Hey, Crypto Enthusiasts!

Discover what’s fueling Bitcoin’s surge to $65,000 and how it’s shaking up the market. Plus, explore key altcoin movements like Ethereum’s steady climb and Solana’s breakout above $150. Don’t miss the latest Solana price prediction!

Bitcoin Price Pump: What's Driving It?

Bitcoin has recently jumped to $65,513, sparking interest across the market. Several factors are contributing to this pump, including:

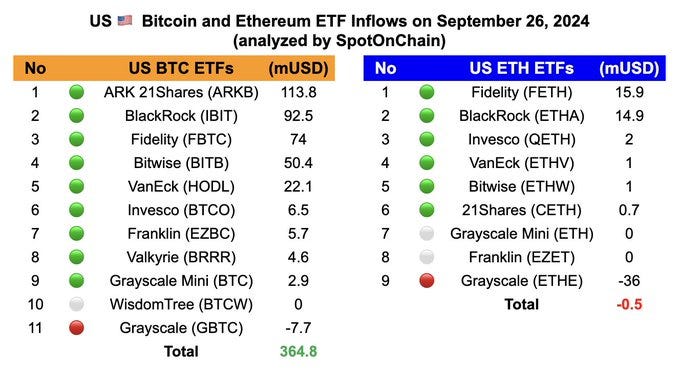

ETF Developments: Positive data from Bitcoin ETFs, particularly the activity from BlackRock, has fueled optimism. BlackRock has been steadily buying Bitcoin, and their purchases on September 24th and 25th played a big role in the price increase.

Institutional Buying: Large inflows of around $272 million into Bitcoin have created upward pressure on the price, signaling confidence from big players.

U.S. Stock Market Performance: Bitcoin’s price is often influenced by the performance of traditional markets, and recent gains in the U.S. stock market have also supported the rise.

Key Levels to Watch: Will Bitcoin Break $68,000?

When you zoom out and look at the weekly time frame, Bitcoin's price action shows clear resistance at around $68,000. Here’s why this level matters:

Breaking Above $68,000: If Bitcoin can close above $68,000 on a weekly candle, it could lead to a significant rally. This level has acted as a strong resistance multiple times in the past.

Potential Rally: A breakout could push Bitcoin into a parabolic bull run, where prices increase dramatically.

Current Resistance Zone: Right now, Bitcoin is stuck just below this resistance. Until we see a break above $68,000, we’re likely to experience more volatility, with short-term dumps and pumps.

What’s Going On in the Broader Crypto Market?

It’s not just Bitcoin making waves right now—the broader cryptocurrency market is also seeing some notable action:

Altcoins: Many altcoins are experiencing double-digit gains alongside Bitcoin’s price surge.

Ethereum (ETH): Ethereum is also on the rise, with positive data coming in, especially from September 24th and 25th, contributing to a more bullish outlook for the entire market. For an updated Ethereum price prediction, things are looking optimistic, with potential for more growth ahead.

Solana (SOL): Solana (SOL) is gaining momentum, breaking the $150 resistance and targeting a potential new high above $158.

The Big Picture: Macroeconomic and Geopolitical Factors

Beyond the crypto-specific news, there are global factors at play that can’t be ignored:

U.S. Recession Fears: There’s increasing speculation about a potential U.S. recession in 2025. If this happens, it could have a ripple effect on both the crypto and stock markets. Some experts believe we’ll see signs of recession in the second quarter of 2025.

Geopolitical Tensions: The ongoing Israel-Palestine conflict and upcoming U.S. elections are adding uncertainty to the markets. These events can have a direct impact on Bitcoin and other cryptocurrencies.

What the U.S. Elections Mean for Crypto

The upcoming U.S. elections could have a major impact on the future of cryptocurrency regulation:

Trump’s Potential Return: If Donald Trump wins the election, we could see favorable policies for crypto. Mark Cuban has expressed interest in becoming the head of the SEC, which would likely benefit the market.

Kamala Harris's Stance: Meanwhile, Kamala Harris has been cautious about openly supporting crypto. She’s spoken more about blockchain technology and digital assets, but has avoided directly addressing Bitcoin or cryptocurrencies. This could indicate a lack of strong support from her side, should she take a leading role.

What’s Next for Bitcoin?

Bitcoin’s future price movements will largely depend on whether it can break above $68,000. Here's what to keep in mind:

Breakout Confirmation: If Bitcoin closes above $68,000 on a weekly candle, we could see a bullish rally.

Failure to Break: If it fails to close above this key level, expect continued volatility, with the price fluctuating between dumps and pumps.

Bitcoin Demand in the U.S.: Bitcoin is seeing increased demand in the U.S., but the Coinbase Premium remains close to zero, indicating the bull run hasn’t fully taken off yet.

Options Expiry and Volatility: Bitcoin is likely to experience short-term price volatility due to the options expiry scheduled for the end of the week.

Final Thoughts

Bitcoin's impressive price surge is fueled by exciting ETF news and hefty institutional purchases. Yet, with the U.S. elections and recession fears looming, watch those key resistance levels closely—big market shifts could be on the horizon!

Mark Cuban supports Harris. Why would you put his name in with Trump????You are misleading people. Harris will be pro crypto as well.