updates to make informed decisions about Ethereum’s trajectory.