Ethereum’s recent price action signals caution for traders and investors alike. After failing to build momentum above the $1,690 resistance, the asset faced rejection and started a fresh decline. The price dropped below crucial support levels at $1,600 and $1,580, even briefly spiking under $1,550 before finding temporary stability at $1,538.

This sharp drop has left the short-term Ethereum price prediction unclear as the market searches for its next direction. Although ETH has attempted a recovery, reclaiming $1,580 and breaking above a bearish trendline at $1,590, the price remains below $1,620 and the 100-hour Simple Moving Average.

Key Resistance Levels to Watch

Ethereum now faces stiff resistance around the $1,600 and $1,615 levels. The $1,615 price point also aligns with the 50% Fibonacci retracement level of the recent downward move. A clear breakout above $1,655 could open the path for ETH to retest the $1,700 and potentially $1,750 price zones.

Derivatives Inflows and Market Sentiment

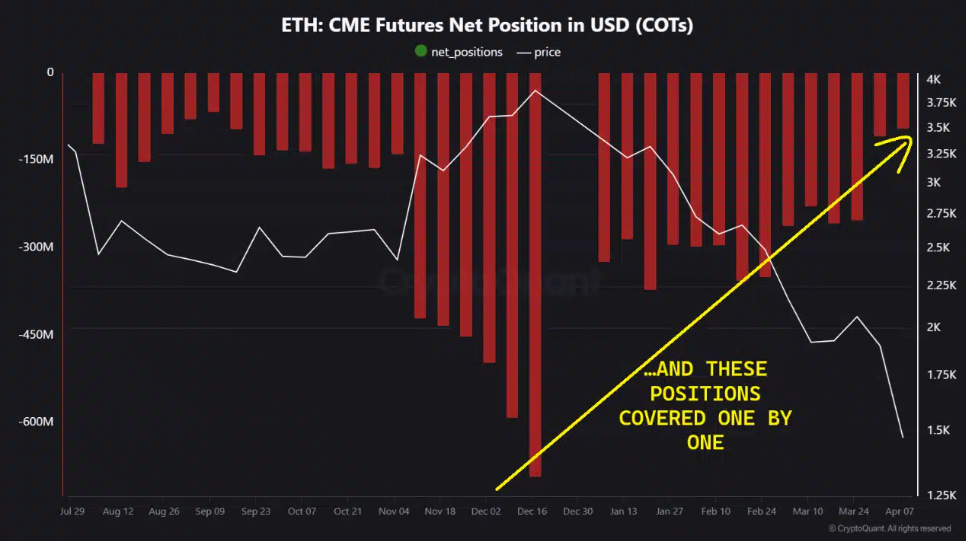

Recently, over $77,000 worth of ETH flowed into derivatives — the largest inflow in two months. Historically, similar spikes have been linked to extended price declines, as noted by CryptoQuant analyst Amr Taha. This inflow arrived amid rising geopolitical tensions, including China’s new retaliatory tariffs, which could further fuel market uncertainty.

Also Read: Compound Price Prediction 2025, 2026 – 2030

Leverage, Liquidations, and Funding Rates

Negative funding rates suggest short traders are expecting further downside.

Open interest remains near multi-month lows, while leverage is still elevated compared to late 2024.

Spot Flow Hints at Weak Demand

Spot inflows reached $36.25 million this month, signaling mild accumulation.

However, exchange inflows continue to surpass outflows, pointing to lingering market uncertainty.

Ethereum bulls are struggling to regain strength as bearish pressure remains dominant. While seller exhaustion could limit further downside, a clear bullish push is still missing — leaving the price vulnerable in the near term.