Hey there, Degens!

The crypto market is in a strong position today, and Bitcoin is showing impressive momentum. With Bitcoin’s price climbing past $60,000, many are wondering what’s driving this pump and whether we’re witnessing the start of a bull run.

Let’s dive into the details and see what’s happening with Bitcoin and the market as a whole.

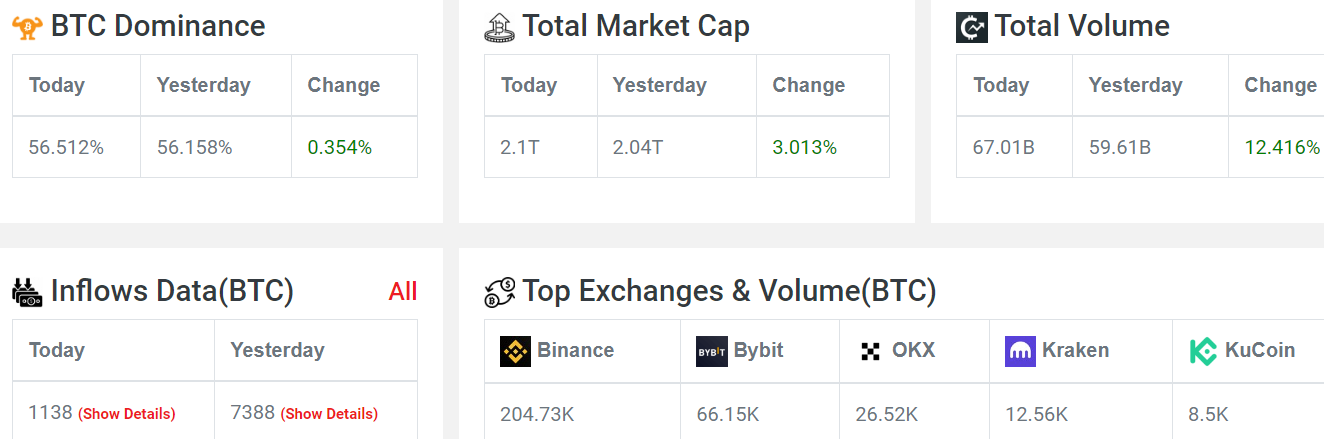

Crypto Market Overview

Market Cap: Increased by 3.4%.

Volume: Up by 10.3%.

BTC Inflows: Since midnight, around 10,038 BTC have flowed into the market, with three major inflows totaling 7,388 BTC.

Fear and Greed Index: Currently neutral at 50.

Sentiment: Over the last hour, the sentiment is leaning towards buying, with Bitcoin up by 4.08%.

Bitcoin’s Critical $60,000 Level

Bitcoin has broken through a significant milestone. After several attempts to cross $58,000, it finally surged past $60,000. What’s more, the last three candles have closed above this key level, adding confidence to the current rally.

Resistance: Between $61,000 and $63,000.

Support: Currently around $59,000, with a stronger support level at $58,000, which previously acted as resistance.

Ethereum price has surged past $2,400, while Solana coin continues to trade strongly in the green.

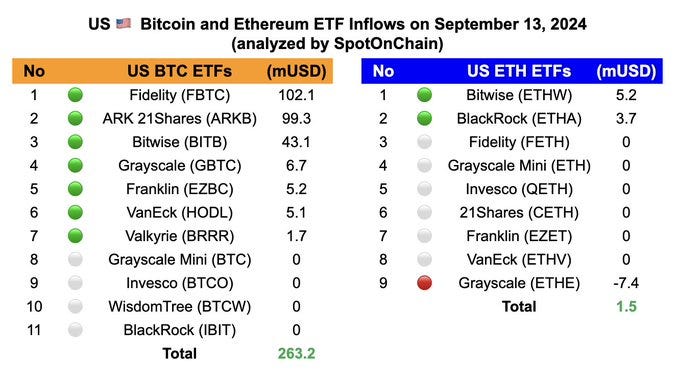

ETF Activity and Institutional Buying

While BlackRock hasn’t made any major moves, several other big players are stepping in:

Fidelity, Bitwise, ARK Invest, and Grayscale’s GBTC have all been active, contributing to a total inflow of $263 million in a single day.

This shows renewed institutional interest in Bitcoin, which often signals future bullish movements.

MicroStrategy’s Continued Confidence

MicroStrategy remains one of the biggest corporate holders of Bitcoin. They recently added 18,300 BTC to their stash, bringing their total to 248,000 BTC.

Average purchase price: $38,681.

Profit: Over $5 billion in gains.

MicroStrategy’s buying spree is another key factor supporting Bitcoin’s rise, as it shows strong confidence from major institutional investors.

FOMC Meeting and Bitcoin’s Outlook

One of the biggest factors driving this pump is the upcoming Federal Open Market Committee (FOMC) meeting, where a potential rate cut is expected.

Initially, the market was expecting a 25 basis points (bps) cut, but now the possibility of a 50 bps cut has increased to 50%.

If a 50 bps cut is announced, we could see another significant pump in Bitcoin. On the other hand, if only a 25 bps cut happens, Bitcoin’s price might see a temporary dip.

Markus Thielen from 10x Research warns that while the Fed aims to ease economic risks, a large rate cut might indicate deeper economic troubles.

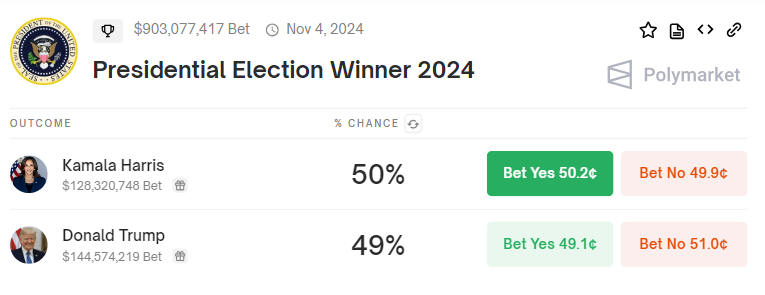

U.S. Elections: What Impact Could They Have?

The U.S. elections are also something to keep an eye on. In the recent debate between Donald Trump and Kamala Harris, there was no mention of crypto, but this could change in future discussions.

If Trump wins, and if the U.S. economy worsens, we might see a recession. This could impact the crypto market, with some speculating that Trump’s economic policies, like potential tax cuts, might influence Bitcoin’s price.

Polymarket odds remain stuck at 50-50 as traders keep dollar-cost averaging into the lower option. Currently, Harris holds a 50% chance of winning, with Trump closely trailing at 49%.