Bitcoin Price Crash: What's Really Happening?

Exploring the Latest Crash, Altcoin Reactions, and What Lies Ahead for Investors

Hey friends! 🌟 Today, we need to talk about the latest Bitcoin price crash. It’s been quite a ride, hasn’t it? Usually, when Bitcoin crashes, altcoins also drop a lot, but this time it’s a bit different. So, the big question everyone’s asking: Is the bull run over? Have we already reached the top for Bitcoin this cycle? Let’s dive into why this crash happened and what it means for the market.

What's the Market Saying?

First things first, let’s take a quick look at the market:

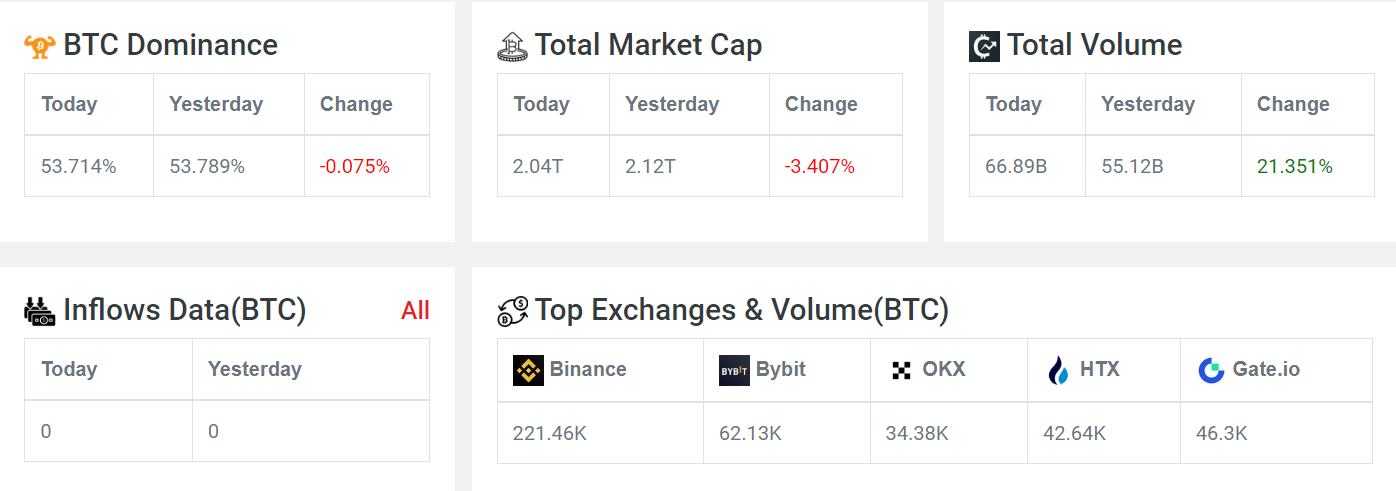

Market cap is down by 5.2%.

Recently, the market cap even dipped below $2 trillion.

Volume is up by 14.4%, but no data on inflows.

The Fear and Greed Index is at 28, showing we’ve been in fear mode for the last three days.

The latest sentiment points towards selling.

