Bitcoin Remain in uptrend following 25 bps Fed rate cut

BlackRock Bitcoin ETF Sees $1.1B Surge in Inflows

Hello, Crypto Crusaders!

Today, we’re diving into the latest market trends, from Bitcoin’s all-time high and BlackRock’s ETF milestone to Ethereum and Solana’s rally. Big changes are unfolding!

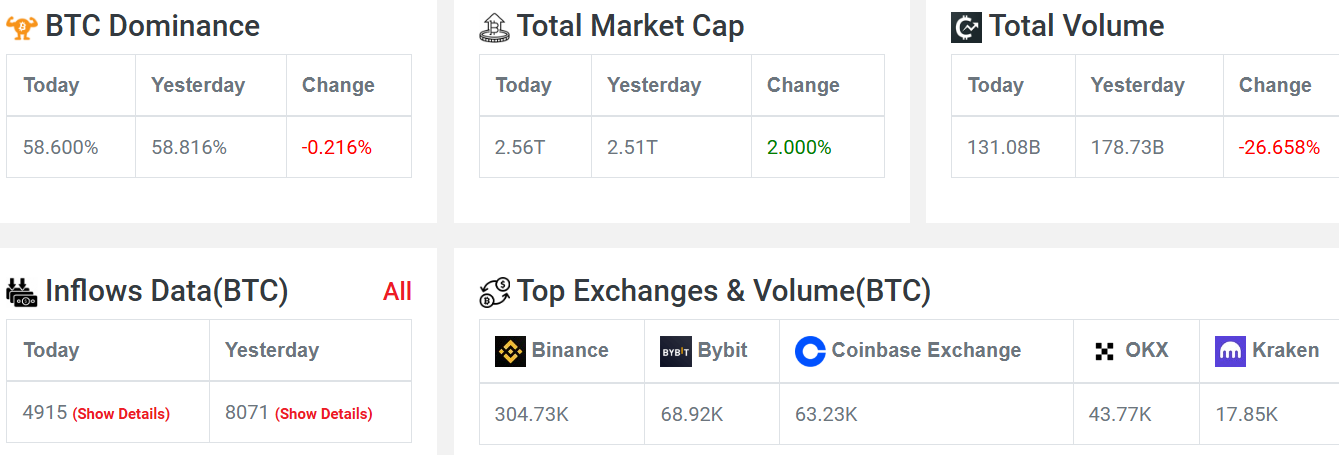

Crypto Market Overview

The global market cap is up by 1.3%, but the volume has dropped by 29.7% as per Coinpedia Markets.

According to the inflow data, there was an inflow of 2,461 BTC as of midnight, compared to 8,071 BTC the day before.

The Fear and Greed Index is currently at 75, indicating market greed.

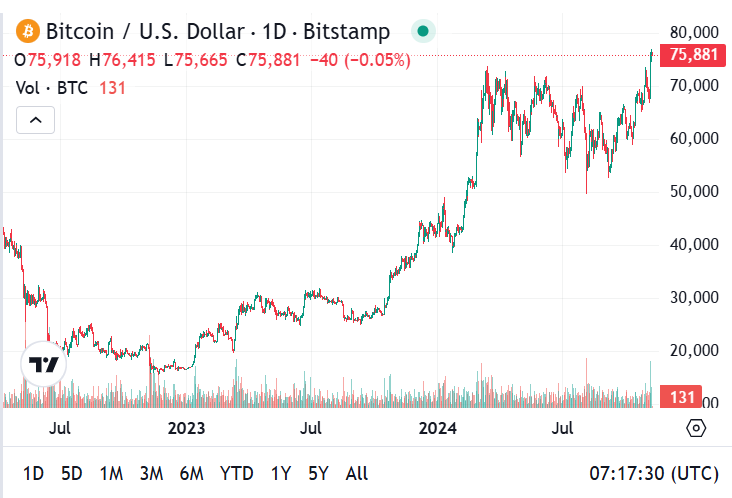

Bitcoin (BTC) is showing bullish signs, with its price currently at $75,913, just shy of the new all-time high of $76,931.

Ethereum (ETH) has risen by 2.45%, with the potential to extend its rally by 11%. Ethereum price could soon retest its weekly resistance level at $3,236.

Solana (SOL) has made waves, reaching $200, and if you bought Solana when it was at $13.14, you might be seeing good returns now!

Bitcoin's All-Time High

Bitcoin has set a new all-time high at $76,931.

The market is still showing positive sentiment as Bitcoin continues to make headlines.

The FOMC Meeting and What Jerome Powell Said

The Federal Open Market Committee (FOMC) meeting took place, and the US Federal Reserve cut rates by 25 basis points.

Jerome Powell, the Fed Chairman, highlighted that the US economy is strengthening and that they’re close to reaching their interest rate targets.

Regarding Trump, Powell clarified that the US government is legally positioned, and Trump’s influence on policies wouldn’t change things drastically.

Powell also mentioned that future policies will depend on available data, and that the government will play a role in future decisions.

Bitcoin ETF and BlackRock's Major Move

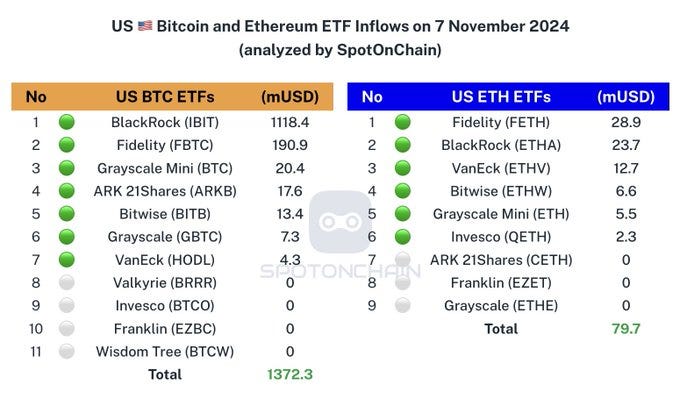

BlackRock’s Bitcoin ETF Hits $1B Milestone: On November 7, BlackRock’s IBIT ETF reached over $1 billion in inflows, a first since its launch, fueled by Bitcoin’s price surge.

Big Inflows After Recent Outflows: After two days of outflows ($113.3M), IBIT bounced back with $1.1B in inflows, capturing 82% of all U.S. Bitcoin ETF inflows totaling $1.34B.

Bitcoin Sets New All-Time High: The ETF surge aligned with Bitcoin reaching a record $76,943, drawing heavy institutional interest.

Other ETFs Join the Rally: Fidelity’s FBTC and ARK’s ARKB ETFs saw inflows of $190.9M and $17.6M, respectively, boosting overall inflows to $1.34B.

FOMO Kicks In: Bitcoin’s price rally is driving FOMO, as even investors new to crypto, including giants like BlackRock, are diving in.

Following the Fed’s rate cut, the crypto market remains strong, with Bitcoin and other assets historically benefiting from low-interest environments that fuel investor appetite for risk, driving prices higher.