Attention Crypto Lovers!

Here’s what’s happening with Bitcoin and Ethereum in today’s volatile market.

Market Overview

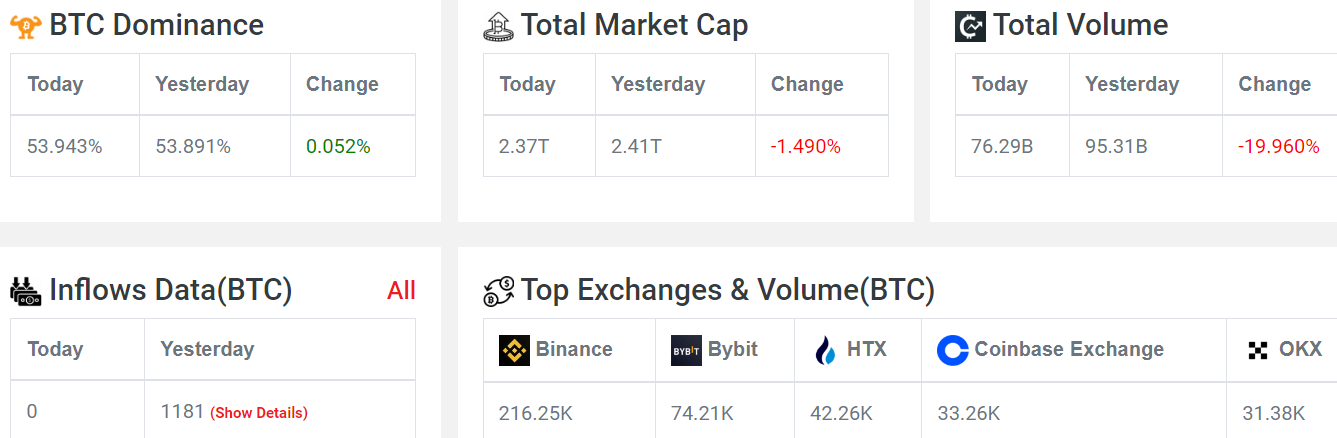

The crypto market has seen a downturn recently after hitting the price $66,000.

Market cap decreased to 1.8, and trading volume also fell.

No significant inflow data observed from midnight until now.

Yesterday, an inflow of 1181 BTC was recorded.

The Fear and Greed Index stands at 61, indicating greed, but recent sentiment shows negativity with a selling bias.

Performance of Bitcoin and Ethereum

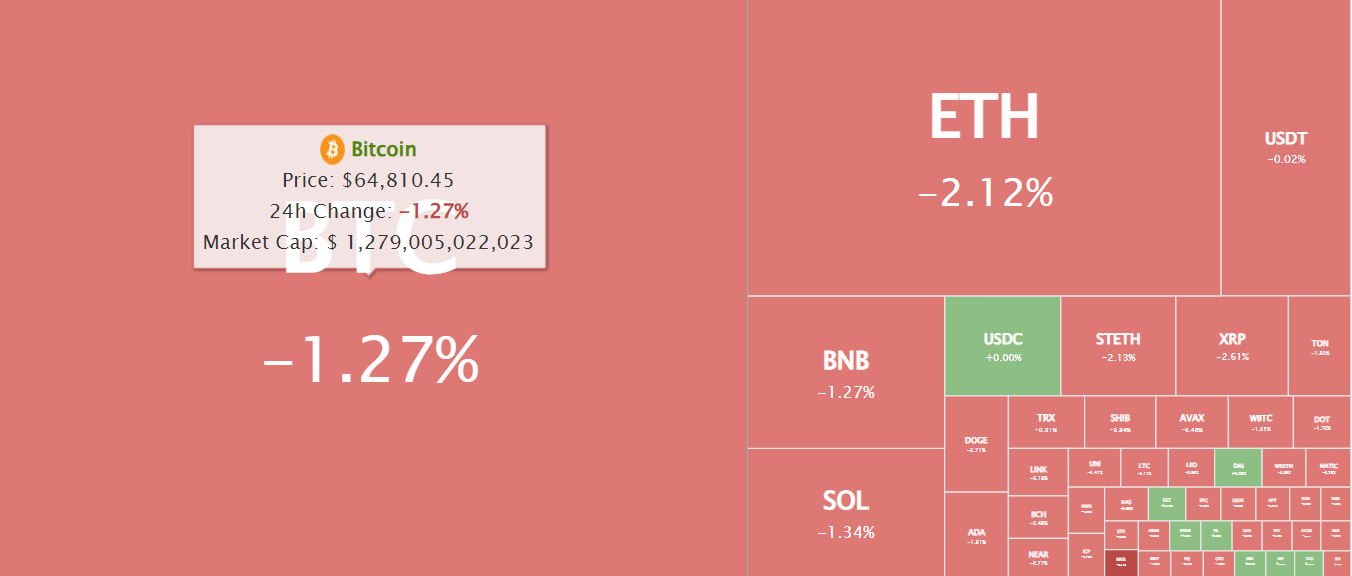

Bitcoin (BTC) is down by 2.26%.

