Bitcoin Price Soars to $55,500! Is the Crash Finally Over?

Crypto Market: Recovery in Sight or a Trap? 🚨

Hey Crypto Champs

Ready to ride the crypto wave? 📈 Dive into strategic buys and seize market dips for potential long-term gains! Discover why now is the time to act.

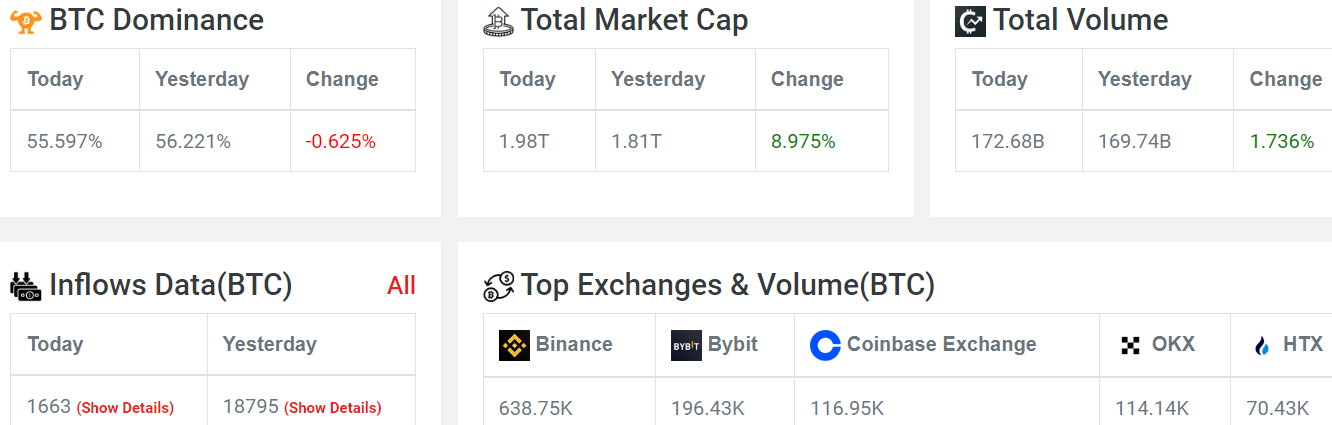

Crypto Market Overview

Market Cap: Currently stands at $8.97 trillion.

Volume: A significant rise in trading volume, with over $200 billion recently observed. This 52% increase in volume is noteworthy.

Inflow Data: Since midnight, 1663 BTC has flowed into the market, with 18,795 BTC inflow recorded yesterday. There have been 13 major inflow events, indicating increased market activity.

Fear and Greed Index

Current Level: The Fear and Greed Index has finally hit the 'Extreme Fear' level.

Market Sentiment: Despite the initial dip, recovery has been slow. BTC is up 2.99%, Ethereum is up 6.21%, and altcoins like BNB and Solana are showing double-digit gains.

Bitcoin's Movement: BTC was around $55,000-54,000 yesterday, dipped to $49,000, but found support as predicted around $52,000-50,000.

Ethereum's Performance: Ethereum has been strong, finding support around $2,500, with potential to reach $25,000 in a few years.

Market Dynamics

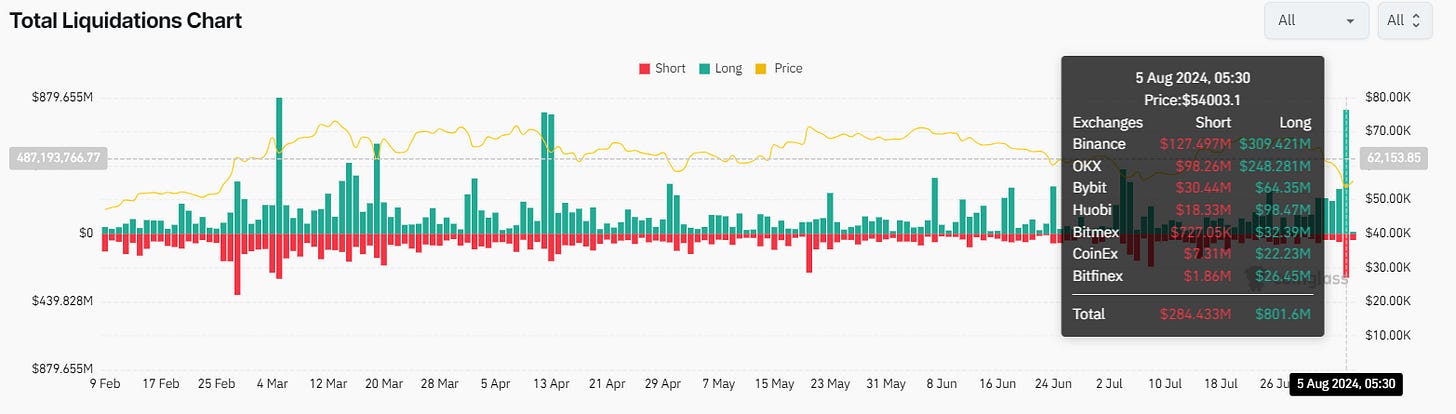

Recent Liquidations: Approximately $1.1 billion in liquidations, affecting both long and short positions. High leverage traders have been particularly impacted.

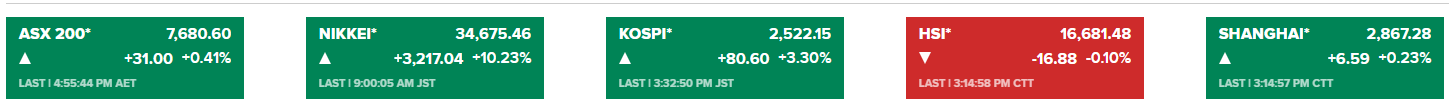

Global Market Impact: Major global markets like Japan, Korea, and Taiwan hit lower circuits. US indices like S&P 500 are down, with some recovery seen.

