Bitcoin Market Sentiment:

Recent market trends indicate a bullish sentiment amid global economic shifts.

Fear and Greed index is around 28 indicating fear in the market.

Bitcoin's current price hovers around $58,564, showing signs of stability after recent fluctuations.

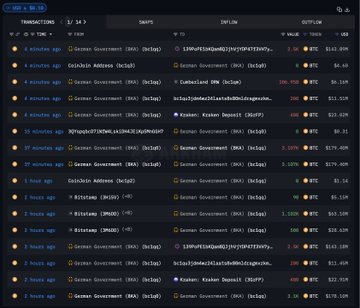

Global Economic Impact and German Regulatory Updates:

Germany continues to regulate Bitcoin transactions cautiously, focusing on maintaining transparency.

Recent data shows increased BTC transactions, reflecting growing investor confidence despite regulatory scrutiny.

Technical Analysis and Market Insights:

Technical charts highlight Bitcoin's resistance level breaking at $58,200, suggesting potential for upward movement.

Support levels confirm stability at $59,200, indicating strong market sentiment favoring continued growth.

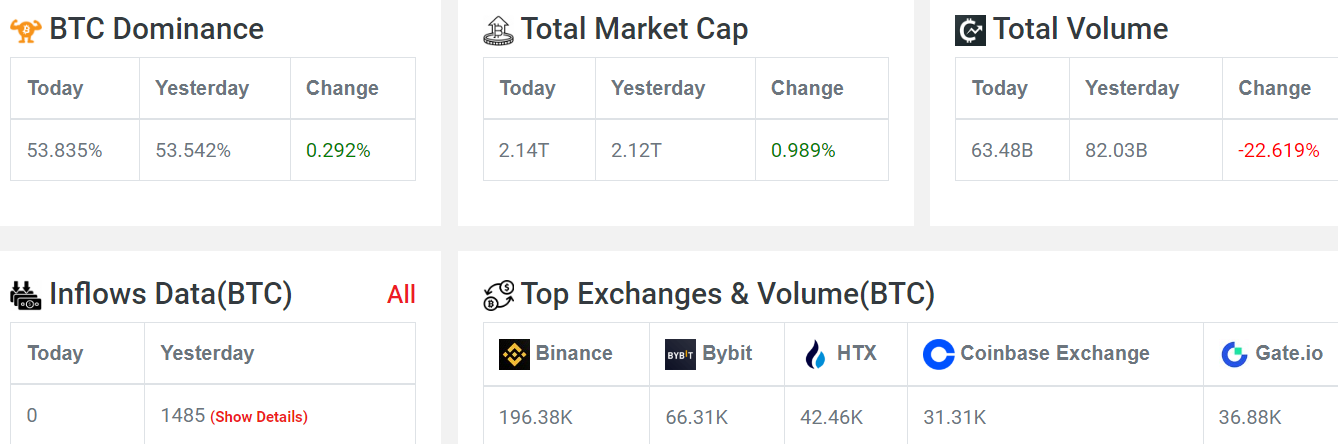

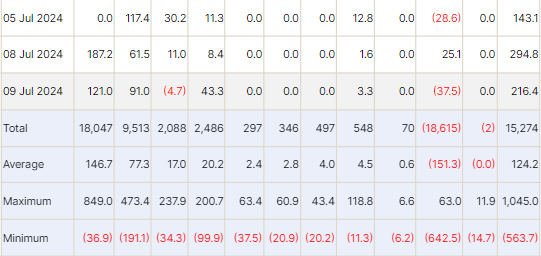

Inflow and Outflow Data Analysis:

Bitcoin ETF inflow metrics indicate a significant increase, with recent data showing a rise in transactions.

Outflow remains steady, with no major anomalies observed, suggesting balanced market behavior.

Market Strategies and Institutional Investments:

Institutional buying patterns show consistent interest, particularly in ETFs and other Bitcoin-related financial instruments.

This institutional support reinforces Bitcoin's position as a viable investment option amidst economic uncertainties.

OTC Desk and ETF Activity:

Bitcoin balances increased on the OTC desk, reaching over 300,000 BTC and reduced buying activity.

Expectations for ETF activity based on recent data.

Future Market Projections and Risk Factors:

Analysts project a bullish outlook for Bitcoin, with potential price targets above $60,000 in the short term.

Risks include regulatory changes, economic downturns, and market volatility, which could impact future price movements.

Discussion about this post

No posts