Bitcoin Price Analysis and Key Events This Week

Insights into Solana ETFs, Ethereum ETF, German Impact, OTC Desk Holdings and CPI Data's Influence on Crypto

Hello, friends! Today, we're diving into the latest developments from Bitcoin's market movements to Germany's impactful decisions and the potential ripple effects of Ethereum ETFs. Let's break it down step by step.

Crypto Market Analysis

Current Market Overview

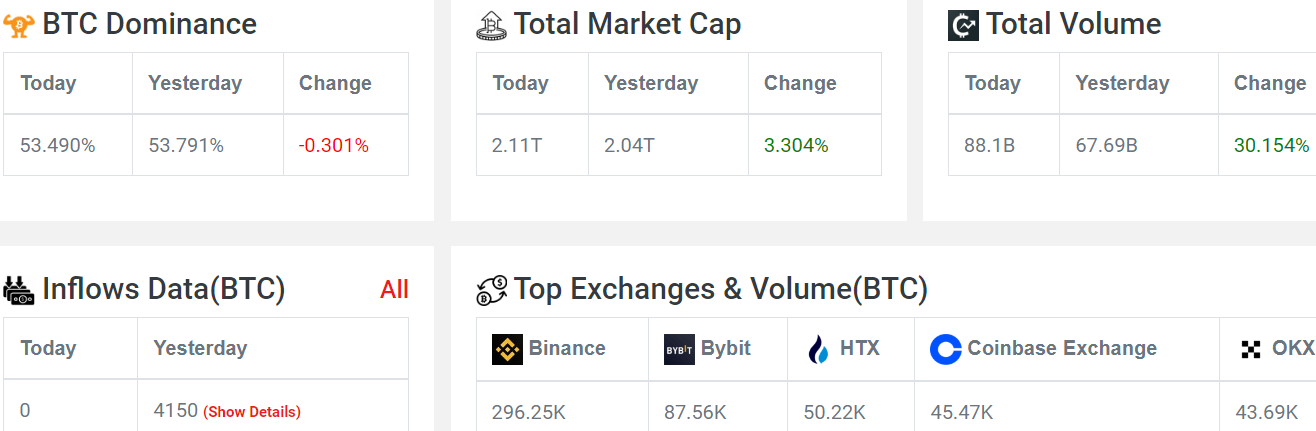

Market Cap: Increased by 5.8%

Volume: Increased by 35.6%

Inflows: No significant data since midnight, with 4150 BTC in inflows reported yesterday

.

Fear & Greed Index: Stands at 27, indicating a period of fear for several days.

The heat map shows a bullish sentiment with a majority of the market in green.

Bitcoin: Up by 2.86%

Ethereum: Up by 5.26%

Altcoins: Mostly green

Surprisingly, liquidations have been low in terms of traders, but the amount liquidated is significant, nearly $2.5 million in the past 24 hours.

