Hello friends,

Exciting changes are on the horizon for Bitcoin! In this article, we’ll explore a crucial tweet revealing key insights that could reshape Bitcoin’s future in the next five years!

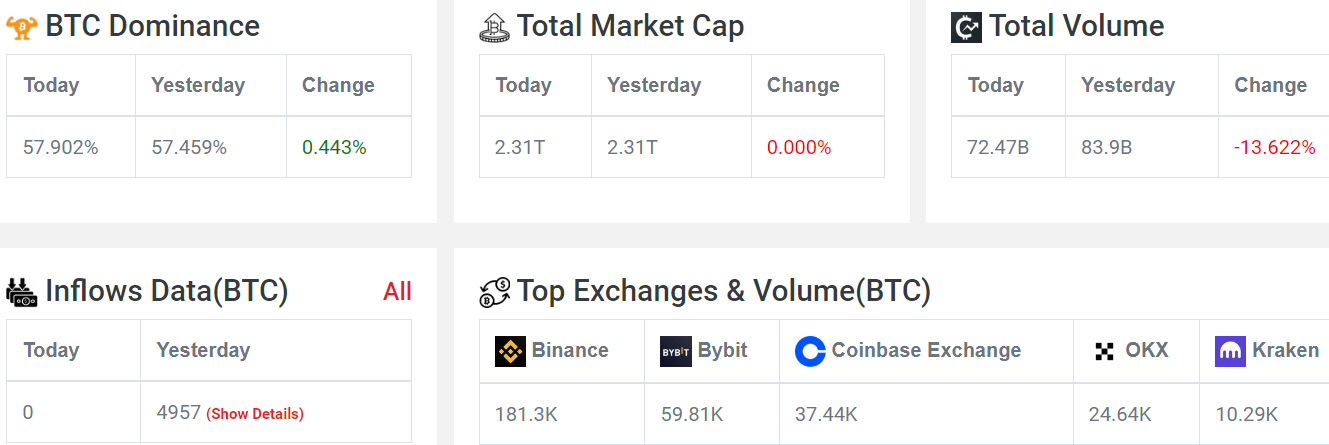

Crypto Market Overview

Market Volume: Trading volume has dropped by 12.6% since midnight.

BTC Inflows: Yesterday saw an inflow of 4,957 BTC.

Market Sentiment: The Fear and Greed Index stands at 72, indicating a sense of greed among investors.

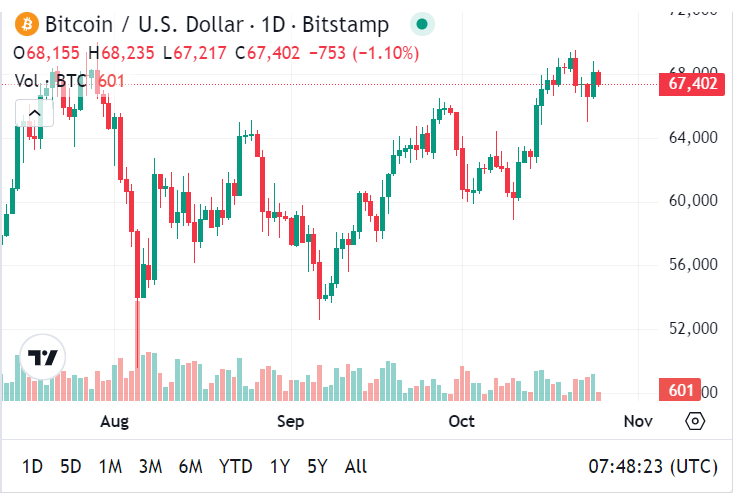

Bitcoin Price Analysis

Current Price: Bitcoin is priced at $67,766 as per Coinpedia Markets, facing resistance at $69,000.

Recent Highs: It is approaching a two-month high, currently trading around $67,739, with a market cap of approximately $1.33 trillion.

Support Levels: Holding above the $68,000 support level could help push prices toward $70,000.

Whale Accumulation: The number of wallets holding over 100 BTC has increased by 297 in two weeks, suggesting bullish sentiment.

Retail Exodus: Over 20,000 smaller wallets have decreased, indicating retail traders are cashing out while larger investors buy during dips.

