Hello, savvy traders!

Over the past week, the cryptocurrency market faced challenges including low readings on the Fear and Greed Index, Bitcoin holds strong above $57,000, hinting at a potential uptrend. Institutional investors seize opportunities with notable ETF inflows, signaling renewed market confidence.

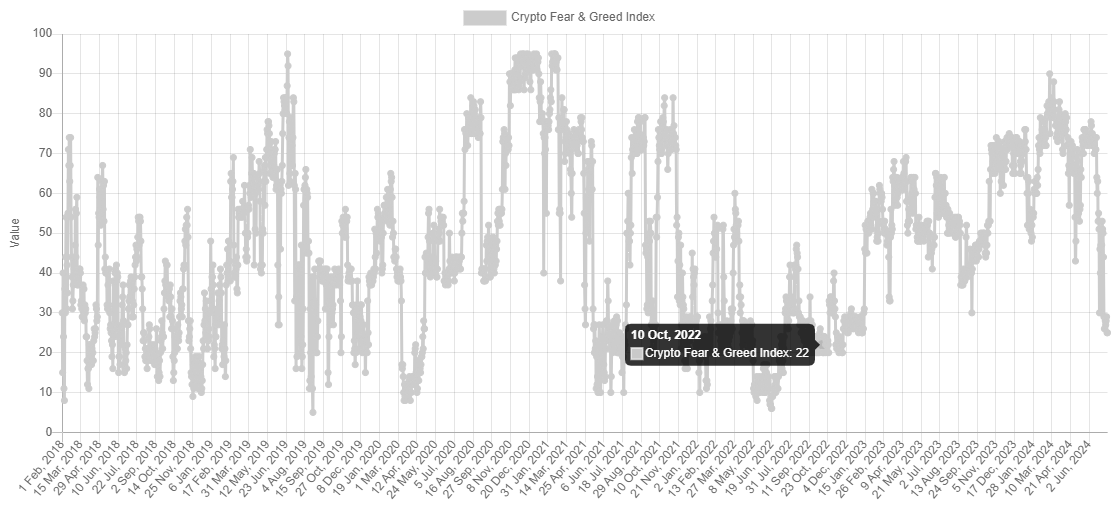

Fear and Greed Index

The Fear and Greed Index recently hit a low of 25, marking one of the lowest readings in this bull market.

Despite this, Bitcoin's price is higher than its previous low of $53,500, now hovering around $57,000 to $58,000.

Price Analysis

The Bitcoin price chart shows a slightly higher low and a slightly higher high, indicating a possible upward trend.

For a longer-term confirmation, Bitcoin needs to close above $58,400, ideally reaching $585,000.

Breaking the downtrend line and closing above $60,000 would be strong bullish signals.

Market Sentiment and Price Movement

Comparing current market sentiment with past events, such as the FTX collapse in 2022 when fear was at 22.

Historical data shows that extreme fear often precedes market stabilization or recovery.

Total Cryptocurrency Market Cap

The total crypto market cap is holding above the 50% level, indicating potential support, and showing strength in specific altcoins like Solana.

Key levels to watch include 2.1 trillion for a close above recent lows and 2.31 trillion for further bullish confirmation.

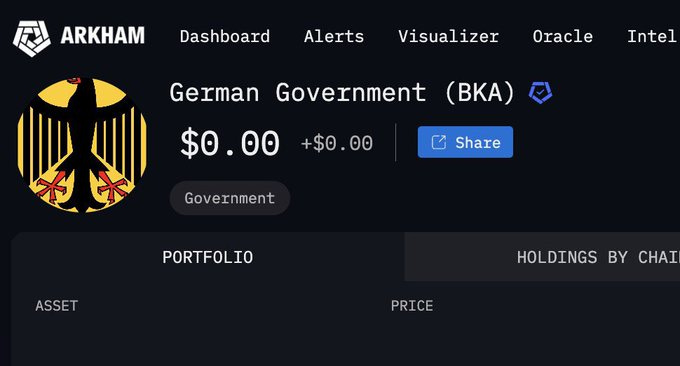

Impact of the German Government's Bitcoin Sale

Over a three-week period, the German government sold around 50,000 Bitcoin.