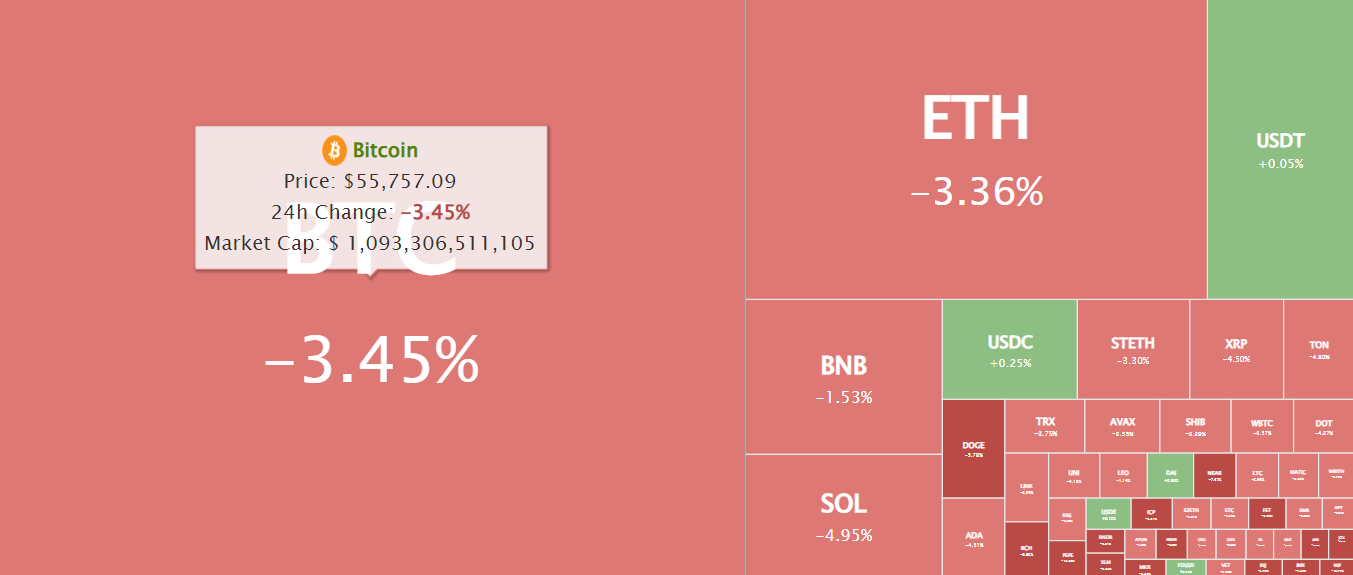

The heatmap is all red – Bitcoin down by 4.58%, Ethereum down by 5.19%

How are Altcoins Doing?

Even though altcoins have dropped, it’s not as bad as it could be. Usually, when Bitcoin falls by 5%, altcoins drop by 10-15%. This time, they’re not dropping as much. For example, meme tokens are hit harder than others.

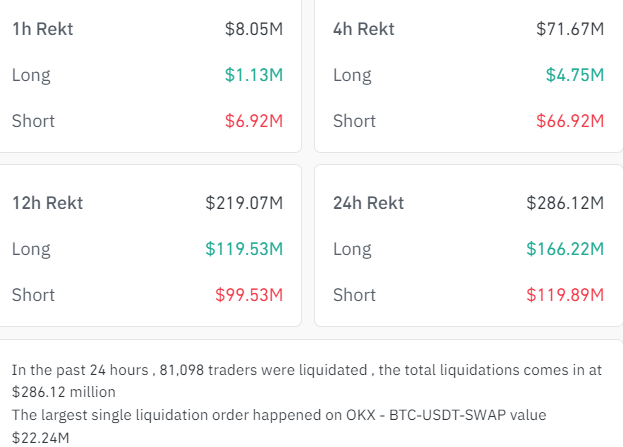

In the past 24 hours, 81,098 traders were liquidated, amounting to $286 million. Ouch!