Bitcoin Analysis

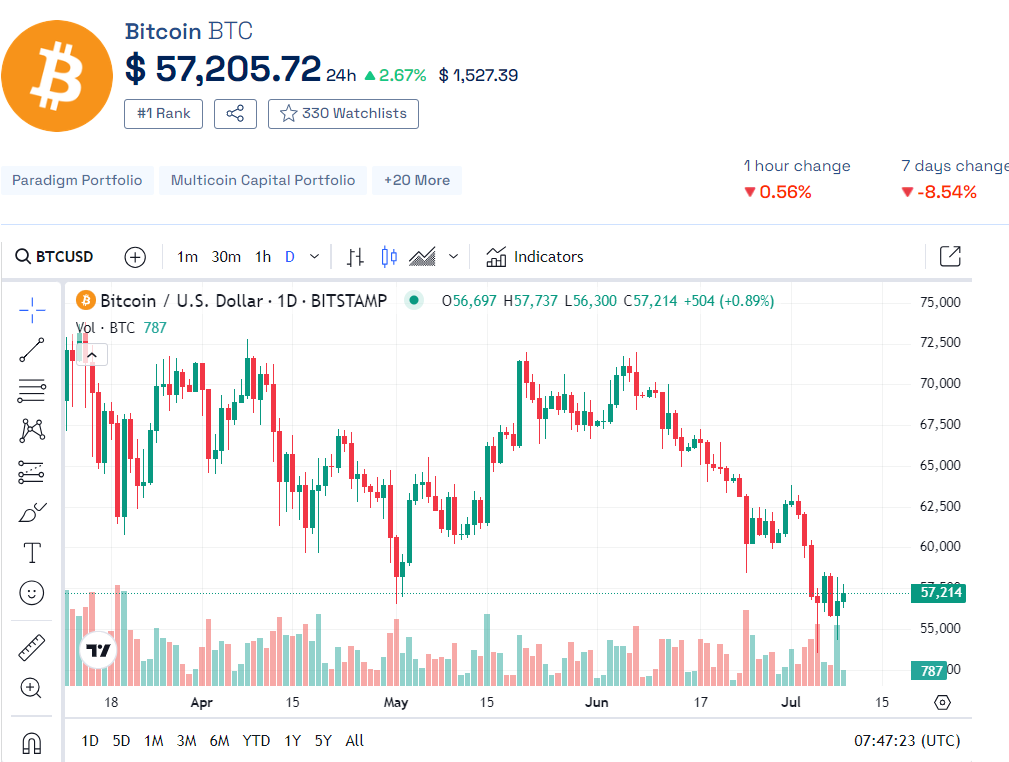

Current Price: $57,205

Weekly Trends: This week has seen significant pump-and-dump activity.

Resistance Levels: Bitcoin faces resistance at the same level, with no recent candle closing above it.

Support Levels: The trendline on the one-day timeframe continues to act as support.

Germany's Impact

Germany's recent actions caused a significant drop in Bitcoin prices. Around 7 PM, a tweet about Germany’s transferring 16,309 bitcoins from its holdings to crypto exchanges and market makers on Monday led to Bitcoin dropping to $55,000

.

Key Insight: Germany seems to be sending a message that cryptocurrencies have no future in Europe. They are moving BTC to exchanges and then back to accounts, causing market panic and price drops without actual selling.

Comparison with US and China

US Holdings: Over 207,189 BTC, despite negative statements about cryptocurrencies.

China Holdings: 194,000 BTC, with bans on mining and trading but still holding a significant amount.

Ethereum ETFs

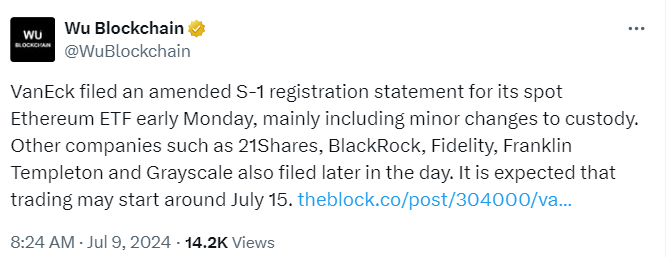

VanEck recently filed an amended A1 registration statement for its spot Ethereum ETF.

Other Filings: 21Shares, BlackRock, Fidelity, Grayscale, and others have also filed.

Expected Trading Start: Around July 15th.

Potential Market Impact: Funds may shift from Bitcoin to Ethereum, causing a pump in Ethereum prices and a possible recovery in the overall crypto market.