Rumors and Speculations: Rumors about the Fed holding an emergency meeting for rate cuts are potentially influencing BTC recovery.

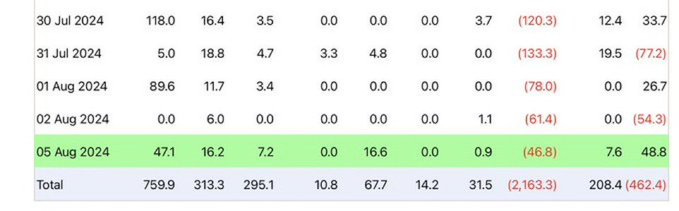

ETF and Institutional Moves

BlackRock Activity: No significant buying, with net positive buying of $48.8 million in Ethereum.

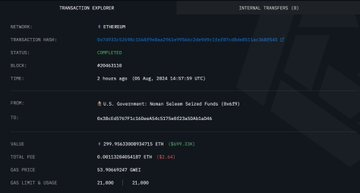

Ethereum Transactions: The US government transferred 300 ETH, sparking some market FUD. The reason for the transfer remains unknown.

Potential Market Recovery

Global Factors: The situation in Japan and the potential for further dips are significant. US market performance and the geopolitical tensions between Israel and Iran could impact the crypto market.

War Speculations: Media reports of imminent war between Israel and Iran, but it's uncertain if the US can afford such a conflict. US and Russia's involvement could escalate the situation.

Market Impact: Tensions have created a volatile market environment, but sustained recovery is crucial.

US Elections

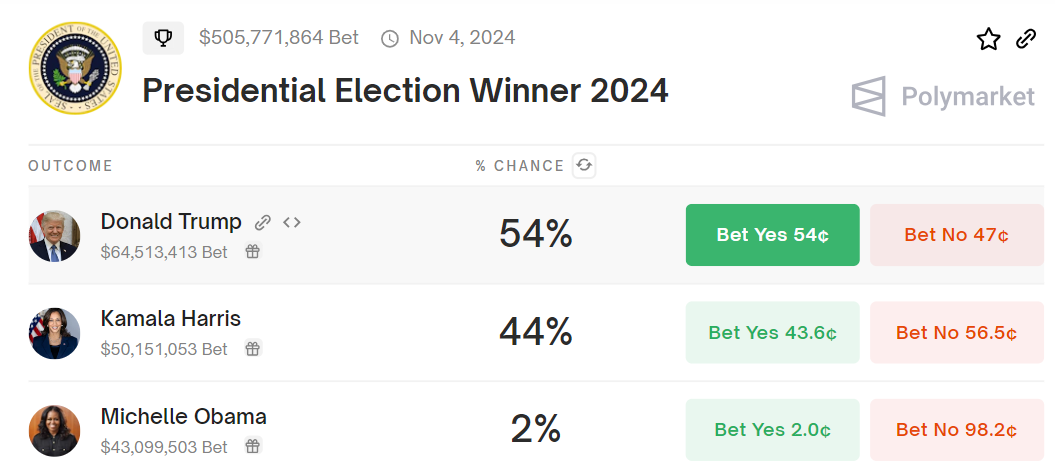

Polls and Predictions: The election race between Trump and Kamala Harris is tightening. Trump is currently at 54%, Harris at 43%, and unexpected numbers for Michelle Obama.

Market Crash and Recovery

Global Issues: The crypto market crash is driven by global issues, not internal crypto problems. The rumors and actual moves by institutions add to the volatility.

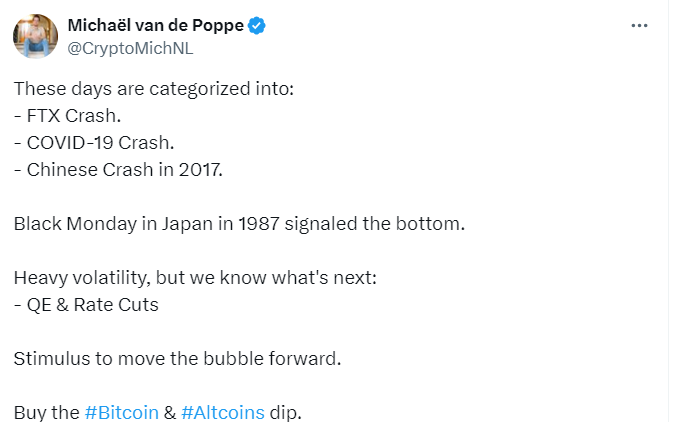

Historical Crashes: Compared to past crashes like the COVID-19 crash (BTC dropped 40% in a day) and the Tesla announcement crash (31% drop), current events are part of ongoing market cycles.

Arthur Hayes predicts a second wave of market crashes due to high-leveraged positions by traders in traditional markets. Despite signs of recovery, Hayes believes this current respite is temporary.

Buying Opportunities

Buying Strategy: Place buy orders for Bitcoin below $53,000 and Ethereum below $2,300 to capitalize on market dips. Continue buying at key levels for both short-term fluctuations and long-term recovery.

Expert Insights: Tuur Demeester suggests a potential downside target for Bitcoin in the $40-45k range, though this is more of a psychological preparation. In a bull market, bearish bets are risky as prices can rebound quickly.

Market Outlook: Despite recent gains, Bitcoin faces historically challenging months ahead. Increased liquidity and positive ETF news could support recovery. However, expect low volatility and gradual accumulation until Q4 when election uncertainties and FED liquidity injections could drive a rebound.