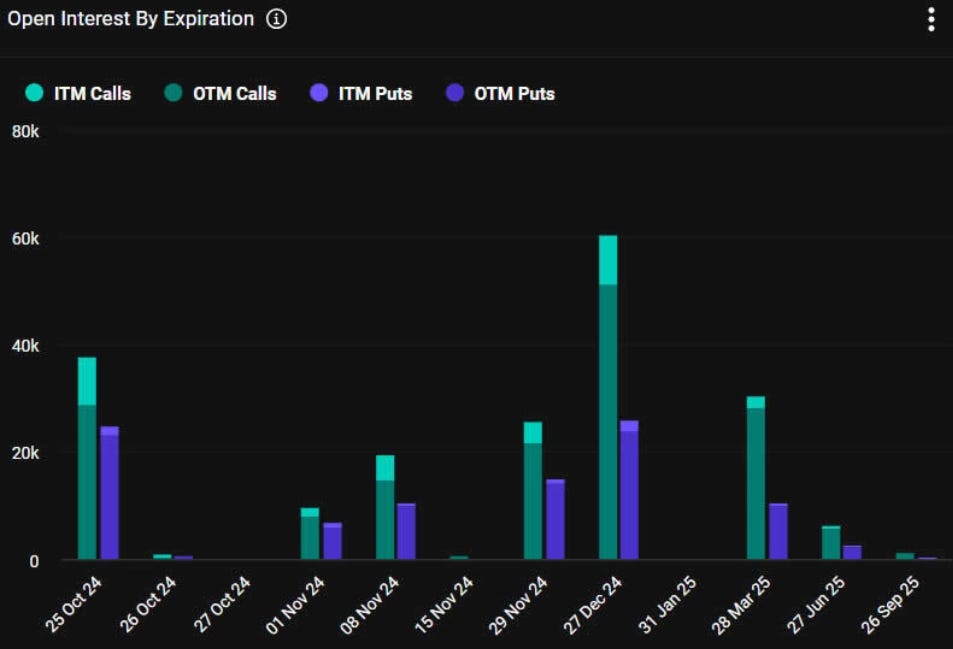

Upcoming Bitcoin Options Expiry

Market Volatility: A significant Bitcoin options expiry today could create volatility.

Contracts Expiring: Approximately 62,600 contracts worth around $4.26 billion are set to expire.

Open Interest: There is over $1 billion in open interest at the $70,000 strike price, reflecting confidence among traders.

Altcoin Performance Insights

ADA Token: The ADA token is down to $0.34, well below its high of $0.810. It needs to break a descending trendline for bullish movement. For more insights, check out the ADA price prediction.

VeChain’s Recovery: VeChain is currently at $0.0226 after a dip. Holding above key support levels could lead to a bullish rebound. Don’t miss out on the latest VET price prediction!

Upcoming U.S. Economic Data

Important U.S. economic data is set to release next week, which could influence Bitcoin's price.

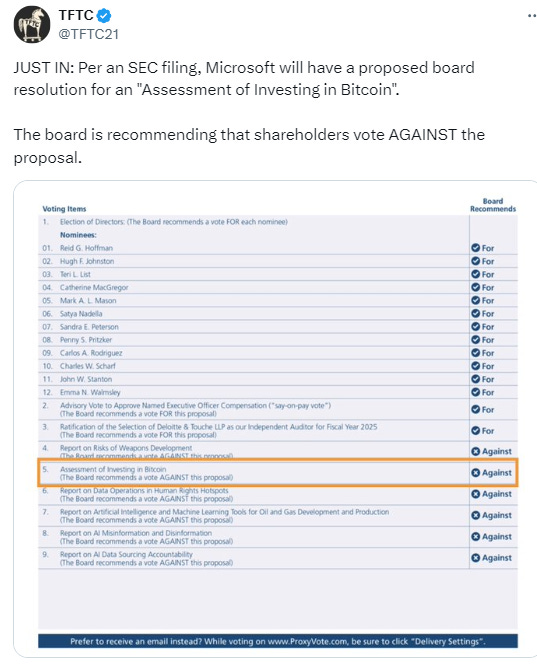

Corporate Developments Impacting Bitcoin

BlackRock Investment: BlackRock recently purchased $317 million in Bitcoin, helping the market recover from bearish trends.

Microsoft’s Interest: Microsoft is considering Bitcoin investment, with a shareholder vote planned for December 10, 2024, to assess its investment strategy.

Future Outlook for Bitcoin

Market Recovery: Bitcoin reached an intraday high of $68,821, showing a 13% increase over the past two weeks.

Reduced Volatility: As more institutions enter the market, Bitcoin's volatility may decrease, paving the way for its use as a serious currency by 2028.

Buying Opportunities: Investors should consider buying Bitcoin now, as prices may rise significantly in the future.

Price Strategy: Aggressive buyers may look to enter the market while prices remain above $66,000.

Risk of Sell-off: A dip below this week’s low, especially with rising volume, could trigger a sell-off toward $60,000.