Hey, Crypto Folks!

Big updates on Bitcoin, plus fresh U.S. news that could shake the market. We’ll also dive into ETH price targets and why October is called “Pump-tober”!

Current Market Overview

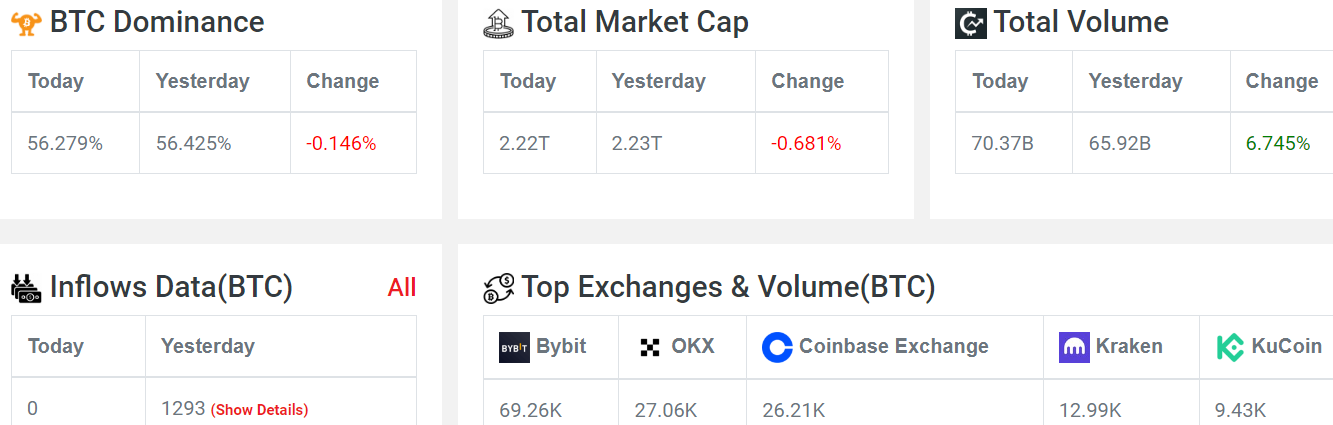

Market Cap: Currently, the market cap is down by 1.8%.

Volume: On a positive note, volume has increased by 20.8%. A new week has started, so we might see some changes soon.

Inflows: Recently, there was an inflow of 1,293 BTC, which is encouraging.

Fear and Greed Index: The index is at 54, indicating a neutral sentiment.

Sentiment Analysis: Recently, market sentiment has leaned towards selling. Bitcoin is down by 2.20%.

Ethereum (ETH) dipped 2% to $2,628, with a day's low of $2,610.86 and a high of $2,701.68. The next ETH price targets are $2,676 and an ambitious $2,817.

Solana (SOL) experienced a nearly 1% drop, trading around $146, with an intraday low of $142.64 and a high of $148.15. The next SOL price targets are set at $150.

Bitcoin Price Analysis

Bitcoin’s Key Level Test: Bitcoin is retesting the $63,176 mark for the third time since August, a critical level highlighted by analyst Ali Martinez. A breakout here could lead to a big move.

Historical Surge Potential: Last time Bitcoin broke this level, it skyrocketed to $70,000. Analysts think history could repeat itself with another explosive price jump.

Previous Bullish Breakout: In October 2023, Bitcoin crossed its 200-day SMA at $28,000, igniting a rally that took it to $70,000 by March 2024, thanks to excitement over a potential Bitcoin ETF.

Institutional Power: Now, with BlackRock’s Bitcoin ETF options trading approved and growing institutional interest, Bitcoin could see a fresh bull run, targeting the $64,000 to $74,000 range.

U.S. Market Influence

A recent event in Wall Street featured a discussion about cryptocurrencies. Harris, a prominent figure, mentioned that if she comes into power, she will promote innovative technologies like AI and digital assets, subtly referring to crypto without explicitly mentioning it.

This mention has sparked interest and may have contributed to Bitcoin’s recent price movements, even though the gains did not hold.

October: The Pump-tober Buzz

Historical Context

Many analysts believe October could be a month of recovery and price increase for cryptocurrencies. Historically, October has seen positive price movements after the volatility of September.

The past performance indicates that the last few days of September often lead to a rally in October.

What to Watch For

Despite the optimism, it’s important to note that calling for recovery solely based on historical trends can be misleading. We need to see strong confirmation from the charts before making any predictions.

For a substantial recovery, Bitcoin needs to close above its all-time high levels, as seen in previous cycles.

Upcoming Data Releases

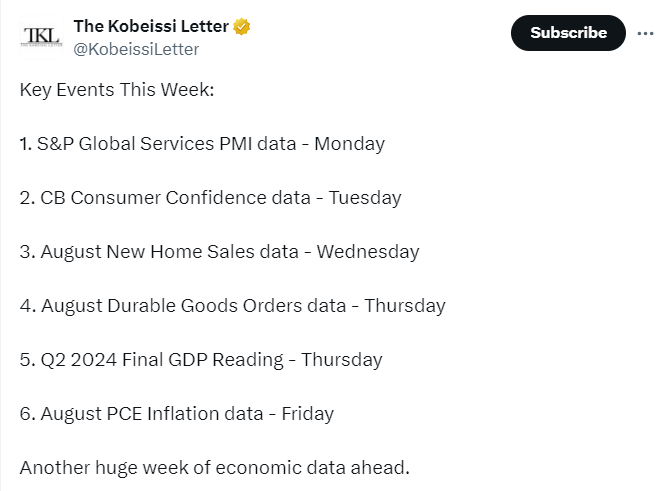

As we move into the new week, we’ll be watching key data releases from the U.S.:

Thursday: Jobless claims and pending home sales data will be released.

Friday: The PCE and consumer sentiment data will be crucial for understanding market trends.

These data points will help us gauge the U.S. economic situation and how it may affect cryptocurrencies.

Final Thoughts

Bitcoin's current positioning near its 200-day MA signals cautious trading. With recent liquidations and mixed market sentiment, success in crypto hinges on strategy, timing, and upcoming economic data.