Bitcoin's Current Price

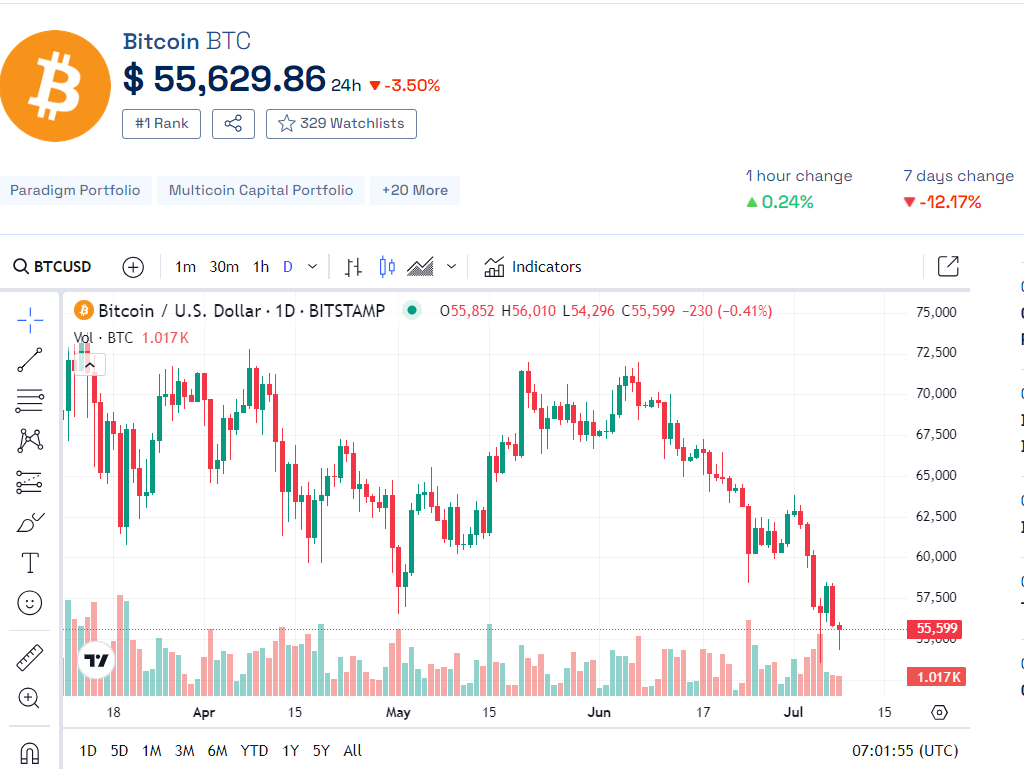

Right now, Bitcoin is sitting at $55,629, Remember that trend line we talked about? It's still our key support level around $53,000.

Why Did This Crash Happen?

So, why the crash? Let’s break it down:

Ethereum ETF Update

Here’s a bit of exciting news: The final date for the Ethereum ETF's S1 form is today. The President of ETF Store predicts we might see Ethereum ETFs trading around July 15. This could be a big deal for the market.

Upcoming Important Events

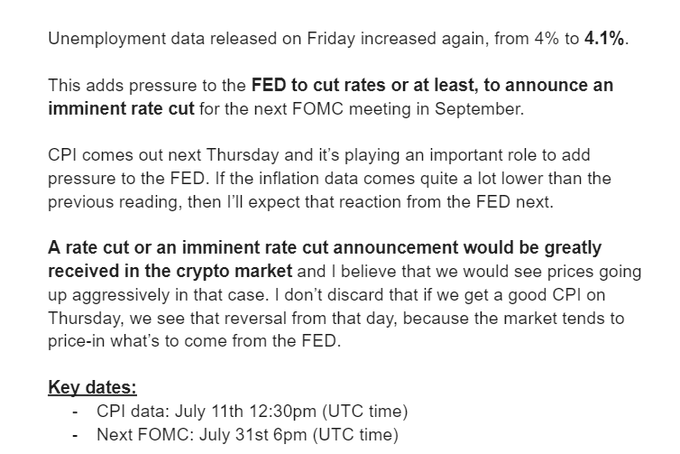

US CPI Data

Mark your calendars! The US CPI data is coming out on July 11. This could heavily influence the Fed's decisions and impact the crypto market.

Powell's Testimony

Jerome Powell is set to testify on Tuesday i.e., tomorrow. His insights could give us a clearer picture of the Fed's plans.

PPI and Consumer Sentiment Data

We also have the PPI and consumer sentiment data coming up, adding more significance to this week.

Are We Still in a Bull Run?

Some people think the bull run is over, but I believe we’re just getting started. Let’s take a look back:

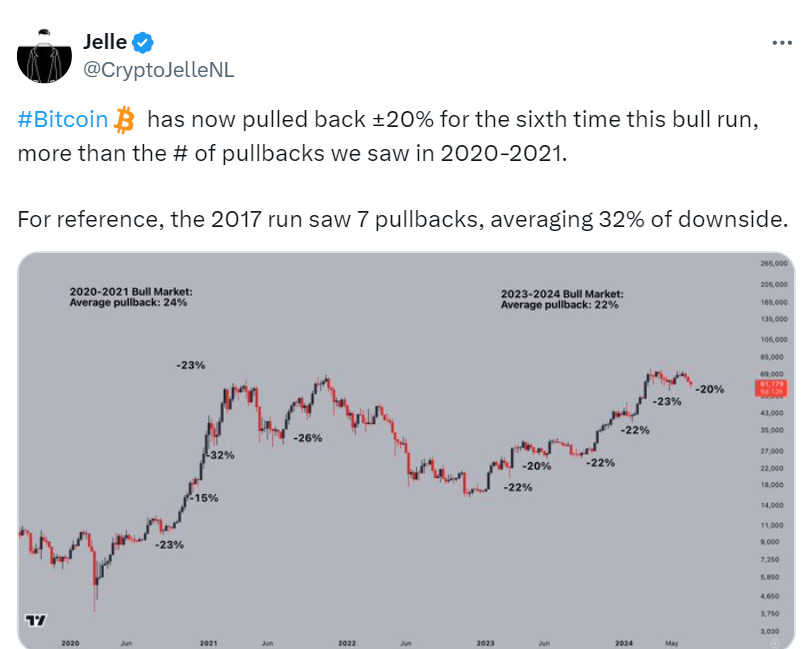

In 2021, which was a bull run year, Bitcoin saw multiple dumps of 27-32% before hitting new highs.

