Hey Degens!

Bitcoin Nears $64K After Powell’s Speech! 🚀 Institutional interest in Bitcoin is skyrocketing as the crypto market adds $110 billion in value. Is this the breakout we've been waiting for? Let’s dive in!

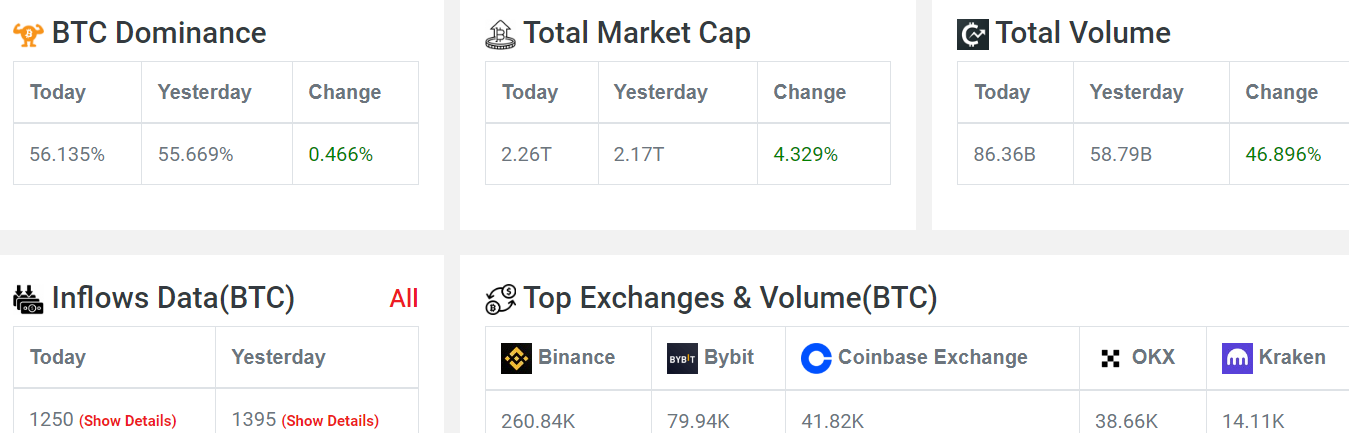

Crypto Market Overview

Market Cap and Volume: The total market cap is up by 4.1%, with increased trading volume. This is a positive sign after a period of low volume.

Fear & Greed Index: For the first time in a while, we’re seeing the index in the ‘Greed’ zone at 56.

Sentiment: The market sentiment is bullish, with major cryptocurrencies like Bitcoin and Ethereum showing gains.

Bitcoin Price Analysis

Recent Pump: Bitcoin has recently seen a price surge, nearing $64,000. Is this the start of a recovery?

Current Resistance and Support: Bitcoin’s resistance is around $64,800, and it’s currently hovering near this level. This area has acted as both a support and resistance zone.

Mikybull Crypto suggests Bitcoin is breaking out of a bullish reversal pattern with a MA golden cross—targeting $67K!

CryptoJelleNL suggests Bitcoin faces resistance at $64,500. A flip opens the path to $70K, but caution with leverage!

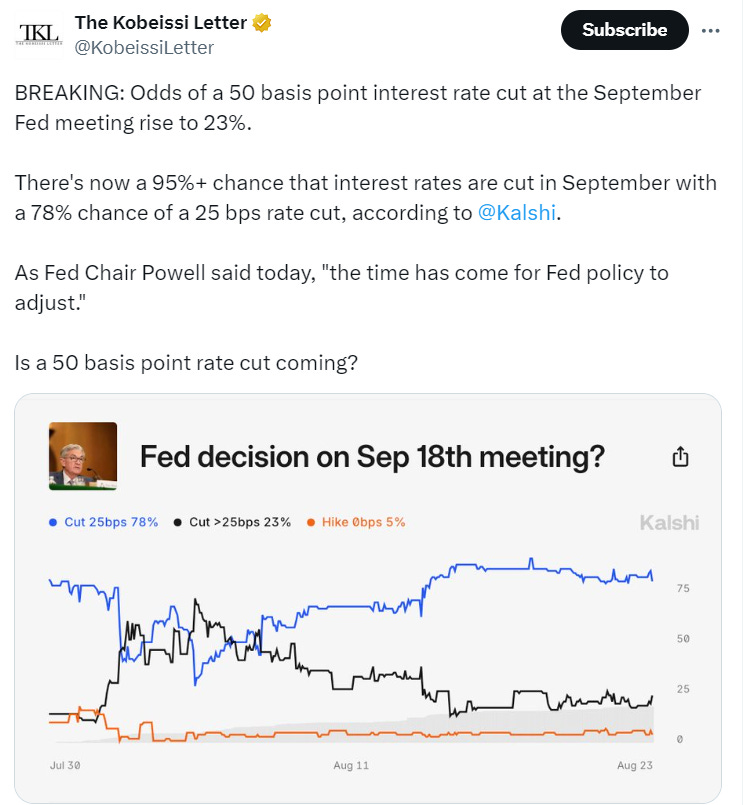

Upcoming Rate Cut

Policy Adjustment: Powell highlighted that it’s time for policy adjustments, which suggests that interest rates may be lowered in the near future.