Ethereum (ETH) is down by 2.12%.

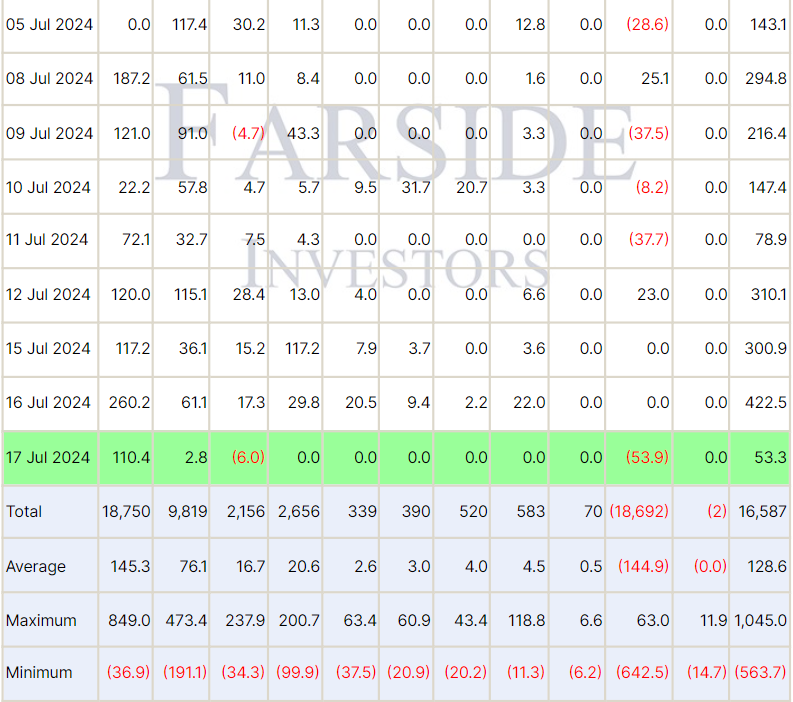

Despite the market downturn, ETF-related activities are noteworthy:

Recent ETF buying hasn't matched the volume of the past eight days.

A total of $53 million worth of Bitcoin has been bought through ETFs.

Since January, ETFs have amassed 916,084 BTC, accounting for 4.362% BTC of the total supply.

In the past six months, ETFs have bought $59 billion worth of Bitcoin.

These numbers are expected to grow significantly over the next few years.

Bitcoin's Current Price and Future Prospects

Bitcoin's current price is $64,893.

Some may question the value of buying Bitcoin now, but historical data suggests significant future price increases.

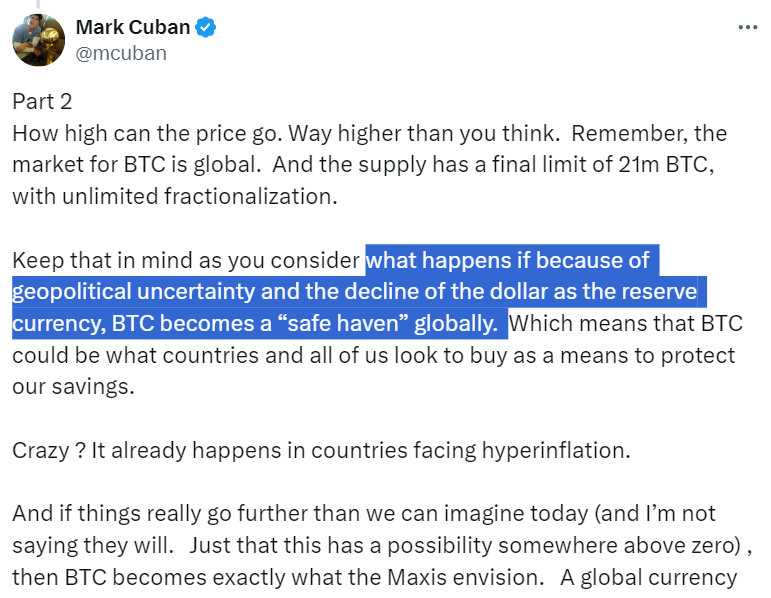

Mark Cuban highlighted the potential for Bitcoin’s price to exceed expectations.

Recalling a time when a $70,000 Bitcoin price seemed improbable, Cuban’s insights offer optimism for future growth.

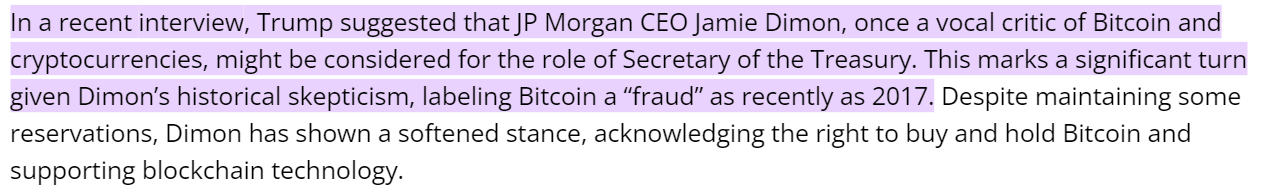

Changing Perspectives on Crypto

Notable figures like Donald Trump and Jamie Dimon have shifted their stances on cryptocurrencies.