Solana ETFs

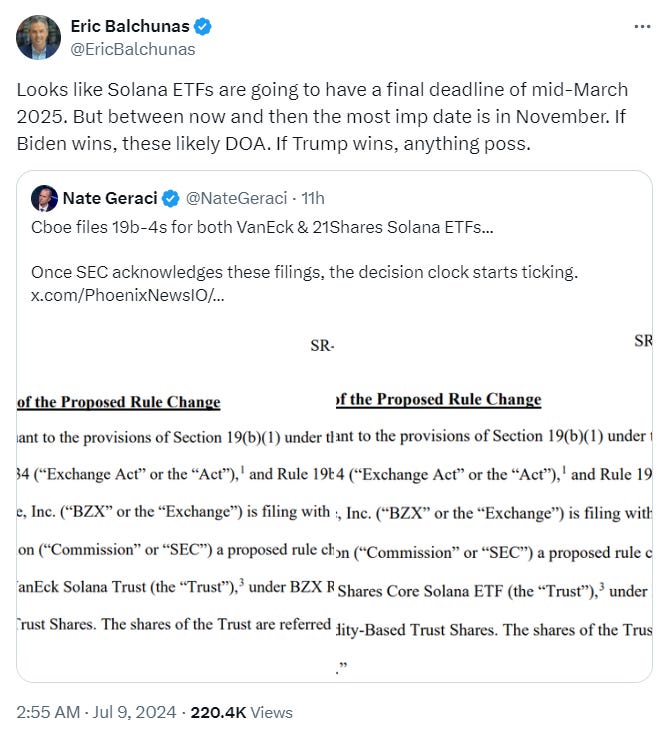

VanEck and 21Shares’ Solana ETF filing is progressing.

Final Deadline: Mid-March 2025.

US Elections Impact: If Biden wins, the approval might be delayed. If Trump wins, it might get approved by next March.

CPI Data

The upcoming CPI data release on July 11th could have a significant short-term impact on the crypto market.

Short-Term Impact: Potential recovery in the crypto market.

Positive Expectations: Better CPI data could signal economic stability, leading to a possible rate cut in September.

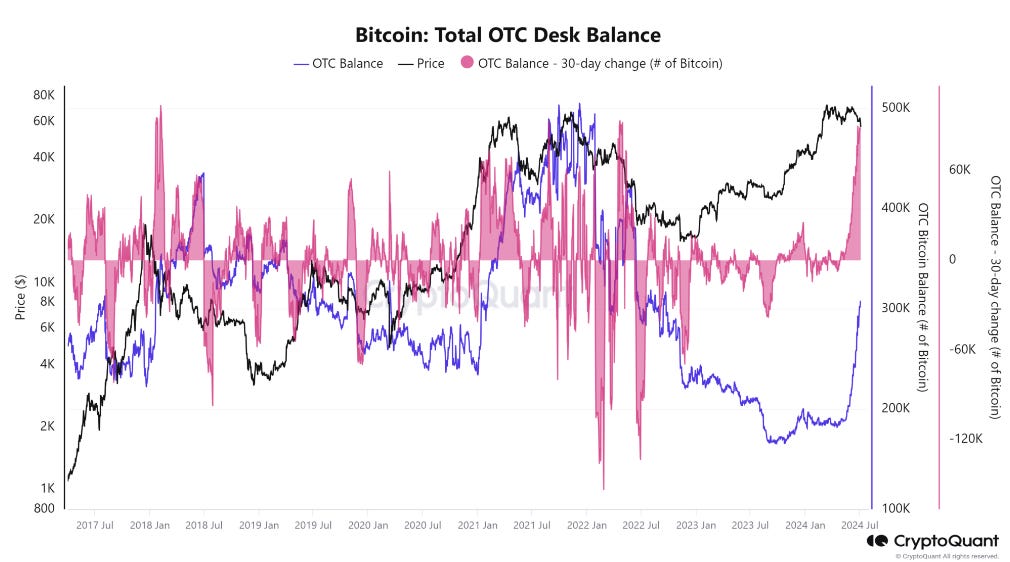

OTC Desk Holdings

OTC desk Bitcoin holdings are increasing, which could have a negative impact on the market.

Market Impact: If OTC desks need to reduce holdings, it might lead to a market crash due to selling pressure.

Current Trends: Significant holdings on OTC desks could be a negative indicator for the market.

Short-Term Outlook

Possible Recovery: Due to Ethereum ETF approvals and expected positive CPI data.

Key Dates: July 11th for CPI data and potential rate cut discussions in September.

Long-Term Outlook

Potential Crash: Due to OTC desk holdings and possible market reactions.

Positive Factors: Post-September recovery expected, influenced by the US elections and economic conditions.

Trading Advice

Leverage: Use caution with leverage. Consider spot trading or low-leverage futures trading to minimize risks.