This large volume came primarily from asset seizures.

Market Impact

The influx of Bitcoin into the market kept prices below $60,000.

Bitcoin prices also remained under the 200-day exponential moving average.

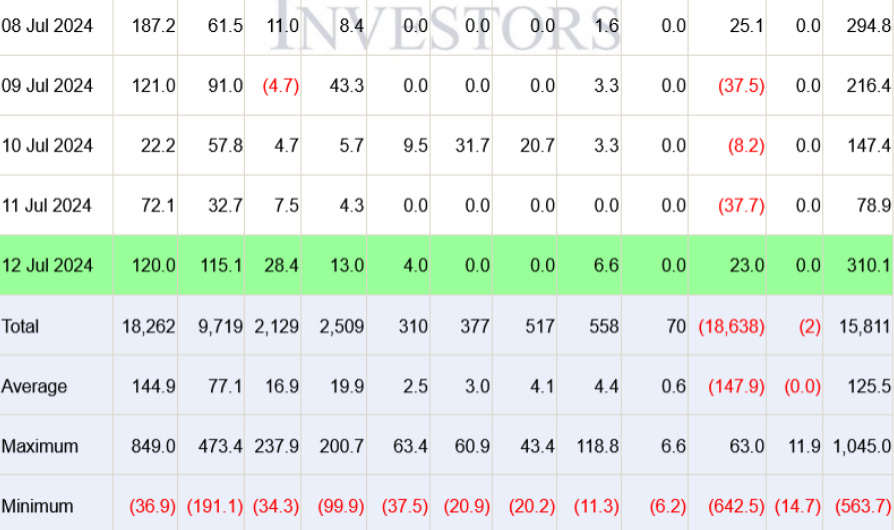

Institutional Investors and Market Resilience

Despite the selling pressure from the German government's actions, institutional investors saw an opportunity to buy the dip.

Data indicates that U.S. exchange-traded funds (ETFs) experienced $295 million in inflows during the week of July 8.

This influx reversed several weeks of low investment activity, showcasing renewed confidence in the market.

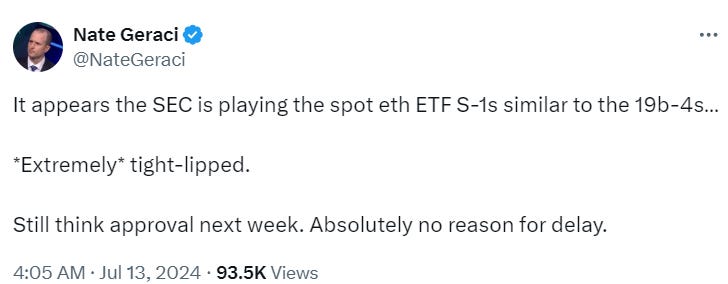

Upcoming Developments in ETFs

Bitcoin ETF issuers are preparing to launch spot Ether (ETH) ETFs.

These new ETFs could be available as early as next week, according to Nate Geraci, President of The ETF Store.

Regulatory Approval

The issuers are currently awaiting the U.S. Securities and Exchange Commission (SEC) to approve their amended S-1 registration statements.

The approval process follows a first round of feedback received late last month.

Despite regulatory challenges and significant selling pressure, including actions by the German government, the cryptocurrency market shows remarkable resilience.

Key altcoins such as Solana exhibit strength, bolstered by active participation from institutional investors through ETFs.

Bitcoin's price holding near $58,000 suggests cautious optimism, with market watchers eyeing $58,400 and $60,000 as pivotal levels for potential bullish confirmation and continuation of the current uptrend.