Fed’s Announcement: There’s anticipation around a potential rate cut by the Fed. The exact amount—whether 25 basis points or 50—is still uncertain.

Impact on Bitcoin: If the rate cut is announced while Bitcoin is at current levels, we might see a significant rally. If Bitcoin is already near its all-time highs, the impact may be less dramatic.

Bitcoin Interest Surge: Following the Fed's indication of lower interest rates, Bitcoin buyer interest in the US hit a 39-day high. According to Julio Moreno of CryptoQuant, there’s been a surge in Bitcoin demand due to the anticipated rate cuts.

Positive Catalysts: Two key factors contributed to the recent rise in cryptocurrency prices. First, Powell’s announcement of a monetary easing cycle starting next month. Second, crypto-friendly support from GOP presidential candidate Donald Trump, who is seen as favorable to cryptocurrencies.

Presidential Race Dynamics: Although RFK Jr. has withdrawn and endorsed Trump, the presidential race remains competitive. Trump and Kennedy have both promised more favorable treatment of cryptocurrencies compared to the current Biden administration.

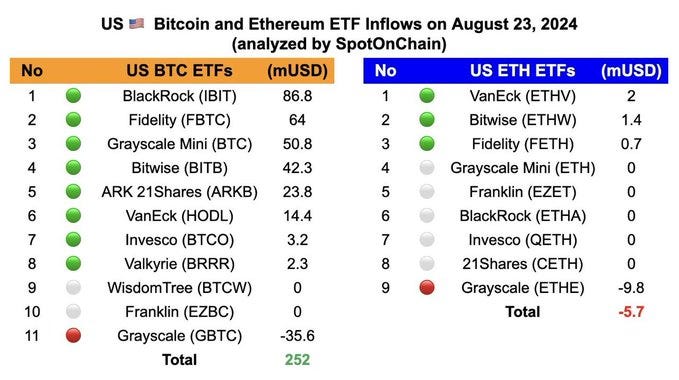

ETF Activity

BTC-spot ETFs, with total net inflows of $252 million on August 23, marking the highest since July.

In contrast, the U.S. ETH-spot ETF market continued to experience outflows, with $44.5 million in net outflows for the week ending August 23.

Positive ETF Data: Recent data shows significant buying activity from major players like BlackRock, Bitwise, and Ark Invest.

Ongoing Trends: Despite some selling from Grayscale, overall ETF trends are positive, with notable purchases in recent days.

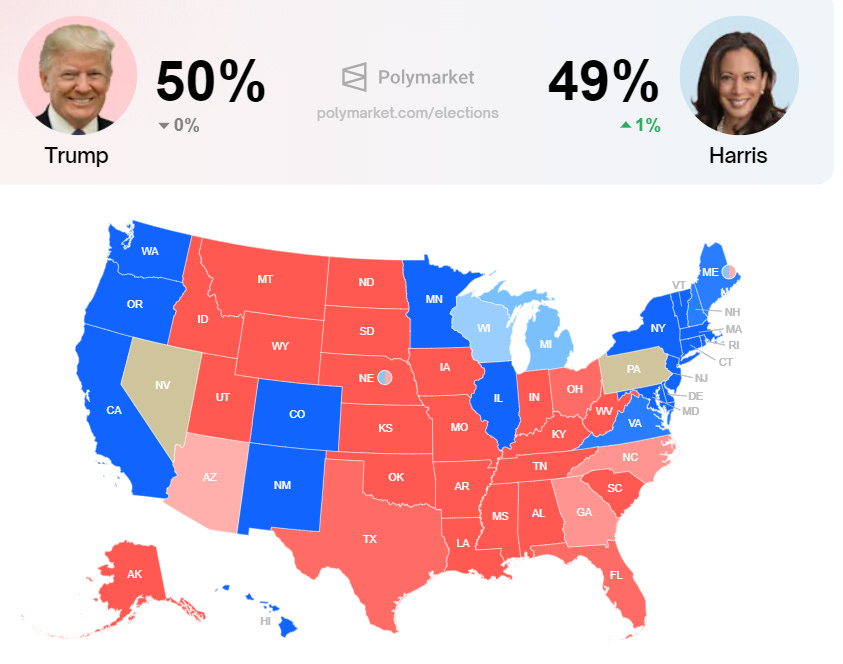

US Election 2024

Trump Gains Edge Over Harris on Polymarket

Trump stands at 50%

Kamala Harris at 49%

Kennedy’s endorsement may boost Trump’s electoral base. A Trump victory could end the SEC’s reign of regulation-by-enforcement that troubles the crypto market.

Bitcoin's surge past $64K signals potential for a $70K breakout. Institutional interest is rising, with Powell's rate cut hint boosting demand. Stay tuned for key ETF and election impacts!