So far, we’ve only seen a 27% dip. In bull markets, Bitcoin can dip by 30-40%.

Key support levels: $50,000-$52,000. Even if Bitcoin hits these levels, it doesn’t mean the bull run is over.

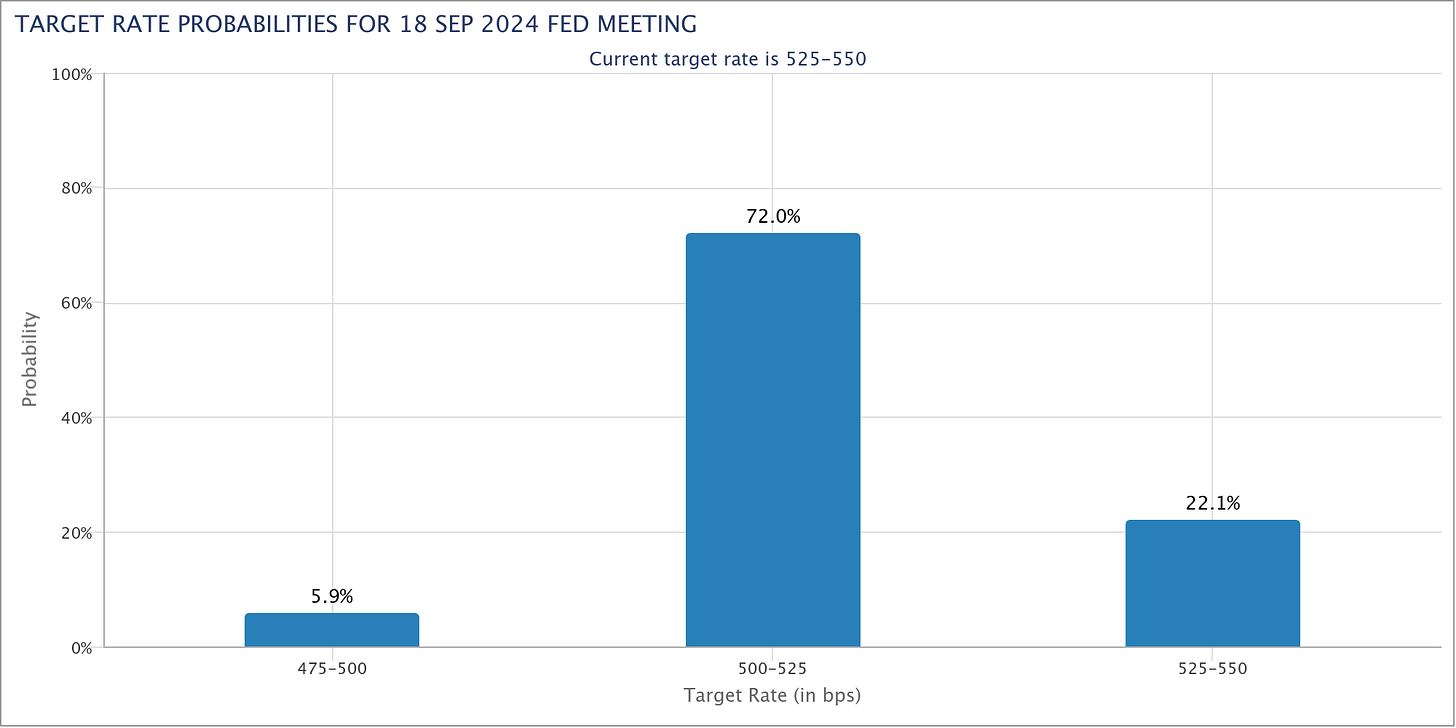

Interest Rates Outlook: There's a high chance the Fed will lower interest rates in September, with Wall Street betting 72% on it. Why? U.S. hiring is slowing down, and cutting rates often boosts the economy.

Lower interest rates make Bitcoin and other risky investments more appealing compared to safer options like U.S. Treasury notes.

So, is the bull run over? I don’t think so. We’re still in the early stages. Dumps like these are part of the process. The market sentiment will flip eventually, and we’ll see positive updates and a bullish trend.