Hey There!

Bitcoin Dips & Dogecoin Drama! 🚨 Bitcoin slips 0.4% as ETF trading volume plummets. Can Dogecoin soar to $0.15 post-Elon Musk's lawsuit win, or will it remain stuck?

Crypto Market Overview

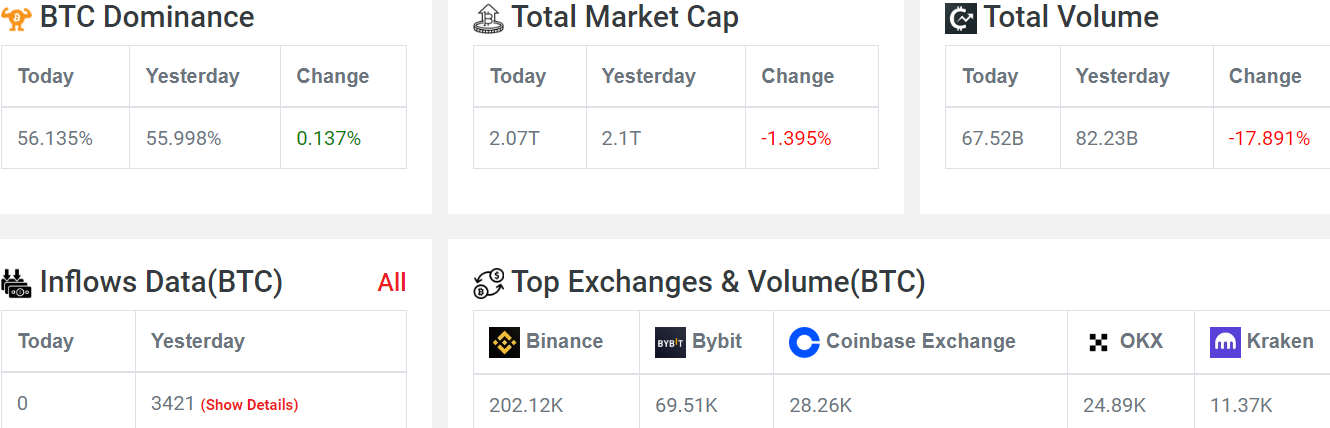

Market Cap & Volume: The market cap is down by 18.5%, and there’s no new inflow data since midnight. Yesterday, there were three inflow data points totaling 3,421 BTC.

Fear & Greed Index: The index is showing a "Fear" sentiment at 34. Over the last hour, sentiment has been leaning towards "Strong Sell."

Current Status: Bitcoin is trading at $59,437. Upcoming U.S. reports on personal income and spending could impact Bitcoin's demand, especially as inflation and Federal Reserve rate cut predictions are in play.

Inflation and Rate Cuts: Economists predict the Core PCE Price Index will rise to 2.7% year-on-year in July, up from 2.6% in June. Higher inflation could reduce expectations for multiple Fed rate cuts in 2024. This might lead to higher borrowing costs.

Impact on Bitcoin: Increased borrowing costs could affect the demand for riskier assets like Bitcoin, potentially influencing its market performance.

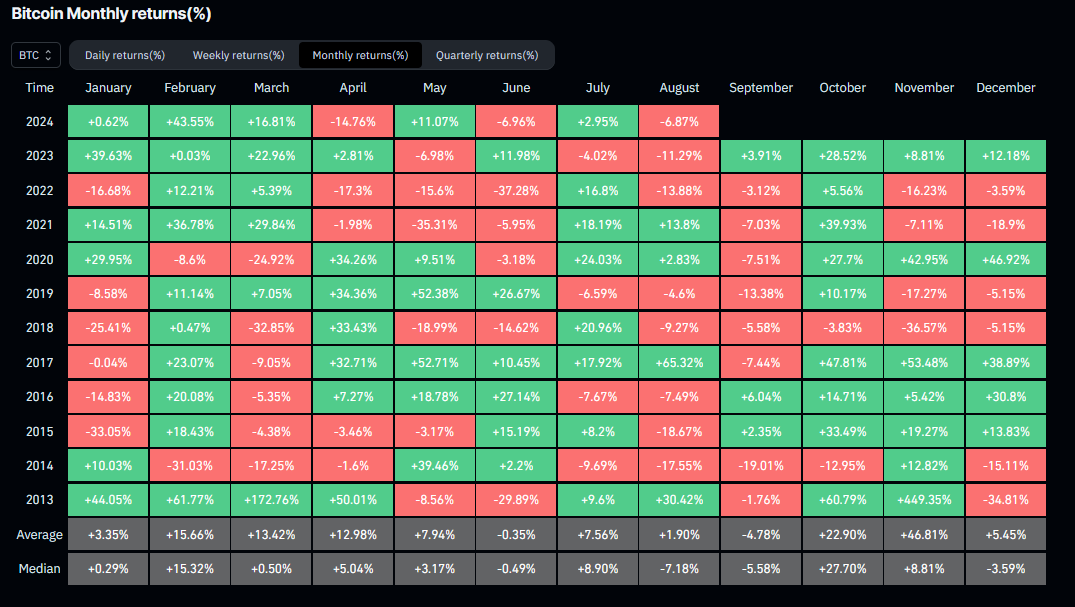

Historical data suggests that September is not the best month for crypto assets.

