Bitcoin Alert: Fear Takes Over! What This Massive Drop Means for the Market

Sudden Plunge in the Fear and Greed Index Could Impact Bitcoin's Future

Understanding the Bitcoin Fear and Greed Index

The Fear and Greed Index measures market sentiment by analyzing several factors:

Volatility

Market momentum and volume

Social media activity

Surveys

Bitcoin dominance

Google Trends

These elements are combined to give an overall score indicating whether the market is driven more by fear or greed.

Recent Changes in the Index

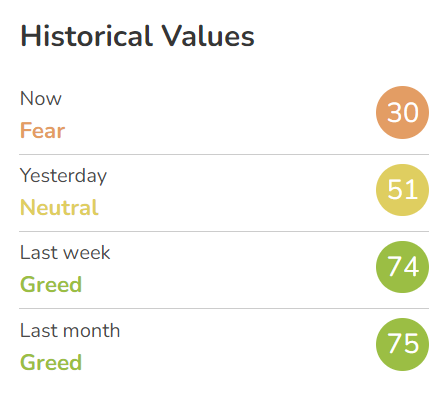

Recently, the Fear and Greed Index has seen a significant drop. Last month and last week, the index was in the 'Greed' zone. Yesterday, it shifted to 'Neutral', and today it hit the 'Fear' level for the first time in quite a while. This change reflects a substantial shift in market sentiment.

Looking Back: Historical Trends

Historically, the Fear and Greed Index has shown patterns that can help us understand current market behavior. For example, in 2019, the index reached the 'Greed' levels in the 90s before the market cooled off. In early 2021, the index stayed in the 90-100 range for a longer period. However, in both 2019 and the recent rally, the index only stayed at these high levels briefly before dropping back to fear.

Comparing 2023 with Previous Years

This year, 2023, shows some similarities and differences with past years. Analyst Benjamin Cowen stated that the monetary policy is similar to 2019, but we've also hit new all-time highs like in 2021.

In 2019, Bitcoin fell below the bull market support band and stayed there for the rest of the year. In 2023, Bitcoin dipped below but quickly recovered, driven by excitement over spot ETFs.

The Importance of the Recent Drop

The recent drop in the Fear and Greed Index from 74 to 30 in just six days is noteworthy. The last similar drop was in September 2023. Historically, sharp declines like this often lead to further drops in the index, sometimes even below 20.

Future Predictions

When we look at historical price charts with the Fear and Greed Index, we see that high fear often follows periods of extreme greed. In 2019, the index quickly moved from the 90s to below 40. Similar patterns were seen in both early and late 2021.

Right now, Bitcoin’s position suggests continued volatility. If Bitcoin holds its recent low, the Fear and Greed Index might bounce back. If Bitcoin drops further, the index could dip below 20, indicating more fear.

Bitcoin Dominance

Bitcoin dominance is another key factor. Despite recent fluctuations, Bitcoin dominance remains above the bull market support band. Bitcoin’s dominance is currently 53.32%, a decrease of 0.96% over the day. Historically, during high fear periods, Bitcoin dominance tends to rise as investors move to Bitcoin from altcoins.

The Fear and Greed Index is a valuable tool for understanding market sentiment. The recent drop to 30 is significant, indicating increased fear in the market. Historical patterns suggest further declines might occur before recovery.

Currently Price status

Bitcoin was trading at $61,332, reflecting a 2.16% decrease over the past 24 hours.