Hey There, Crypto folks!

Crypto Market Shake-Up! Global cap dips 1.5% to $2.2T as Bitcoin withdrawals surge and altcoin fever rises. Could this mean a Bitcoin boom in Q4 2024? Let’s dive in!

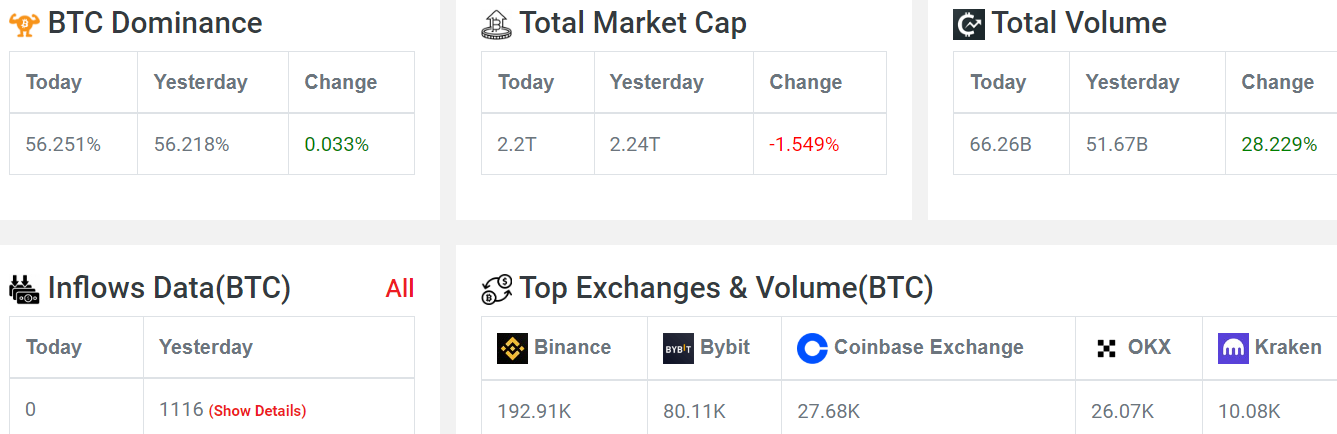

Crypto Market Overview

Market Cap: Down to $1.9 trillion.

Volume: Up by 29.7%.

Inflows: No data available since midnight; yesterday's inflow was 1116 BTC.

Fear and Greed Index: Neutral at 48.

Sentiment: Currently bearish.

Heat Map: Mostly red, with Toncoin showing darker shades.

Bitcoin Analysis

Price Movement: Bitcoin is down by 1.86%, and Ethereum is down by 2.43%.

Support Levels: Bitcoin is currently testing a crucial support zone between $63,000 and $61,400, which has been significant in the past.

Important Support: The next critical support is at $59,223.

Market Volume: There’s low volume overall. A brief spike occurred when Fed Chair Powell indicated rate cuts in September, but the market has since trended downward.

Expert Opinion: Crypto trader Mags believes Bitcoin is in a bullish trend. If historical patterns continue, a major breakout could occur soon.

Potential Breakout Timeline: Mags suggests that Bitcoin’s next major peak might happen between June and October 2025, approximately 400-550 days from now, aligning with past cycle patterns.

Regulatory Pressure: The SEC’s ongoing regulatory actions, including complaints against crypto firms like Abra for unregistered activities, have further impacted Bitcoin's price.

Semler Scientific's Bitcoin Investment: Semler Scientific increased its Bitcoin holdings by $5 million, reflecting growing institutional interest in BTC despite the market’s volatility.

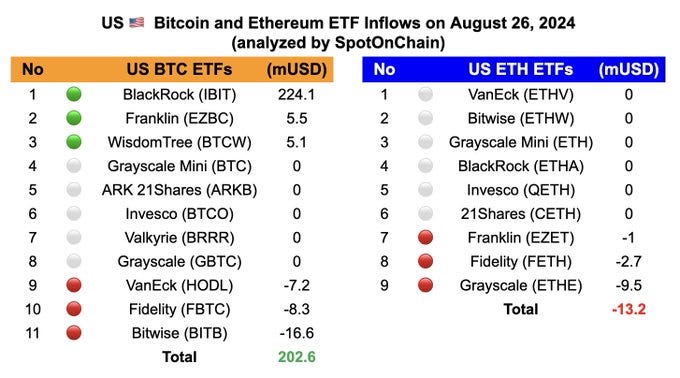

ETF Activity

Bitcoin ETF Overview:

Net Inflow: Bitcoin spot ETFs saw $203 million in net inflows.

Asset Value: The total net asset value of Bitcoin spot ETFs reached $58.473 billion. BlackRock's IBIT had a daily net inflow of $224 million, while Grayscale experienced no daily outflows.

Ethereum ETF Overview:

Net Outflow: Ethereum ETFs saw a total net outflow of $13.228 million.

Historical Data: Grayscale's ETHE had outflows of $9.5189 million, with a cumulative historical outflow of $2.542 billion. The total net asset value of Ethereum ETFs is $7.457 billion, with a historical net outflow of $478 million.

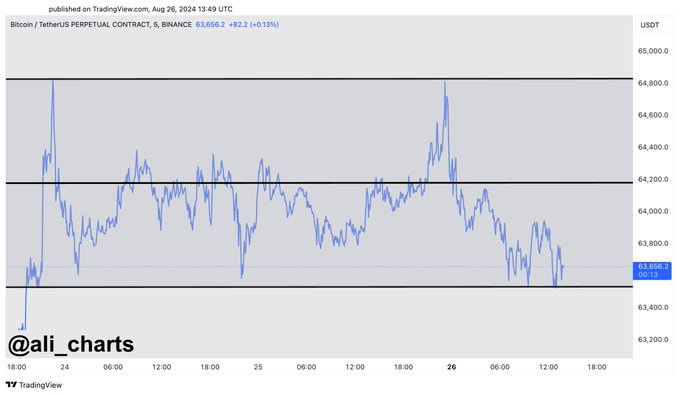

Can Bitcoin Break $62k?

Support Levels: Analyst Ali Martinez identifies $63,500 as crucial support. If Bitcoin holds this level, it could rise to $64,200 or $64,800; if it breaks, it might fall to $62,800.

RSI Comparison: Bitcoin’s current RSI is 53 at $63,500, compared to a higher RSI of 87 at the same price in March.

Short-Term Forecast: Trader Jelle expects a minor dip to around $62,700 before a potential rally, following a positive trend over the weekend.

Investment Strategy: While historical patterns suggest December 2025 could be a peak, investors should stay informed about market conditions and consider various strategies due to crypto market volatility.

Telegram Concerns

Telegram CEO Pavel Durov faces serious charges, including illegal transactions, minor pornography, narcotics trafficking, organized fraud, and unauthorized cryptology services.

French President Emmanuel Macron clarified that Durov’s arrest is part of a judicial investigation and not a political decision, highlighting France’s commitment to freedom of expression and legal frameworks.

The Russian Embassy criticized French authorities for not cooperating, while the UAE requested consular services for Durov.

Bitcoin faces a crucial test at $63,000. While short-term volatility and bearish sentiment persist, institutional interest and ETF inflows support a bullish outlook. Watch for potential breakouts above $62,800 and keep an eye on broader market trends.