Trump, who once criticized Bitcoin, now advocates for the US to lead in crypto adoption.

Jamie Dimon of JP Morgan, who previously called Bitcoin a fraud, is now considered for a role in Trump’s cabinet if he wins the election.

This shift underscores the growing acceptance and integration of cryptocurrencies in mainstream finance.

Ethereum's ETF Impact

Ethereum is also expected to see significant price impacts with the introduction of its ETF.

Institutions have already filled Ethereum ETF applications, indicating strong interest.

If even half the investment seen in Bitcoin ETFs flows into Ethereum ETFs, a price pump is anticipated.

The current forecast suggests Ethereum’s price could reach $5500, contingent on ETF launches.

BlackRock's Significant BTC Acquisition

Purchase Details: BlackRock has bought 4005 BTC.

Total Holdings: They now hold over 322,000 BTC, equivalent to about $21 billion.

Market Impact: This constitutes 1.5% of the total Bitcoin supply, demonstrating BlackRock's substantial influence in the Bitcoin market.

Insights from Prominent Crypto Traders

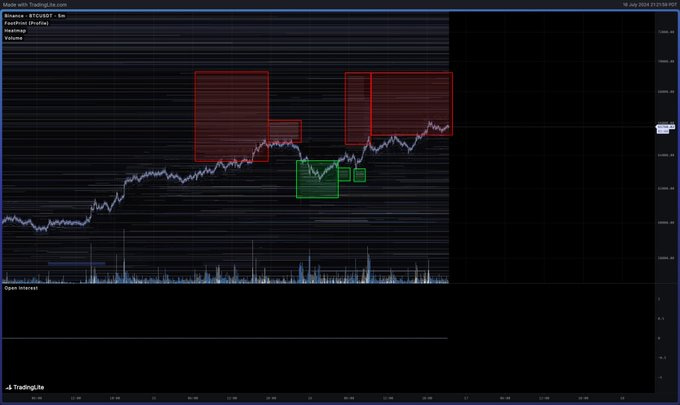

Trader Insight: Crypto trader CredibleCrypto observed that approximately 1,500 BTC (worth $100 million) are positioned as asks above current price levels on Binance.

Market Implication: This suggests that buyers need to increase their efforts to break through this resistance and push prices higher.

Michaël van de Poppe: Highlighted a significant capitulation among Bitcoin miners, with the True Hashrate Drawdown reaching a low comparable to the FTX collapse on July 1st.

Cycle Low Indication: This capitulation is seen as marking a cycle low.

Recent Price Rally: Since the Mt. Gox news, Bitcoin's price has rallied by 20%.

Future Prediction: The next upward movement could see Bitcoin reaching $110,000.

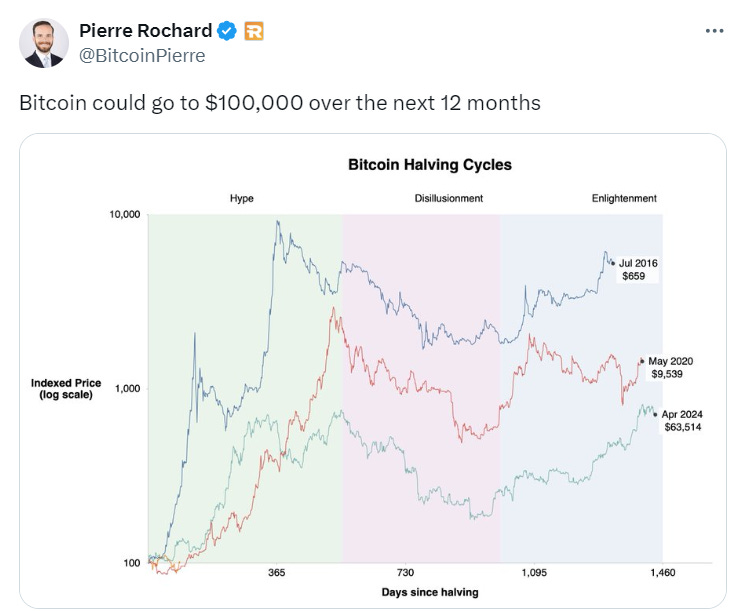

Pierre Rochard:

Price Forecast: Predicted that Bitcoin could hit $100,000 within the next 12 months.

Conclusion

The recent activities and insights from key players in the Bitcoin market suggest significant bullish potential. With major acquisitions by institutions like BlackRock and notable traders predicting substantial price increases, the market dynamics point towards a potentially robust upward trend for Bitcoin in the near future.