Bitcoin Is Just 9% Away From Its All-Time High of $73,798

What’s next for the crypto market in Q4?

Hey, crypto enthusiasts!

We're diving deep into the most pressing question right now: Why is Bitcoin pumping while our altcoin portfolios remain flat? Let’s discuss when we can expect altcoins to surge and how to manage our portfolios. Let's jump into the details!

Current Market Overview

Market cap has dropped by 6.5%.

We don’t have today’s inflow data yet, but yesterday saw inflows of 2,340 BTC.

Fear & Greed Index is at 73, which shows a greedy market.

Bitcoin Price: Bitcoin is hovering around $68,000, but it's facing strong resistance.

Keep an eye on $68,000 as a breakout could send prices soaring!

Bitcoin Analysis

Resistance Level: Bitcoin faces strong resistance at $68,000. It may stay in this range unless it breaks above this level on a 4-hour candle.

Potential Price Movement: If Bitcoin breaks through $68,000, it could rise toward the all-time high of $69,000, last reached in 2021.

Technical Analysis: Key support is at $67,400, with immediate resistance at $68,900. If momentum continues, Bitcoin could aim for $70,000, though short-term consolidation might occur.

Geopolitical Factors: Arthur Hayes suggests that rising Bitcoin prices could be linked to increasing Middle East tensions, similar to past oil crises that boosted commodity prices.

Market Predictions: Surveys show a 72% chance of Bitcoin hitting new all-time highs in 2024, with historical data indicating strong Q4 returns in halving years.

Institutional Support: BlackRock CEO Larry Fink's optimistic view on Bitcoin’s long-term potential highlights the growing institutional interest in the cryptocurrency market.

ETF Activity

ETF Frenzy: Bitcoin is riding high, thanks to a surge in capital from Bitcoin ETFs. Grayscale has switched gears from selling to buying Bitcoin over the past four days, marking a big shift in sentiment.

BlackRock's Bitcoin Bonanza: BlackRock is making waves by adding 4,619 BTC (about $309 million) to its iShares Bitcoin Trust (IBIT) yesterday, topping the inflow charts for the third consecutive day.

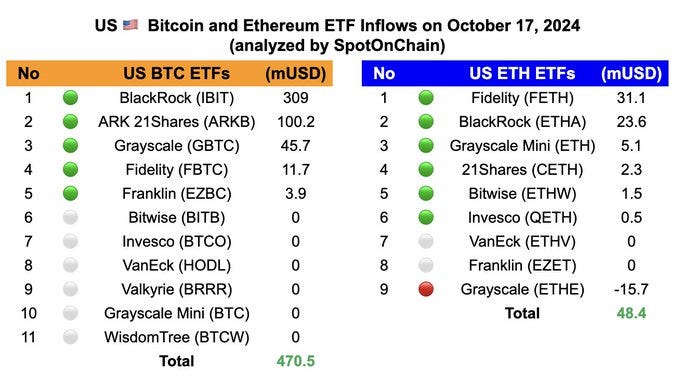

Cash Flow Surge: On October 17, US spot ETFs saw impressive inflows of $470.5 million for Bitcoin and $48.4 million for Ethereum, pushing total capital to $20.7 billion after 194 trading days!

Altcoins: Why Aren’t They Pumping?

Bitcoin's Dominance: Bitcoin is currently dominating the market, similar to 2021. When Bitcoin leads, interest in altcoins tends to decline.

Rally Conditions: Altcoins usually rally when retail investors flock to the market, often triggered by headlines about massive gains in meme coins or smaller assets.

Altcoin Pump Potential: For altcoins to surge, Bitcoin needs to break its all-time high, encouraging money to move into larger altcoins and attracting retail investors back to the market.

VeChain's Potential: VeChain (VET) is currently trading at $0.02248 and shows signs of a potential price breakout, entering a “Turbo Trigger” phase. Check out the latest VET price prediction for details.

XLM's Range Bound: Since August's sell-off, XLM has been stuck between $0.09 and $0.10, with $0.10 acting as a local supply zone. Keep an eye on XLM price prediction for potential market movement.

Managing Your Portfolio

FOMO is Missing: Bitcoin is just 9% away from its all-time high of $73,798, but surprisingly, investors aren't feeling the fear of missing out, even as major cryptocurrencies post modest gains.

Smart Portfolio Strategy: Many investors cling to too many altcoins in hopes of quick profits. Focusing more on Bitcoin can offer greater stability during market swings, helping to balance out potential losses.

Regulatory Optimism Fuels Rally: Positive vibes around US regulatory changes are boosting the crypto rally, especially with the presidential election on the horizon.