Hey Crypto Champs! 🚀

Bitcoin has dipped below $60,000! With crucial events unfolding in the U.S. this week and the Trump vs. Harris election heating up, get ready—an explosive move in the cryptocurrency market is just 48 hours away!

Crypto Market Overview

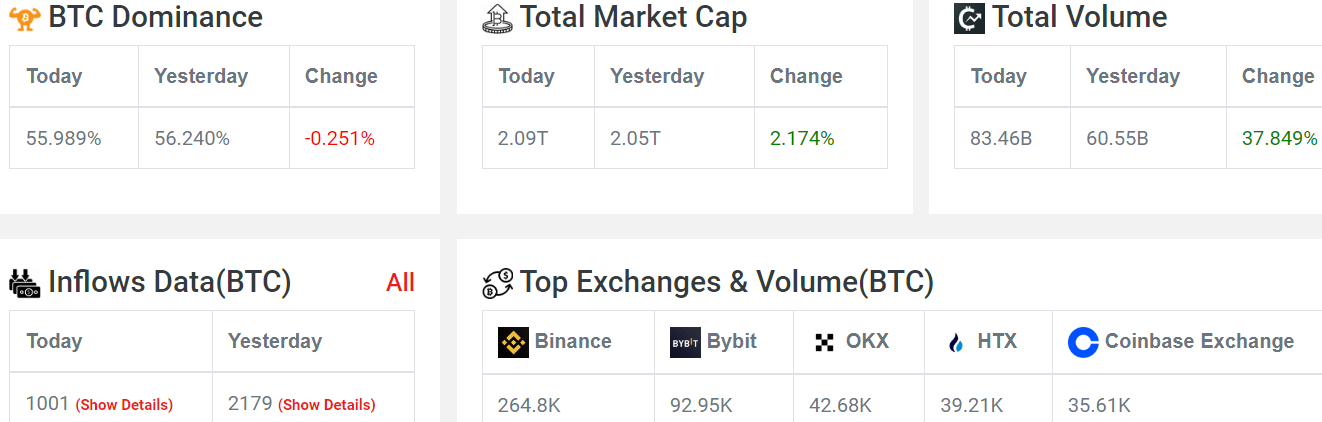

Market Cap: Down by 3.7%.

Volume: Up by 37.8%, but inflow data shows 1001 bitcoin which is less compared to the previous day.

Fear and Greed Index: Back to fear 31.

Sentiment: Over the past hour, the market sentiment is leaning toward buying.

Heat Map: It's all green, with BTC up by 1.77% and Ethereum up by 4.16%.

Why the Next 48 Hours Are Crucial

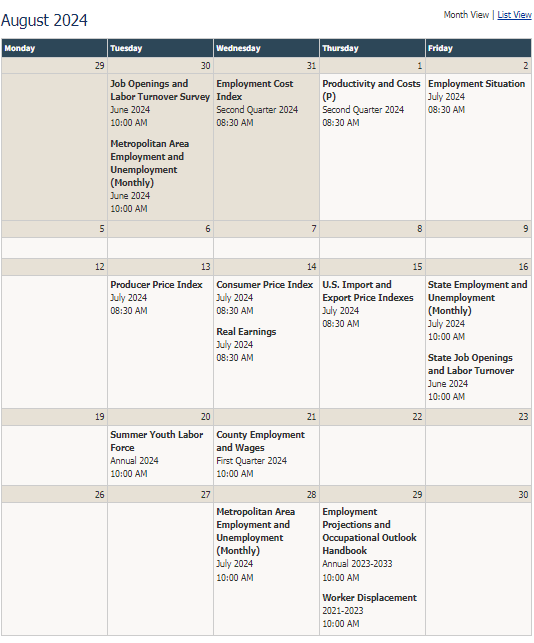

All eyes are on the upcoming U.S. inflation data set to be released on the 14th. The market is speculating whether the rate cut will be 25 or 50 basis points:

High Inflation: If inflation comes in higher than expected, it could trigger a sell-off in Bitcoin and other markets, leading to a possible drop.

Low Inflation: A lower-than-expected figure could ease market fears and spark a rally, potentially pushing Bitcoin out of its current range.

3. Looking at the Bigger Picture

While the short-term outlook may seem uncertain, the long-term prospects for Bitcoin remain strong. Here’s why:

Federal Reserve’s Next Steps: The Fed is expected to cut interest rates eventually. When this happens, it could increase global liquidity, driving up the value of scarce assets like Bitcoin.

Historical Patterns: Bitcoin is in the early stages of a new cycle. Historically, this is when the most significant gains occur, so there’s a lot of potential ahead.

4. What Could Happen Next?

Depending on how the market reacts, Bitcoin could move in either direction:

Bearish Scenario: A break below the current support could see Bitcoin drop to around $55,000.

Bullish Scenario: A breakout above resistance might push Bitcoin up to $64,000.

Key Trigger: Wednesday’s data release will be crucial in determining which way Bitcoin moves.

Crypto trader Crypto Rover notes that Bitcoin is currently supported by an upward-sloping line that has held strong several times. This setup often leads to a major breakout, and given the current market conditions, it could happen soon.

Michaël van de Poppe notes that Bitcoin had a strong bounce last week but needs to break $60K to potentially reach a new all-time high by September or October. Meanwhile, he expects Ethereum to outperform during this period.

5. Market Sentiment: A Time to Be Greedy?

The market is currently in a state of fear, which historically has been a good time to buy. Here’s what you should consider:

Negative Funding Rates: Bitcoin and altcoins are being heavily shorted, creating the potential for a short squeeze if the market turns bullish.

Trading Strategy: For those already invested, this might be a good time to add to positions, especially if Bitcoin dips to key support levels.

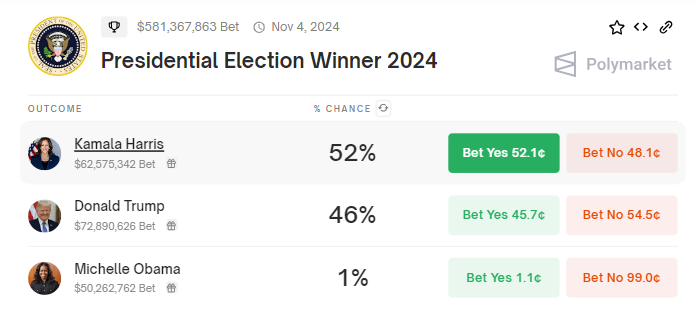

S. Trump vs. Harris

Market Impact: Trump’s chances have dropped from 70% to 45%, while Harris has risen to 52%. This shift is significant and could impact the market.

A Bernstein report suggests that Kamala Harris's increasing odds of winning the U.S. presidential election may be contributing to Bitcoin's recent price dip.

Bernstein analysts highlight that a Trump win is viewed as bullish for the crypto market, while a Harris win could lead to negative consequences for cryptocurrencies.

What’s Next?

This week is packed with important events – CPI data, jobless claims, and retail sales. Last time, a dip in the U.S. market led to a drop in Bitcoin’s price. So, keep a close eye on these developments.