Hey there, crypto enthusiasts! We've seen some major market shifts, and there's a lot to unpack. Let's dive into the latest Bitcoin news, the Mt. Gox sell-off, and how economic factors like the job market and Federal Reserve policies are impacting Bitcoin's price.

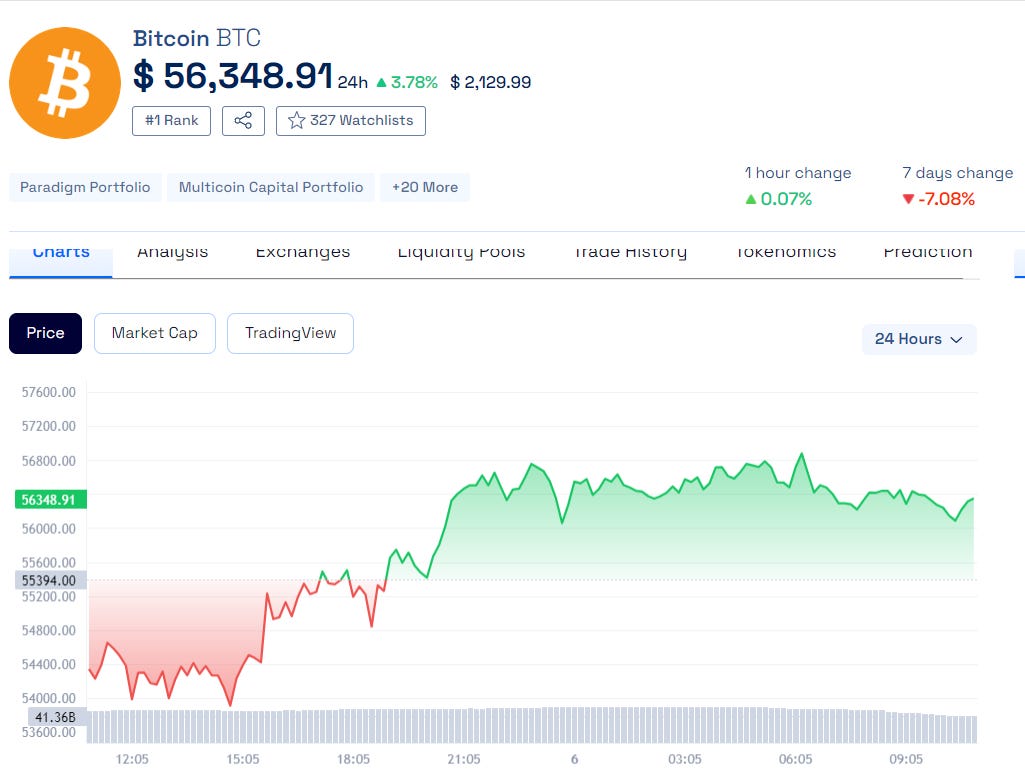

After taking a dive to a 24-hour low of $53,898, Bitcoin managed to claw its way back up above the $56,000 mark, rising by 1.6% in just the past hour.

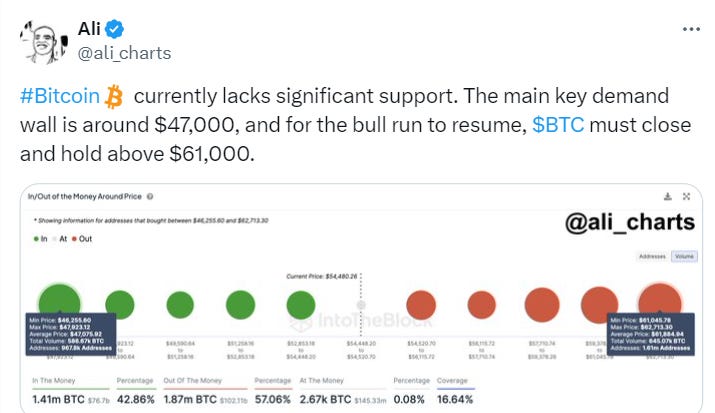

Despite this impressive recovery, not everyone is convinced that Bitcoin's out of the woods. Ali, the crypto analyst, warned that Bitcoin might take a significant tumble down to around $47,000. That’s a bold prediction, right?

And that's not all—today's been buzzing with talk about emerging volatility in the crypto market. Greek Live pointed out that a bunch of Bitcoin and Ethereum options are about to expire, and this could shake things up even more.

We're talking about 18,000 Bitcoin options and 164,000 Ethereum options set to expire soon. These options have notional values of $1 billion and $470 million, respectively. That's a huge amount of money, and it could definitely stir the pot.

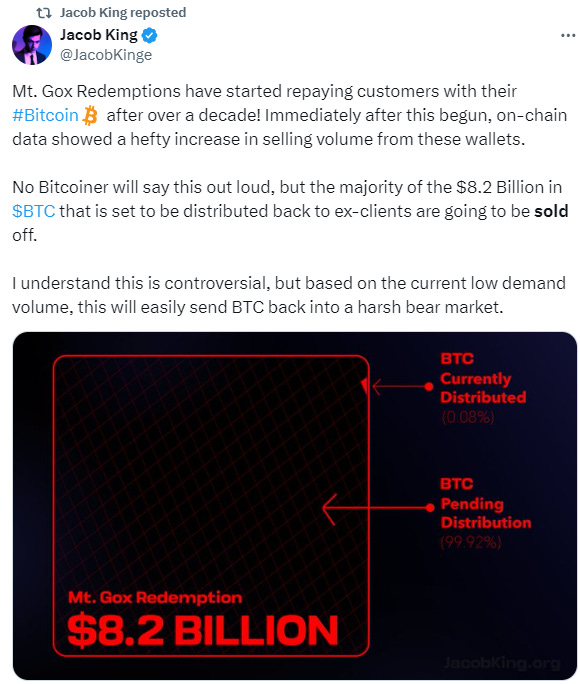

What's Going On with the Mt. Gox Sell-Off?

Well, after almost a decade, creditors are finally getting their Bitcoin back. We're talking about $8.2 billion worth! But here's the catch: most of these creditors are expected to sell their Bitcoin to lock in profits. This could flood the market and put a lot of downward pressure on Bitcoin's price.

How the Job Market Affects Bitcoin

Let's shift gears a bit. Recently, we've seen some weakness in the US job market. The unemployment rate has climbed to 4.1%, the highest it's been since December 2021.

So, what does this mean for Bitcoin? Well, when traditional investments look shaky, people often turn to alternatives like Bitcoin. If the job market continues to struggle and we see weaker growth in the non-farm payroll (NFP) report, there might be more talk about the Federal Reserve cutting interest rates. This could boost Bitcoin as investors look for better returns.

Federal Reserve Interest Rates and Market Movements

Speaking of the Federal Reserve, their interest rate policies are another key factor to watch. Historically, when the Fed shifts from raising to lowering interest rates (a "pivot"), the market tends to react strongly. Rate hikes usually lead to market downturns, while rate cuts can cause initial drops followed by recoveries.

Right now, the Fed's interest rates are around 5.5%, a level we haven't seen since November 2007. Looking back, markets typically don't like these rate cuts at first, but they eventually bounce back. For instance, during the 2019 Fed pivot, the S&P 500 dropped 15% before recovering.

If we see the Fed cutting rates soon, we might experience a similar pattern. There could be a short-term market dip affecting Bitcoin and other risk assets, but this could also set the stage for a recovery and potential buying opportunities.