However, Bitcoin’s reserves on exchanges are at a new low, which might reduce selling pressure and help Bitcoin retest and possibly surpass $60,000.

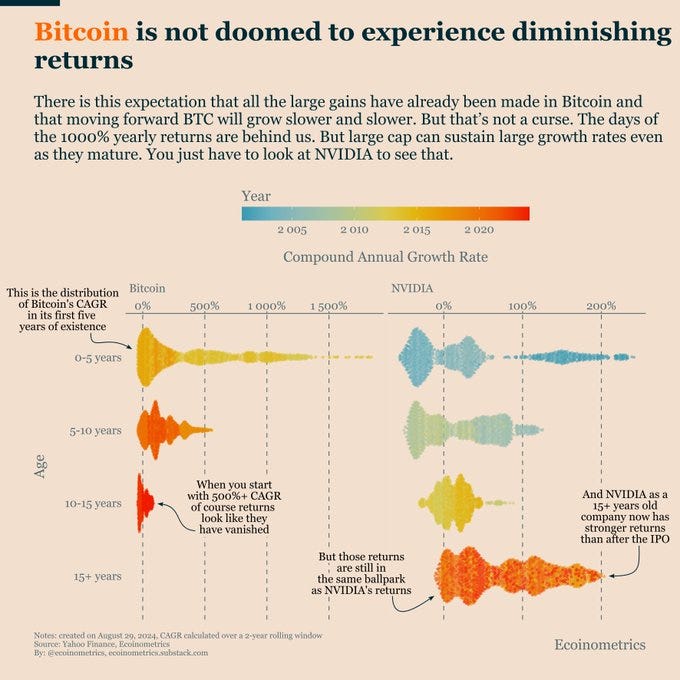

Growth Potential: Although Bitcoin may not see dramatic price jumps soon, it still has growth potential.

Analyst Ecoinometrics compares Bitcoin’s potential to NVIDIA’s sustained growth, suggesting that Bitcoin remains a viable investment as long as it retains its relevance.

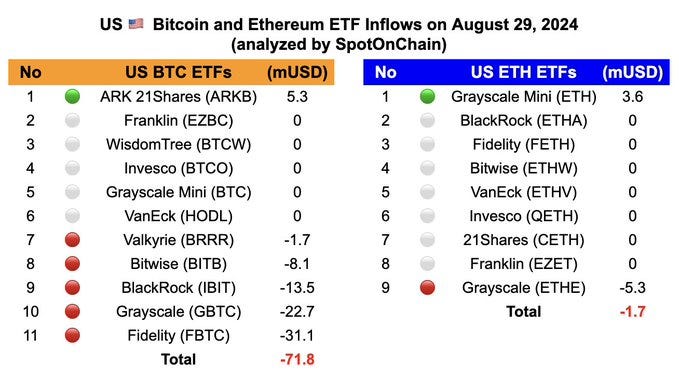

ETF Activity

Bitcoin ETF: Total outflow of $71.73 million; Grayscale ETF (GBTC) outflow of $22.68 million, and Ark Invest & 21Shares ETF (ARKB) inflow of $5.34 million. Total net asset value at $54.36 billion.

Ethereum ETF: Total outflow of $1.77 million; Grayscale ETF (ETHE) outflow of $5.35 million, and Grayscale Mini ETF (ETH) inflow of $3.57 million. Total net asset value at $7.03 billion.

Dogecoin Lawsuit

Lawsuit Dismissed: A US District Court has dismissed the $258 billion lawsuit against Elon Musk and Tesla, which alleged they manipulated Dogecoin's price. The court found that no reasonable investor based their decisions on Musk's tweets.

Court’s Finding: The court noted that Musk’s tweets about Dogecoin were exaggerated and misleading but didn’t influence investors' decisions.

Decision Date: The lawsuit was dismissed on August 29.

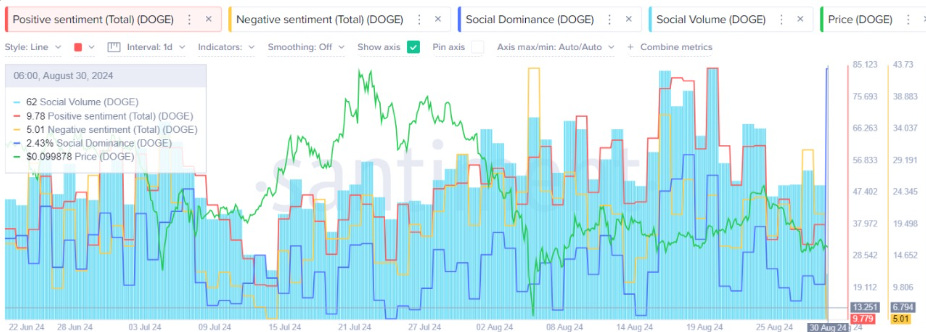

Market Response: Despite Musk’s legal victory, Dogecoin’s price has remained flat, showing market indecision.

Social and User Activity: Dogecoin’s social dominance hit a 3-month high and active addresses reached a two-week peak, suggesting growing interest.

However, the price remains stagnant. If market conditions improve, Dogecoin could rise to $0.13, but there’s also a risk of a 6.3% drop to $0.0935 if support levels fail.

Bitcoin is grappling with ETF outflows and inflation worries, struggling to breach $60,000. Dogecoin’s price remains flat despite Musk’s legal win. Market volatility calls for careful trading and vigilance.